Region:Middle East

Author(s):Rebecca

Product Code:KRAD5049

Pages:80

Published On:December 2025

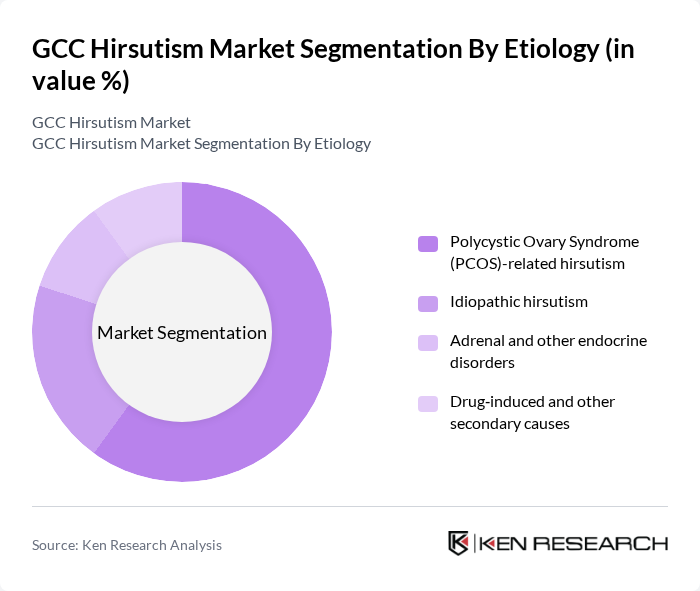

By Etiology:The etiology of hirsutism can be categorized into several subsegments, including Polycystic Ovary Syndrome (PCOS)-related hirsutism, Idiopathic hirsutism, Adrenal and other endocrine disorders, and Drug-induced and other secondary causes. Among these, PCOS-related hirsutism is the most prevalent, accounting for a significant portion of cases, in line with global data showing PCOS as the leading cause of clinical hirsutism in women of reproductive age. This is largely due to the increasing incidence and diagnosis of PCOS in the GCC region, driven by rising obesity, insulin resistance, and sedentary lifestyles, coupled with genetic predispositions. The awareness and diagnosis of PCOS and related hyperandrogenic disorders have improved through broader gynecology and endocrinology screening, leading to a higher recognition of hirsutism as a symptom and thereby driving demand for both medical and aesthetic treatment options.

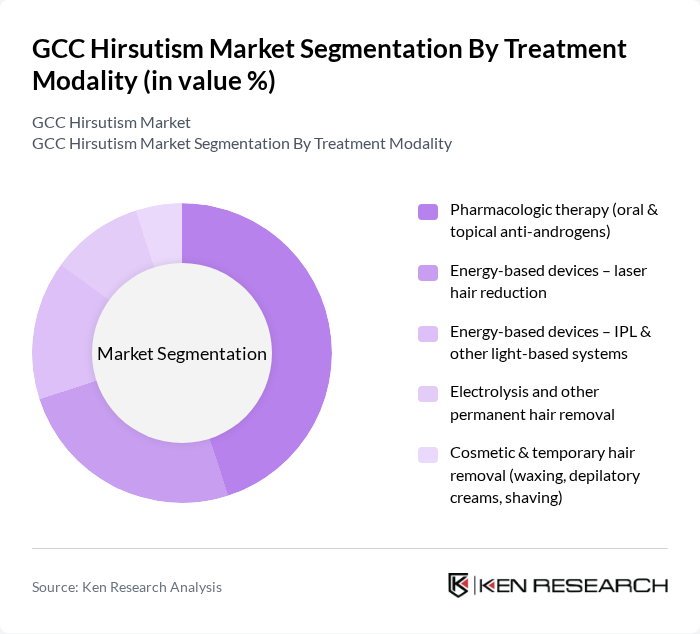

By Treatment Modality:The treatment modalities for hirsutism include Pharmacologic therapy (oral & topical anti-androgens), Energy-based devices – laser hair reduction, Energy-based devices – IPL & other light-based systems, Electrolysis and other permanent hair removal, and Cosmetic & temporary hair removal (waxing, depilatory creams, shaving). Among these, pharmacologic therapy is an essential treatment modality, particularly for women with underlying endocrine disorders such as PCOS, where combined oral contraceptives, anti-androgens, and insulin-sensitizing agents are widely used to address the hormonal drivers of excessive hair growth in line with global clinical practice patterns. However, energy-based devices for laser hair reduction account for a substantial share of overall intervention spending in hirsutism and unwanted hair management worldwide, reflecting strong patient preference for longer-term hair reduction and rapid uptake of diode and Nd:YAG laser platforms in private aesthetic centers, a trend also visible in GCC markets.

The GCC Hirsutism Market is characterized by a dynamic mix of regional and international players. Leading participants such as Galderma S.A., Bayer AG, HRA Pharma (Perrigo Company plc), Sun Pharmaceutical Industries Ltd., Cipla Limited, Bausch Health Companies Inc. (including the former Valeant portfolio), Lumenis Be Ltd., Candela Corporation, Cutera, Inc., Alma Lasers Ltd., Procter & Gamble Company, L'Oréal S.A., Unilever PLC, Johnson & Johnson, and local GCC dermatology & aesthetic chains (e.g., Cosmesurge, Silkor, Kaya Skin Clinic) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC hirsutism market appears promising, driven by advancements in treatment technologies and increasing acceptance of cosmetic procedures. As telemedicine continues to expand, patients will have greater access to consultations and treatment options. Additionally, the integration of artificial intelligence in treatment planning is expected to enhance personalized care, improving patient outcomes. These trends indicate a shift towards more accessible and effective solutions for managing hirsutism, fostering a more supportive environment for affected individuals.

| Segment | Sub-Segments |

|---|---|

| By Etiology | Polycystic Ovary Syndrome (PCOS)-related hirsutism Idiopathic hirsutism Adrenal and other endocrine disorders Drug?induced and other secondary causes |

| By Treatment Modality | Pharmacologic therapy (oral & topical anti?androgens) Energy?based devices – laser hair reduction Energy?based devices – IPL & other light?based systems Electrolysis and other permanent hair removal Cosmetic & temporary hair removal (waxing, depilatory creams, shaving) |

| By End-User Setting | Dermatology and aesthetic clinics Hospitals & multispecialty centers Medical spas & beauty centers Home?use / over?the?counter products |

| By Patient Demographics | Adolescents and young adults (15–24 years) Adults (25–39 years) Middle?aged and above (40+ years) Obese and metabolic?syndrome population segment |

| By Distribution Channel | Hospital & clinic pharmacies Retail pharmacies E?pharmacies and online platforms Direct sales & aesthetic device distributors |

| By Country (GCC) | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain |

| By Treatment Duration | Single?session & short treatment courses (< 6 months) Long?term and maintenance therapy (? 6 months) Recurrent / retreatment cases |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dermatology Clinics | 45 | Dermatologists, Clinic Managers |

| Endocrinology Practices | 40 | Endocrinologists, Nurse Practitioners |

| Pharmaceutical Distributors | 35 | Sales Representatives, Product Managers |

| Patient Advocacy Groups | 30 | Patient Coordinators, Community Outreach Managers |

| Health Insurance Providers | 40 | Policy Analysts, Claims Managers |

The GCC Hirsutism Market is valued at approximately USD 1.3 billion, based on a five-year historical analysis. This valuation reflects the region's share of the global hirsutism treatment market, which is estimated to be around USD 3.13.2 billion.