Region:Middle East

Author(s):Geetanshi

Product Code:KRAB9503

Pages:83

Published On:October 2025

By Type:The market is segmented into various types of vehicles, including buses, delivery vans, waste collection vehicles, taxis, light commercial vehicles, heavy-duty trucks, and others. Among these, buses and delivery vans are leading the market due to their high demand in public transport and logistics sectors, respectively. The increasing focus on reducing urban air pollution and enhancing public transport efficiency drives the adoption of hydrogen-powered buses, while delivery vans are favored for their operational efficiency and lower emissions.

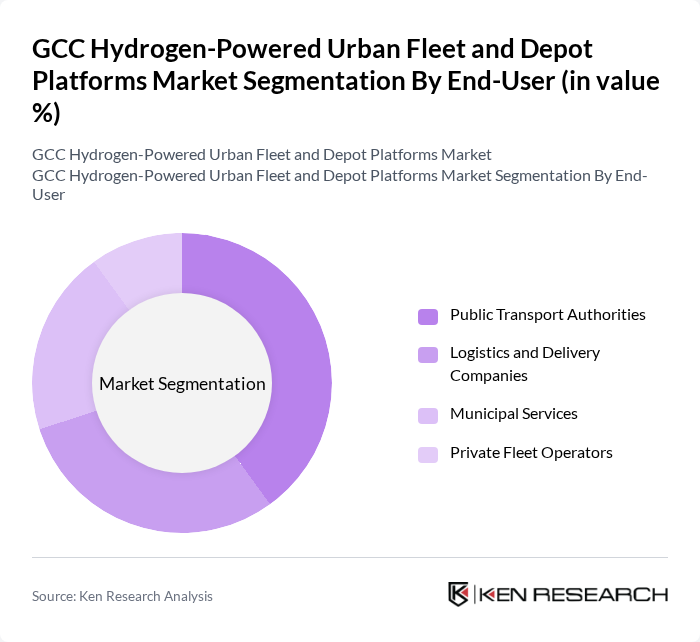

By End-User:The end-user segmentation includes public transport authorities, logistics and delivery companies, municipal services, and private fleet operators. Public transport authorities are the dominant segment, driven by government mandates to transition to cleaner transport solutions. The increasing need for efficient urban mobility solutions and the push for sustainable public transport systems are key factors contributing to the growth of hydrogen-powered vehicles in this segment.

The GCC Hydrogen-Powered Urban Fleet and Depot Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Air Products and Chemicals, Inc., Ballard Power Systems Inc., Plug Power Inc., Nikola Corporation, Hyundai Motor Company, Toyota Motor Corporation, Siemens AG, ABB Ltd., Cummins Inc., Shell plc, Air Liquide S.A., Linde plc, ITM Power plc, McPhy Energy S.A., FuelCell Energy, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC hydrogen-powered urban fleet market appears promising, driven by increasing investments in green hydrogen projects and a strong push towards decarbonization. By future, urban authorities are expected to implement stricter emission regulations, further incentivizing the transition to hydrogen solutions. Additionally, collaborations between automotive manufacturers and energy providers are likely to enhance the development of hydrogen infrastructure, facilitating broader adoption and integration into existing urban transport systems.

| Segment | Sub-Segments |

|---|---|

| By Type | Buses Delivery Vans Waste Collection Vehicles Taxis Light Commercial Vehicles Heavy-Duty Trucks Others |

| By End-User | Public Transport Authorities Logistics and Delivery Companies Municipal Services Private Fleet Operators |

| By Application | Urban Public Transport Freight and Logistics Waste Management Emergency Services |

| By Distribution Channel | Direct Sales Online Sales Dealerships |

| By Fuel Supply Model | On-Site Hydrogen Production Centralized Hydrogen Production Hydrogen Refueling Stations |

| By Fleet Size | Small Fleets Medium Fleets Large Fleets |

| By Policy Support | Government Subsidies Tax Incentives Grants for Research and Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Fleet Operators | 150 | Fleet Managers, Operations Directors |

| Municipal Transport Authorities | 100 | City Planners, Transportation Policy Makers |

| Hydrogen Technology Providers | 80 | Product Managers, R&D Engineers |

| Logistics and Supply Chain Experts | 70 | Supply Chain Analysts, Logistics Coordinators |

| Environmental Policy Makers | 60 | Regulatory Affairs Specialists, Sustainability Officers |

The GCC Hydrogen-Powered Urban Fleet and Depot Platforms Market is valued at approximately USD 1.2 billion, driven by investments in sustainable transportation, government initiatives promoting hydrogen as a clean fuel, and growing environmental awareness among consumers and businesses.