Region:Middle East

Author(s):Shubham

Product Code:KRAD5491

Pages:94

Published On:December 2025

Market.png)

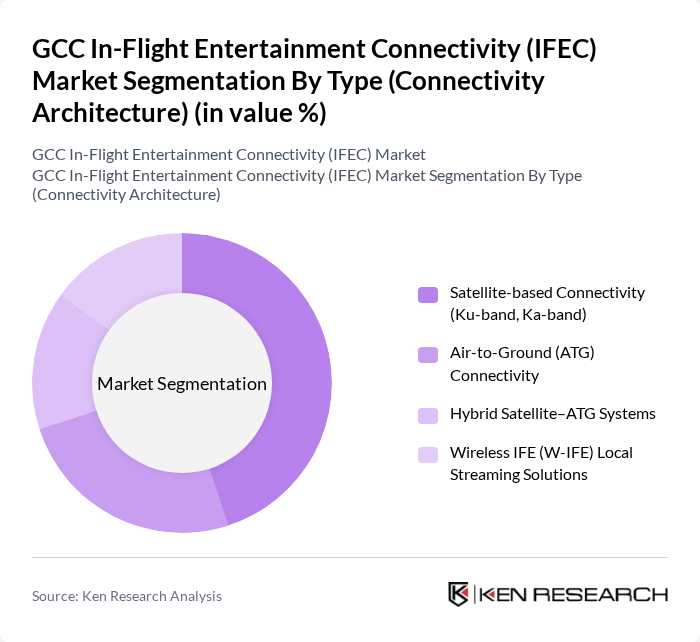

By Type (Connectivity Architecture):The connectivity architecture segment includes various technologies that facilitate in-flight entertainment and connectivity. The dominant sub-segment is Satellite-based Connectivity, which is preferred for its extensive coverage and reliability on medium- and long-haul routes, and aligns with global trends where satellite connectivity leads IFEC adoption. Air-to-Ground (ATG) Connectivity is also gaining traction in suitable geographies for short- and medium-haul flights due to lower latency and potentially lower operating cost, while Hybrid Satellite–ATG Systems are emerging as a versatile solution that combines global reach with improved performance. Wireless IFE (W-IFE) Local Streaming Solutions are increasingly popular among airlines looking to reduce hardware weight and retrofit cost, enabling passengers to stream content on their own devices and supporting ancillary revenue models.

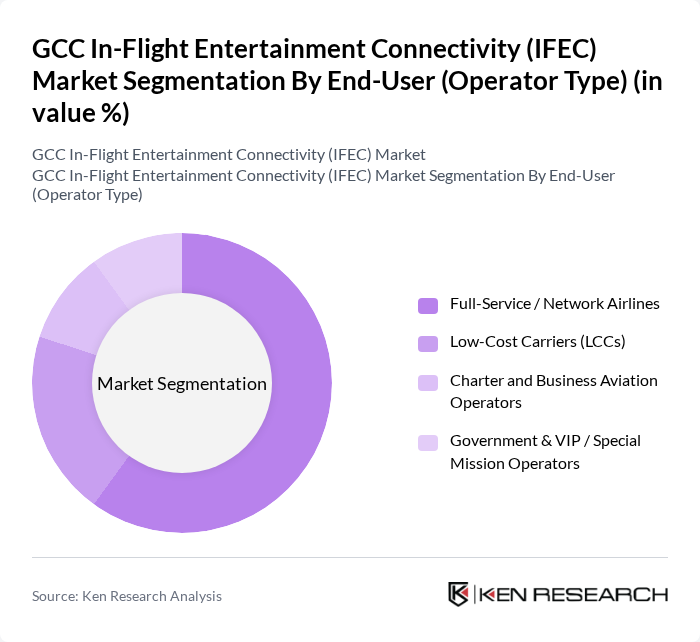

By End-User (Operator Type):The end-user segment is characterized by different types of airline operators. Full-Service/Network Airlines dominate this segment due to their extensive fleets, wide-body aircraft concentration, and higher passenger volumes, which necessitate advanced IFEC solutions and premium content offerings. Low-Cost Carriers (LCCs) are increasingly adopting IFEC, especially wireless and bring?your?own?device (BYOD) models, to enhance customer satisfaction and differentiate themselves in a competitive market while controlling costs. Charter and Business Aviation Operators also contribute to the market, focusing on highly customized, premium connectivity and entertainment services tailored to corporate and high?net?worth passengers, while Government & VIP/Special Mission Operators require secure, resilient, and mission?specific IFEC and communication solutions.

The GCC In-Flight Entertainment Connectivity (IFEC) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Panasonic Avionics Corporation, Thales Group (Thales InFlyt Experience), Viasat Inc. (including former Inmarsat IFC business), Intelsat S.A. (including former Gogo Commercial Aviation), SITAONAIR, Collins Aerospace, Safran Passenger Innovations, Lufthansa Systems, SES S.A., Eutelsat Communications, Honeywell Aerospace, Emirates Group (Emirates & flydubai IFEC Programs), Qatar Airways Group (Oryx One IFEC Program), Saudi Arabian Airlines Group (Saudia & flyadeal IFEC Programs), Oman Air & Gulf Air IFEC Programs contribute to innovation, geographic expansion, and service delivery in this space, including adoption of high?throughput satellites, partnerships with content providers, and deployment of wireless and personalized IFEC platforms.

The future of the GCC IFEC market appears promising, driven by technological advancements and evolving passenger preferences. The integration of 5G technology is expected to revolutionize connectivity, offering faster and more reliable internet services. Additionally, airlines are increasingly focusing on enhancing the passenger experience through personalized content and seamless connectivity. As the market matures, partnerships with telecom providers will likely play a crucial role in delivering innovative solutions that cater to the growing demand for in-flight entertainment and connectivity.

| Segment | Sub-Segments |

|---|---|

| By Type (Connectivity Architecture) | Satellite-based Connectivity (Ku-band, Ka-band) Air-to-Ground (ATG) Connectivity Hybrid Satellite–ATG Systems Wireless IFE (W-IFE) Local Streaming Solutions |

| By End-User (Operator Type) | Full-Service / Network Airlines Low-Cost Carriers (LCCs) Charter and Business Aviation Operators Government & VIP / Special Mission Operators |

| By Aircraft Type | Narrow-body Aircraft Wide-body Aircraft Regional Jets & Turboprops Business Jets |

| By Service Type | In-Flight Connectivity (IFC) – Broadband Internet & Messaging In-Flight Entertainment (Seatback & Overhead Systems) Wireless IFE / Bring-Your-Own-Device (BYOD) Content Ancillary Digital Services (E-commerce, Advertising, Destination Services) |

| By Region (GCC Countries) | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain |

| By Customer Segment (Passenger Profile) | Business Travelers Leisure Travelers Family & Group Travelers Transit / Connecting Passengers |

| By Pricing & Monetization Model | Free-to-Use (Sponsored / Loyalty-funded) Pay-per-use / Session-based Subscription & Bundled Fare-family Plans Revenue-share & Advertising-supported Models |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Airline IFEC Strategy | 100 | Chief Technology Officers, In-Flight Services Managers |

| Passenger Experience Feedback | 120 | Frequent Flyers, Business Travelers |

| Connectivity Technology Providers | 80 | Product Managers, Sales Directors |

| Regulatory Compliance Insights | 60 | Aviation Regulatory Officials, Compliance Officers |

| Market Trends and Innovations | 70 | Industry Analysts, Market Researchers |

The GCC In-Flight Entertainment Connectivity (IFEC) Market is valued at approximately USD 1.3 billion, reflecting significant growth driven by increasing passenger demand for enhanced connectivity and entertainment options during flights.