Region:Middle East

Author(s):Dev

Product Code:KRAD5141

Pages:89

Published On:December 2025

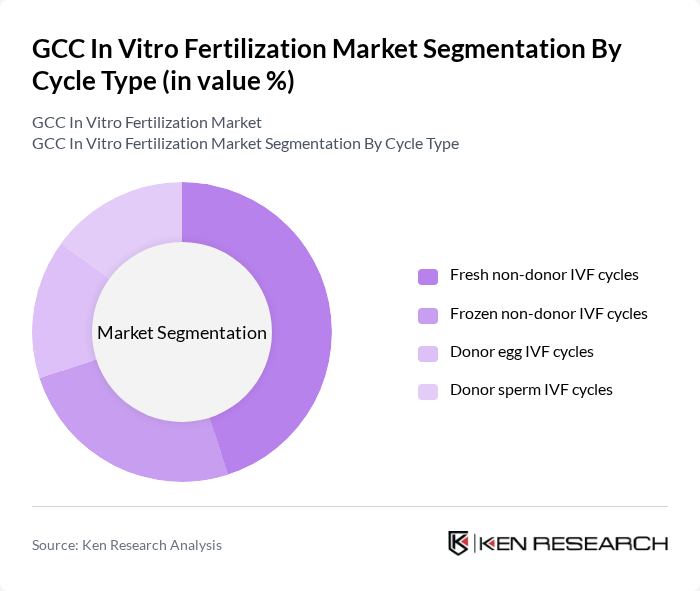

By Cycle Type:The cycle type segmentation includes various methods of IVF procedures, which are crucial for addressing different patient needs. The subsegments include Fresh non-donor IVF cycles, Frozen non-donor IVF cycles, Donor egg IVF cycles, and Donor sperm IVF cycles. Among these, Fresh non-donor IVF cycles are currently the most popular due to their higher success rates and the preference of patients for using their own eggs and sperm. The increasing awareness and acceptance of IVF treatments have led to a significant rise in the number of fresh cycles performed.

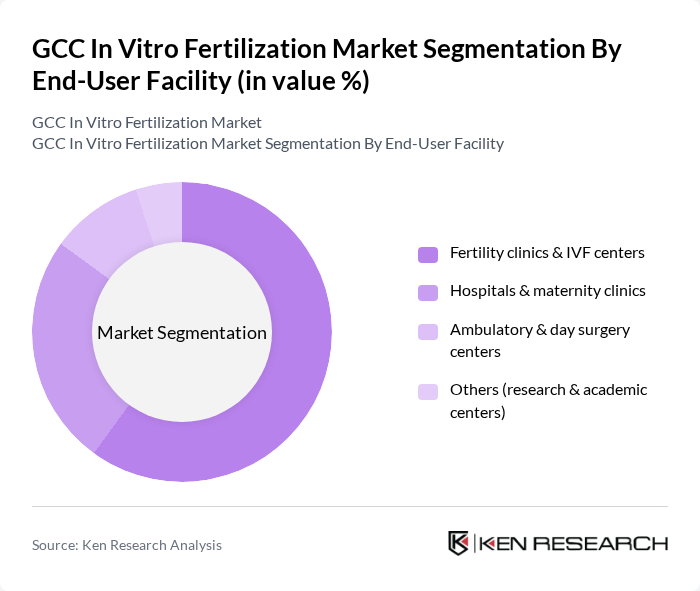

By End-User Facility:The end-user facility segmentation encompasses various healthcare settings where IVF procedures are performed. This includes Fertility clinics & IVF centers, Hospitals & maternity clinics, Ambulatory & day surgery centers, and Others (research & academic centers). Fertility clinics & IVF centers dominate this segment due to their specialized services and focus on reproductive health, which cater specifically to patients seeking IVF treatments. The increasing number of such clinics in the GCC region has further solidified their leading position in the market.

The GCC In Vitro Fertilization Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dubai Fertility Centre (UAE), HealthPlus Fertility Center (Abu Dhabi, UAE), Bourn Hall Fertility Centre (Dubai & Abu Dhabi, UAE), Fakih IVF Fertility Center (UAE & Oman), Orchid Fertility Clinic (Dubai, UAE), Medcare Fertility Centre, Medcare Women & Children Hospital (Dubai, UAE), Conceive – The Gynaecology & Fertility Hospital (Sharjah, UAE), King Faisal Specialist Hospital & Research Centre – IVF Unit (Riyadh, Saudi Arabia), Dr. Sulaiman Al Habib Medical Group – IVF & Fertility Centers (Saudi Arabia), Dallah Hospital – IVF & Reproductive Medicine Center (Riyadh, Saudi Arabia), Sidra Medicine – Reproductive Medicine & IVF (Doha, Qatar), Qatar Center for Reproductive Medicine / Qatar Fertility Center (Doha, Qatar), New Hope IVF Gynaecology & Fertility Hospital (Sharjah, UAE), Bahrain Defence Force Hospital – IVF & Fertility Center (Bahrain), Royal Hospital – IVF & Fertility Services (Muscat, Oman) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC IVF market appears promising, driven by increasing investments in healthcare infrastructure and advancements in reproductive technologies. As telemedicine becomes more integrated into fertility treatments, patients will benefit from remote consultations and follow-ups, enhancing accessibility. Additionally, the integration of artificial intelligence in IVF processes is expected to improve success rates and patient experiences. These trends indicate a robust growth trajectory for the IVF market, with a focus on patient-centered care and innovative solutions.

| Segment | Sub-Segments |

|---|---|

| By Cycle Type | Fresh non-donor IVF cycles Frozen non-donor IVF cycles Donor egg IVF cycles Donor sperm IVF cycles |

| By End-User Facility | Fertility clinics & IVF centers Hospitals & maternity clinics Ambulatory & day surgery centers Others (research & academic centers) |

| By Patient Profile (Age Group) | Under 30 years –34 years –39 years years & above |

| By Procedure Type | Conventional IVF IVF with ICSI (Intracytoplasmic Sperm Injection) IUI (Intrauterine Insemination) IVF with donor gametes and surrogacy programs |

| By Technology | Conventional stimulation protocols Minimal stimulation & natural cycle IVF Assisted hatching, PGT/PGS and genetic testing Cryopreservation (oocyte, sperm & embryo freezing) |

| By Country | United Arab Emirates Saudi Arabia Qatar Kuwait Oman Bahrain |

| By Service Offering | Diagnostic & consultation services Ovarian stimulation & monitoring Laboratory & embryology services Counseling, follow?up & support services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fertility Clinics in UAE | 80 | Clinic Directors, IVF Coordinators |

| Patient Experience Surveys | 120 | IVF Patients, Fertility Treatment Seekers |

| Healthcare Policy Makers | 40 | Health Ministry Officials, Regulatory Bodies |

| Reproductive Health Specialists | 90 | Gynecologists, Reproductive Endocrinologists |

| Insurance Providers | 60 | Health Insurance Analysts, Policy Underwriters |

The GCC In Vitro Fertilization Market is valued at approximately USD 500 million, driven by increasing infertility rates, advancements in IVF techniques, and growing awareness of assisted reproductive technologies.