Region:Middle East

Author(s):Shubham

Product Code:KRAD3686

Pages:82

Published On:November 2025

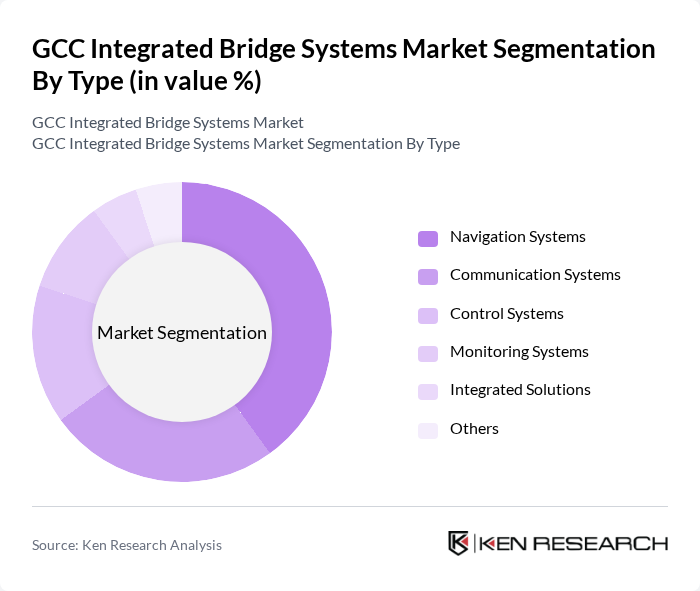

By Type:The market is segmented into various types, including Navigation Systems, Communication Systems, Control Systems, Monitoring Systems, Integrated Solutions, and Others. Among these, Navigation Systems are currently leading the market due to their critical role in ensuring safe and efficient maritime operations. The increasing complexity of maritime routes and the need for real-time data have driven the demand for advanced navigation technologies. Communication Systems also hold a significant share, as they are essential for maintaining connectivity and safety at sea.

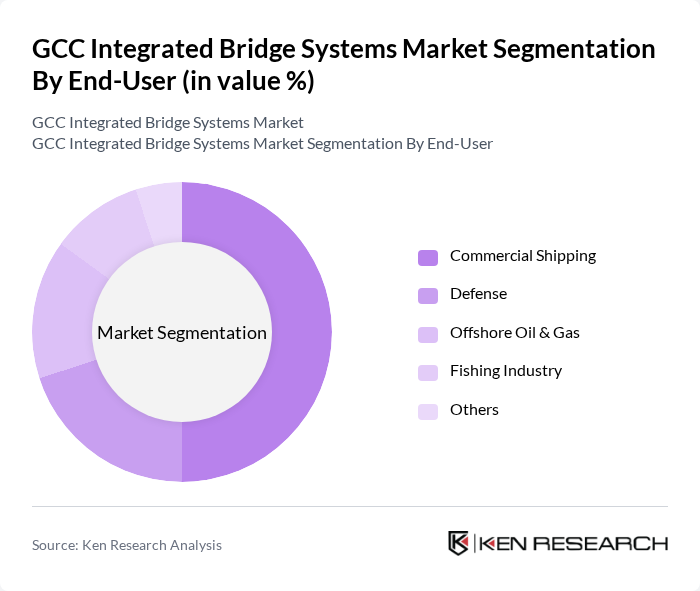

By End-User:The market is categorized into Commercial Shipping, Defense, Offshore Oil & Gas, Fishing Industry, and Others. The Commercial Shipping segment is the most dominant, driven by the increasing global trade and the need for efficient logistics. The Offshore Oil & Gas sector also plays a crucial role, as the demand for integrated bridge systems is rising with the expansion of offshore exploration and production activities. Defense applications are growing as well, with investments in naval capabilities and modernization of fleets.

The GCC Integrated Bridge Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kongsberg Gruppen, Raytheon Technologies, Thales Group, Northrop Grumman, Siemens AG, ABB Ltd., Rolls-Royce Holdings, Wärtsilä Corporation, Navico, Furuno Electric Co., Ltd., BAE Systems, Elbit Systems, Leonardo S.p.A., Mitsubishi Heavy Industries, Honeywell International Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC integrated bridge systems market is poised for transformative growth, driven by the increasing adoption of automation and digitalization. As maritime operators seek to enhance operational efficiency, the integration of AI and machine learning technologies will become more prevalent. Additionally, the emphasis on cybersecurity will shape the development of robust systems, ensuring data protection and compliance with international regulations. These trends will create a dynamic landscape for innovation and investment in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Navigation Systems Communication Systems Control Systems Monitoring Systems Integrated Solutions Others |

| By End-User | Commercial Shipping Defense Offshore Oil & Gas Fishing Industry Others |

| By Vessel Type | Cargo Ships Tankers Passenger Ships Fishing Vessels Others |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman |

| By Application | Navigation and Control Communication Monitoring and Surveillance Data Management Others |

| By Technology | Radar Systems AIS (Automatic Identification Systems) ECDIS (Electronic Chart Display and Information System) Integrated Navigation Systems Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Vessel Operators | 100 | Fleet Managers, Operations Directors |

| Shipbuilding Companies | 80 | Project Managers, Technical Directors |

| Maritime Training Institutions | 60 | Curriculum Developers, Training Coordinators |

| Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

| Integrated Bridge System Manufacturers | 70 | Product Managers, Sales Directors |

The GCC Integrated Bridge Systems Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by the demand for advanced navigation and communication technologies in maritime operations and investments in the shipping and offshore oil and gas sectors.