Region:Middle East

Author(s):Rebecca

Product Code:KRAD7354

Pages:93

Published On:December 2025

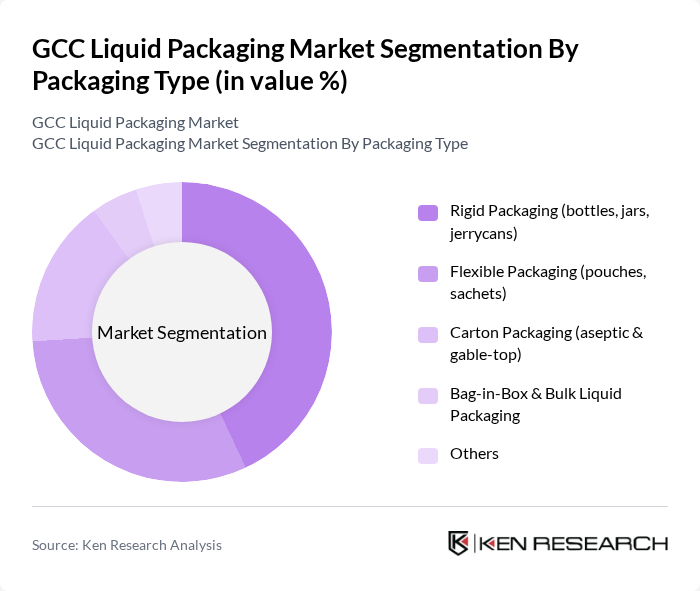

By Packaging Type:The packaging type segment includes various forms of liquid packaging, which are essential for different applications. The subsegments are Rigid Packaging (bottles, jars, cans), Flexible Packaging (pouches, sachets, bags), Cartons (aseptic and gable-top), Bag-in-Box & Bulk Containers, Closures, Caps & Dispensing Systems, and Others. Rigid packaging is currently the dominant subsegment due to its durability, product protection, and suitability for a wide range of products, including bottled water, carbonated soft drinks, juices, and household chemicals, in line with global trends where rigid containers hold a larger share of liquid packaging formats. Flexible packaging is gaining traction due to its lightweight, lower material usage, and cost-effective nature, appealing to both manufacturers and consumers, especially for juices, dairy drinks, and refill packs, while cartons remain important in long?life dairy and juice segments driven by aseptic technology.

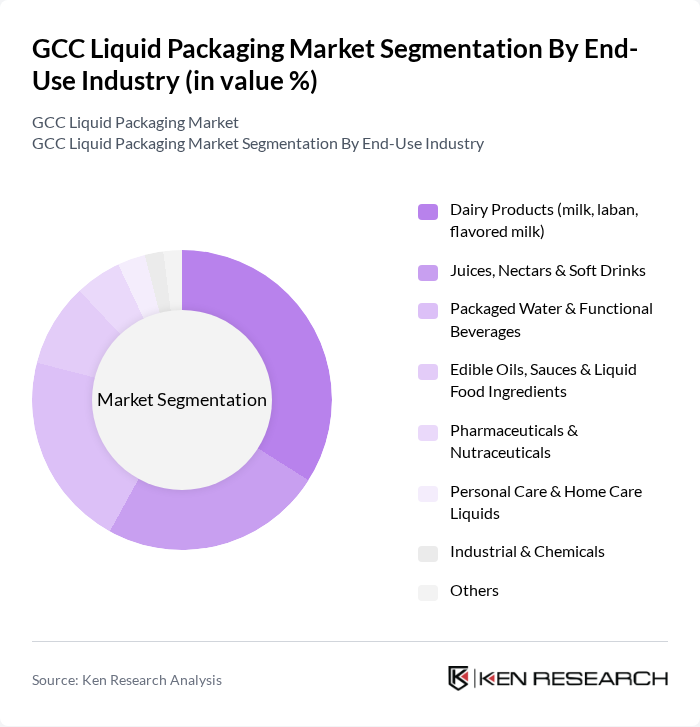

By End-Use Industry:The end-use industry segment encompasses various sectors utilizing liquid packaging, including Dairy (milk, laban, flavored milk), Juices & Non-Carbonated Beverages, Packaged Drinking Water, Carbonated Soft Drinks & Energy Drinks, Edible Oils & Condiments, Household & Industrial Chemicals, Pharmaceuticals & Healthcare Liquids, Personal Care & Cosmetics, and Others. The dairy segment is leading in aseptic cartons and chilled liquid packaging due to the high consumption of milk and related products in the GCC region and the strong presence of regional dairy brands. The beverage sector, including juices, functional drinks, and bottled water, is also significant, driven by growing health consciousness, preference for packaged safe drinking water, and rising demand for fortified and value?added beverages, while household, personal care, and pharmaceutical liquids are steadily increasing their use of specialized, compliant packaging formats.

The GCC Liquid Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tetra Pak, SIG Group, Elopak, Amcor plc, Huhtamaki Oyj, Mondi Group, Smurfit Kappa Group, DS Smith plc, Napco National, Zamil Plastic Industries, Saudi Arabian Packaging Industry W.L.L. (SAPI), Arabian Beverage Company (key regional liquid packer), Gulf Packaging Industries Ltd. (GPIL), Almarai Company (major aseptic liquid packaging user), Agthia Group PJSC contribute to innovation, geographic expansion, lightweighting, and the development of more recyclable and fiber?based liquid packaging solutions in this space.

The GCC liquid packaging market is poised for transformative growth, driven by increasing consumer demand for sustainable and safe packaging solutions. As the beverage industry expands, manufacturers are likely to innovate and adopt advanced technologies, including smart packaging. Additionally, the focus on circular economy practices will encourage companies to develop recyclable and biodegradable materials, aligning with global sustainability goals. This evolving landscape presents opportunities for collaboration and investment in emerging markets, fostering a more resilient and adaptive industry.

| Segment | Sub-Segments |

|---|---|

| By Packaging Type | Rigid Packaging (bottles, jars, cans) Flexible Packaging (pouches, sachets, bags) Cartons (aseptic and gable-top) Bag-in-Box & Bulk Containers Closures, Caps & Dispensing Systems Others |

| By End-Use Industry | Dairy (milk, laban, flavored milk) Juices & Non?Carbonated Beverages Packaged Drinking Water Carbonated Soft Drinks & Energy Drinks Edible Oils & Condiments Household & Industrial Chemicals Pharmaceuticals & Healthcare Liquids Personal Care & Cosmetics Others |

| By Material | Plastic (PET, HDPE, PP and others) Paper & Paperboard / Liquid Packaging Board Glass Metal (aluminum, steel) Bioplastics & Other Emerging Materials |

| By Filling Technology | Aseptic Filling Hot-Fill Cold-Fill Blow-Fill-Seal Form-Fill-Seal (FFS) Others |

| By Region | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain |

| By Application | Food & Beverage Liquids Industrial & Automotive Fluids Agrochemicals Pharmaceuticals & Nutraceuticals Personal Care & Home Care Liquids Others |

| By Sustainability Attribute | Recyclable Packaging Reusable & Refillable Packaging Bio?based / Compostable Packaging Lightweighted & Material?Optimized Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Beverage Packaging Solutions | 120 | Production Managers, Quality Assurance Leads |

| Dairy Product Packaging | 90 | Procurement Specialists, Operations Managers |

| Food Service Packaging | 70 | Supply Chain Directors, Packaging Engineers |

| Pharmaceutical Liquid Packaging | 60 | Regulatory Affairs Managers, Product Development Heads |

| Consumer Goods Liquid Packaging | 80 | Marketing Managers, Brand Managers |

The GCC Liquid Packaging Market is valued at approximately USD 5.5 billion, driven by the increasing demand for packaged beverages, dairy products, and convenience packaging across the region, particularly in Saudi Arabia and the United Arab Emirates.