Region:Middle East

Author(s):Shubham

Product Code:KRAB8230

Pages:100

Published On:October 2025

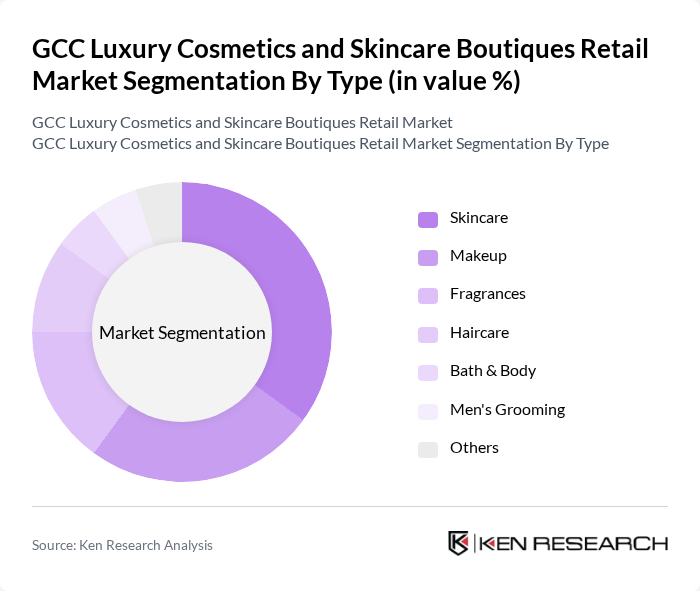

By Type:The market is segmented into various types, including Skincare, Makeup, Fragrances, Haircare, Bath & Body, Men's Grooming, and Others. Among these, the Skincare segment is the most dominant, driven by increasing consumer awareness about skin health and the rising popularity of natural and organic products. The demand for anti-aging and moisturizing products has significantly influenced this segment's growth.

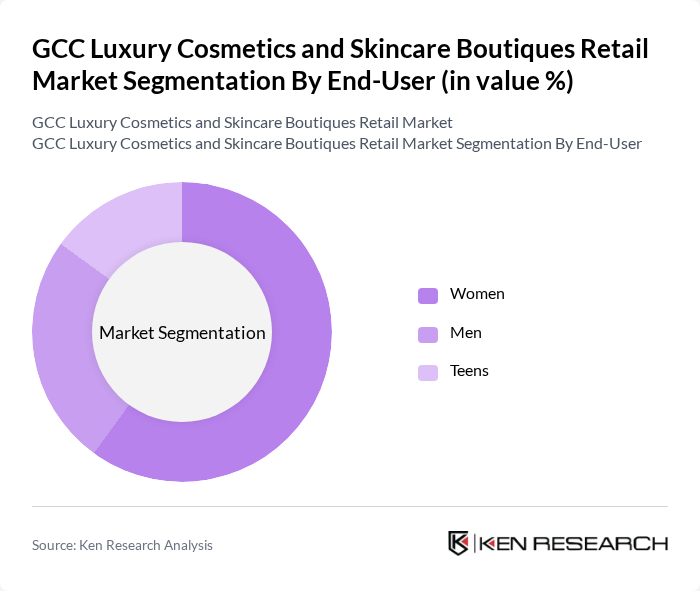

By End-User:The end-user segmentation includes Women, Men, and Teens. The Women segment holds the largest share, driven by a growing emphasis on beauty and personal care among female consumers. This demographic is increasingly investing in luxury cosmetics and skincare products, influenced by social media trends and celebrity endorsements.

The GCC Luxury Cosmetics and Skincare Boutiques Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as L'Oreal Group, Estée Lauder Companies Inc., Shiseido Company, Limited, Coty Inc., Procter & Gamble Co., Chanel S.A., Dior (Christian Dior SE), Unilever PLC, Beiersdorf AG, Amway Corporation, Mary Kay Inc., Avon Products, Inc., Oriflame Cosmetics S.A., Natura & Co., Arbonne International, LLC contribute to innovation, geographic expansion, and service delivery in this space.

The GCC luxury cosmetics and skincare market is poised for dynamic growth, driven by evolving consumer preferences and technological advancements. The increasing focus on sustainability and clean beauty is reshaping product offerings, with brands prioritizing eco-friendly formulations. Additionally, the rise of personalized skincare solutions is expected to enhance customer engagement, as consumers seek tailored products that meet their unique needs. As e-commerce continues to expand, brands will leverage digital platforms to reach a broader audience, ensuring sustained market momentum.

| Segment | Sub-Segments |

|---|---|

| By Type | Skincare Makeup Fragrances Haircare Bath & Body Men's Grooming Others |

| By End-User | Women Men Teens |

| By Sales Channel | Online Retail Specialty Stores Department Stores Direct Sales Others |

| By Price Range | Premium Super Premium Affordable Luxury |

| By Brand Origin | Local Brands International Brands |

| By Packaging Type | Bottles Jars Tubes |

| By Distribution Mode | Direct Distribution Indirect Distribution Franchise |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Skincare Purchasers | 150 | Affluent Consumers, Beauty Enthusiasts |

| Cosmetics Boutique Owners | 100 | Retail Managers, Business Owners |

| Beauty Influencers and Bloggers | 80 | Social Media Influencers, Content Creators |

| Market Analysts and Experts | 60 | Industry Analysts, Market Researchers |

| Luxury Brand Representatives | 70 | Brand Managers, Marketing Executives |

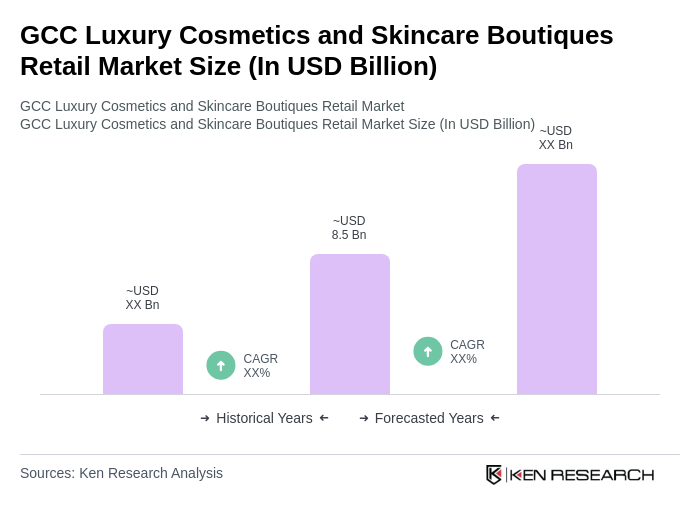

The GCC Luxury Cosmetics and Skincare Boutiques Retail Market is valued at approximately USD 8.5 billion, reflecting significant growth driven by rising disposable incomes and increasing consumer demand for premium beauty products.