Region:Middle East

Author(s):Rebecca

Product Code:KRAB8343

Pages:89

Published On:October 2025

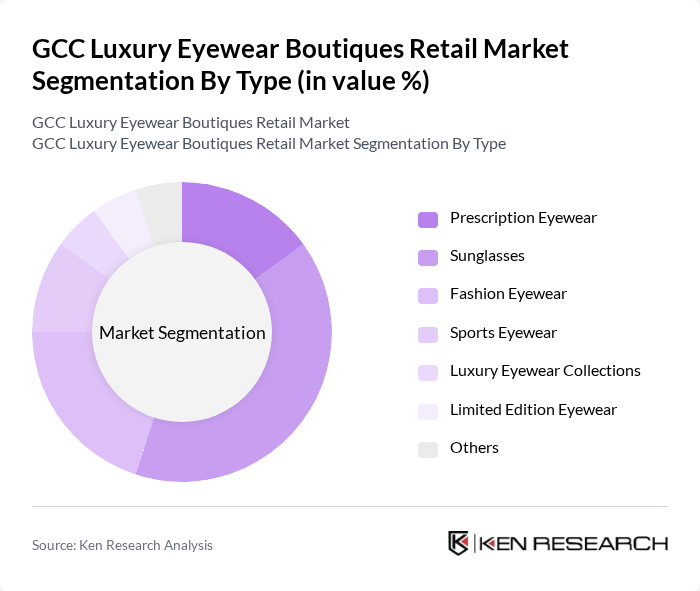

By Type:The market is segmented into various types of eyewear, including Prescription Eyewear, Sunglasses, Fashion Eyewear, Sports Eyewear, Luxury Eyewear Collections, Limited Edition Eyewear, and Others. Among these, Sunglasses dominate the market due to their dual functionality as both a fashion accessory and a protective eyewear option. The increasing trend of outdoor activities and fashion consciousness among consumers has led to a surge in demand for stylish and functional sunglasses.

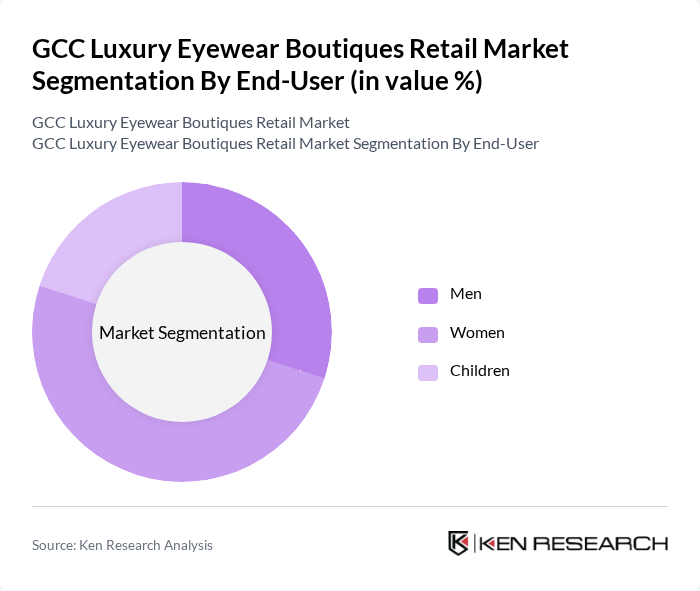

By End-User:The market is segmented by end-user demographics, including Men, Women, and Children. The Women segment leads the market, driven by a growing emphasis on fashion and personal style. Women are increasingly investing in luxury eyewear as a statement accessory, which has resulted in a higher market share compared to men and children.

The GCC Luxury Eyewear Boutiques Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Luxottica Group S.p.A., Safilo Group S.p.A., Kering Eyewear, Marcolin S.p.A., Chanel S.A., Dior S.A., Gucci, Prada S.p.A., Ray-Ban, Tom Ford, Versace, Fendi, Bvlgari, Valentino, Oliver Peoples contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC luxury eyewear market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands are likely to introduce eco-friendly eyewear options, appealing to environmentally conscious consumers. Additionally, the integration of augmented reality in retail experiences is expected to enhance customer engagement, allowing for virtual try-ons. These trends indicate a dynamic market landscape, where innovation and consumer-centric strategies will play crucial roles in shaping the industry's growth trajectory.

| Segment | Sub-Segments |

|---|---|

| By Type | Prescription Eyewear Sunglasses Fashion Eyewear Sports Eyewear Luxury Eyewear Collections Limited Edition Eyewear Others |

| By End-User | Men Women Children |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Luxury Department Stores Specialty Boutiques |

| By Price Range | Premium Mid-Range Budget |

| By Brand Positioning | High-End Luxury Brands Designer Collaborations Emerging Luxury Brands |

| By Material | Plastic Metal Wood |

| By Distribution Mode | Direct Sales Indirect Sales Franchise |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Eyewear Retailers | 100 | Store Managers, Boutique Owners |

| Affluent Consumers | 150 | High-Net-Worth Individuals, Luxury Shoppers |

| Fashion Influencers | 50 | Stylists, Fashion Bloggers |

| Market Analysts | 30 | Industry Experts, Economic Analysts |

| Tourism Sector Representatives | 40 | Travel Agency Managers, Tourism Board Officials |

The GCC Luxury Eyewear Boutiques Retail Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing disposable incomes and a rising demand for luxury eyewear, particularly in urban areas.