Region:Middle East

Author(s):Rebecca

Product Code:KRAD8432

Pages:89

Published On:December 2025

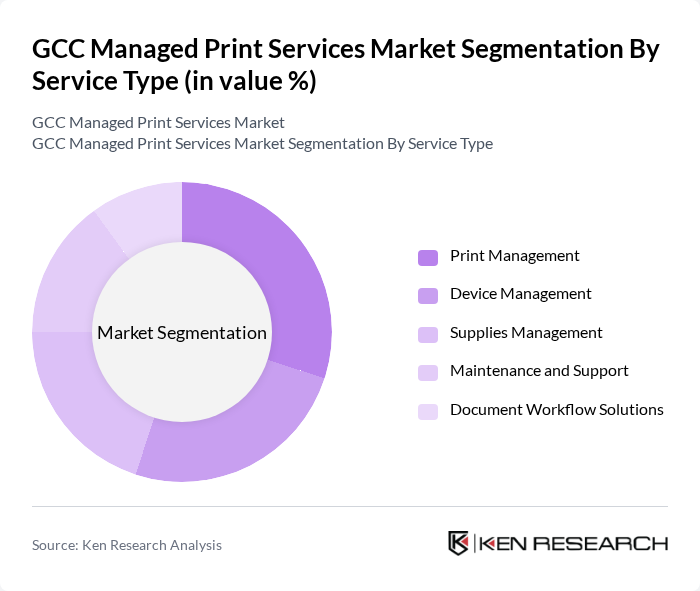

By Service Type:The service type segmentation includes various subsegments such as Print Management, Device Management, Supplies Management, Maintenance and Support, and Document Workflow Solutions. Each of these subsegments plays a crucial role in the overall managed print services ecosystem, catering to different organizational needs and preferences. Print Management and Device Management remain the dominant service categories, reflecting enterprises' focus on cost optimization and infrastructure control.

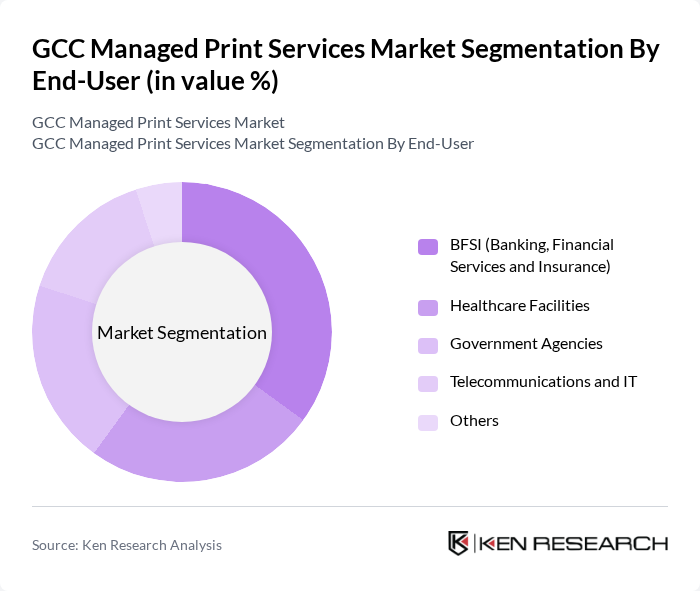

By End-User:The end-user segmentation encompasses various sectors including BFSI (Banking, Financial Services and Insurance), Healthcare Facilities, Government Agencies, Telecommunications and IT, and Others. Each sector has unique requirements and challenges that managed print services can address effectively. BFSI institutions prioritize secure print infrastructure and compliance with data protection regulations, while healthcare facilities focus on document workflow efficiency and regulatory adherence.

The GCC Managed Print Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as HP Inc., Canon Inc., Xerox Corporation, Ricoh Company, Ltd., Konica Minolta, Inc., Lexmark International, Inc., Sharp Corporation, Kyocera Document Solutions, Brother Industries, Ltd., Toshiba Tec Corporation, Dell Technologies, Epson Middle East and North Africa, Datamax-O'Neil (Zebra Technologies), Nasaco Electronics, Gulf Business Machines contribute to innovation, geographic expansion, and service delivery in this space. The competitive landscape is shaped by consolidation activities, with major OEMs integrating hardware, firmware control, and consumables supply to build defensible cost bases and expand service capabilities.

The future of the GCC managed print services market appears promising, driven by increasing digital transformation initiatives across various sectors. As businesses prioritize efficiency and sustainability, the adoption of cloud-based and mobile printing solutions is expected to rise significantly. Furthermore, the integration of advanced data analytics will enhance print management capabilities, allowing organizations to optimize their printing processes and reduce costs. This evolving landscape will create new opportunities for service providers to innovate and meet the changing needs of their clients.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Print Management Device Management Supplies Management Maintenance and Support Document Workflow Solutions |

| By End-User | BFSI (Banking, Financial Services and Insurance) Healthcare Facilities Government Agencies Telecommunications and IT Others |

| By Industry Vertical | Financial Services Healthcare Telecommunications Manufacturing Others |

| By Deployment Mode | On-Premise Services Cloud-Based Services Hybrid Services |

| By Geographic Distribution | UAE Saudi Arabia Qatar Kuwait Bahrain Oman |

| By Customer Size | Large Enterprises Small and Medium Enterprises (SMEs) |

| By Channel Type | Printer/Copier Manufacturers System Integrators and Resellers Independent Software Vendors (ISVs) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Large Enterprises MPS Adoption | 120 | IT Managers, Procurement Directors |

| SME Printing Needs Assessment | 100 | Business Owners, Office Managers |

| Healthcare Sector Printing Solutions | 80 | Healthcare Administrators, IT Directors |

| Education Sector MPS Implementation | 70 | School Administrators, IT Coordinators |

| Government Printing Services | 60 | Public Sector Procurement Officers, IT Managers |

The GCC Managed Print Services market is valued at approximately USD 1.4 billion, driven by the demand for cost-effective printing solutions and enhanced operational efficiency across various sectors.