Region:Middle East

Author(s):Dev

Product Code:KRAC3423

Pages:82

Published On:October 2025

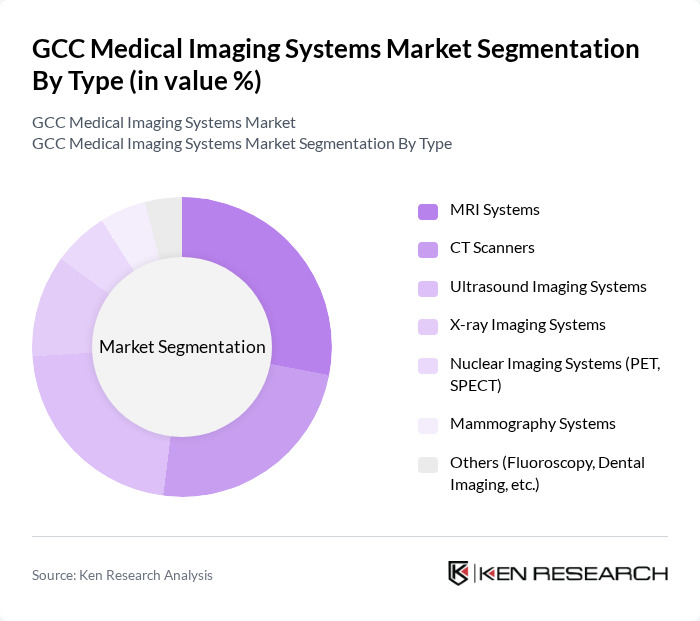

By Type:The market is segmented into various types of imaging systems, including MRI Systems, CT Scanners, Ultrasound Imaging Systems, X-ray Imaging Systems, Nuclear Imaging Systems (PET, SPECT), Mammography Systems, and Others (Fluoroscopy, Dental Imaging, etc.). Each of these sub-segments plays a crucial role in the overall market dynamics, addressing a spectrum of clinical needs from oncology and cardiology to orthopedics and women’s health. The adoption of digital and portable imaging modalities is rising, particularly in outpatient and ambulatory settings, driven by demand for faster, more accessible diagnostics .

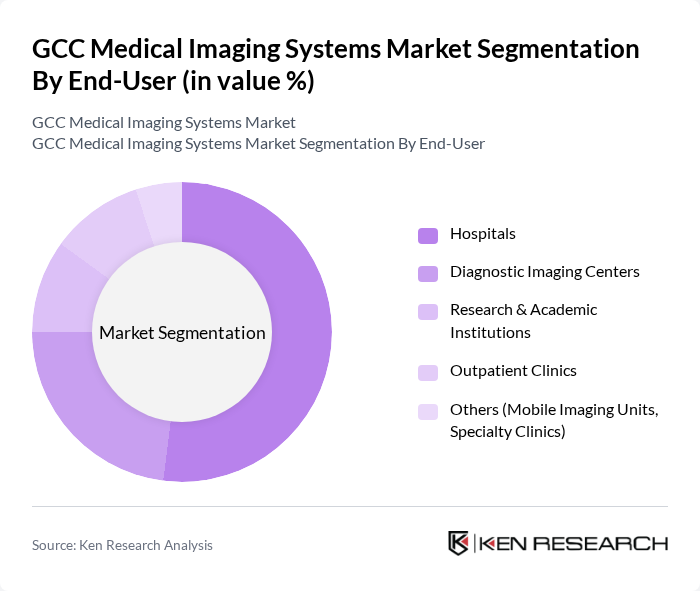

By End-User:The end-user segmentation includes Hospitals, Diagnostic Imaging Centers, Research & Academic Institutions, Outpatient Clinics, and Others (Mobile Imaging Units, Specialty Clinics). Hospitals remain the primary adopters due to the scale of imaging requirements and integration with broader healthcare IT systems. Diagnostic imaging centers are expanding rapidly, driven by demand for specialized, high-throughput services, while outpatient clinics and mobile units are leveraging portable imaging solutions for point-of-care diagnostics .

The GCC Medical Imaging Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers, GE Healthcare, Philips Healthcare, Canon Medical Systems Corporation, Fujifilm Holdings Corporation, Hitachi Medical Corporation, Agfa-Gevaert Group, Carestream Health, Hologic, Inc., Mindray Medical International Limited, Samsung Medison Co., Ltd., Varian Medical Systems, Neusoft Medical Systems Co., Ltd., Esaote S.p.A., and Bracco Imaging S.p.A. contribute to innovation, geographic expansion, and service delivery in this space. These companies are at the forefront of introducing AI-powered diagnostics, expanding cloud-based imaging solutions, and supporting the region’s digital health transformation .

The future of the GCC medical imaging systems market appears promising, driven by ongoing technological advancements and increasing healthcare investments. The integration of artificial intelligence and machine learning into imaging systems is expected to enhance diagnostic accuracy and efficiency. Additionally, the expansion of telemedicine services will facilitate remote consultations, further driving the demand for advanced imaging solutions. As healthcare providers adapt to these trends, the market is likely to experience significant growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | MRI Systems CT Scanners Ultrasound Imaging Systems X-ray Imaging Systems Nuclear Imaging Systems (PET, SPECT) Mammography Systems Others (Fluoroscopy, Dental Imaging, etc.) |

| By End-User | Hospitals Diagnostic Imaging Centers Research & Academic Institutions Outpatient Clinics Others (Mobile Imaging Units, Specialty Clinics) |

| By Application | Oncology Cardiology Neurology Orthopedics & Musculoskeletal Obstetrics/Gynecology (OB/GYN) Others (Urology, Gastroenterology, etc.) |

| By Distribution Channel | Direct Sales Distributors/Dealers Online Sales Others |

| By Region | Saudi Arabia United Arab Emirates (UAE) Qatar Kuwait Oman Bahrain Others (Rest of GCC) |

| By Price Range | Low-End Systems Mid-Range Systems High-End Systems |

| By Technology | Analog Imaging Systems Digital Imaging Systems Hybrid Imaging Systems (e.g., PET/CT, SPECT/CT) Others (AI-Integrated, Portable, etc.) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Imaging Departments | 120 | Radiologists, Imaging Directors |

| Private Clinics and Diagnostic Centers | 90 | Clinic Managers, Radiology Technologists |

| Medical Imaging Equipment Manufacturers | 50 | Sales Executives, Product Managers |

| Healthcare Policy Makers | 40 | Health Ministry Officials, Regulatory Experts |

| Healthcare IT Solutions Providers | 60 | IT Managers, Solutions Architects |

The GCC Medical Imaging Systems Market is valued at approximately USD 2.2 billion, driven by advancements in digital imaging technology and increasing healthcare expenditure in the region.