Region:Middle East

Author(s):Dev

Product Code:KRAE0011

Pages:114

Published On:December 2025

By Type:The metal stamping market can be segmented into various types, including Blanking, Bending, Deep Drawing, Embossing, Coining, Flanging, and Others. Each of these processes serves specific applications and industries, contributing to the overall market dynamics. Blanking is widely used for producing flat components such as brackets, panels, and structural parts for automotive, construction, and electrical enclosures, while Deep Drawing is critical for manufacturing complex, cup- or shell-shaped components used in automotive body parts, appliance housings, and industrial equipment, making both processes particularly significant in the GCC’s automotive, industrial machinery, and consumer goods value chains.

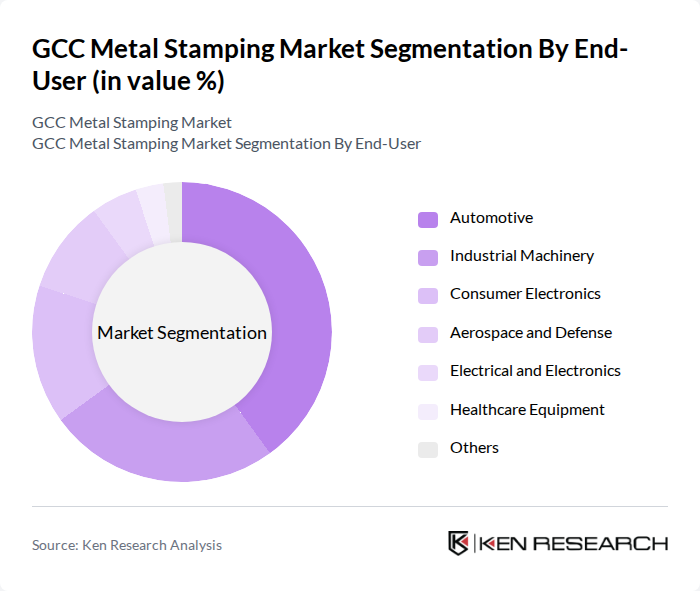

By End-User:The end-user segmentation of the metal stamping market includes Automotive, Industrial Machinery, Consumer Electronics, Aerospace and Defense, Electrical and Electronics, Healthcare Equipment, and Others. The automotive sector is the largest consumer, driven by the demand for lightweight, high-strength, and safety-critical components such as body panels, brackets, chassis parts, and interior structural elements, while the industrial machinery sector follows closely due to the need for precision parts in pumps, compressors, construction equipment, and process machinery serving oil and gas, petrochemicals, and utilities. Additionally, growing regional output of consumer electronics, electrical switchgear, and appliances, along with expanding aerospace, defense, and medical device manufacturing activities, is increasing the use of precision metal stamping for enclosures, connectors, terminals, and complex sub-assemblies.

The GCC Metal Stamping Market is characterized by a dynamic mix of regional and international players. Leading participants such as National Metal Manufacturing and Casting Co. (Maadaniyah) – Saudi Arabia, Al Ghurair Iron & Steel LLC – United Arab Emirates, Emirates Steel Arkan – United Arab Emirates, Al Jazeera Steel Products Co. SAOG – Oman, Zamil Steel Holding Company Ltd. – Saudi Arabia, Saudi Metal Industries Co. (SMI) – Saudi Arabia, Arabian International Company for Steel Structures (AIC Steel) – Saudi Arabia, Kanoo Steel and Alloys – United Arab Emirates, Al Rajhi Steel Industries Co. – Saudi Arabia, Bahra Advanced Electrical Co. Ltd. – Saudi Arabia, Bin Ghurair Metal Industries LLC – United Arab Emirates, Hidayath Group – United Arab Emirates, United Iron & Steel Company LLC – United Arab Emirates, Universal Metal Coating Company Ltd. (UNICOIL) – Saudi Arabia, Al Yamamah Steel Industries Co. – Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The GCC metal stamping market is poised for significant transformation, driven by technological advancements and increasing demand from key sectors. As manufacturers adopt automation and smart technologies, operational efficiencies will improve, allowing for greater customization. Additionally, the focus on sustainability will lead to the development of eco-friendly products, aligning with global trends. The market is expected to adapt to these changes, positioning itself for robust growth in the coming years, particularly in response to evolving consumer preferences and regulatory requirements.

| Segment | Sub-Segments |

|---|---|

| By Type | Blanking Bending Deep Drawing Embossing Coining Flanging Others |

| By End-User | Automotive Industrial Machinery Consumer Electronics Aerospace and Defense Electrical and Electronics Healthcare Equipment Others |

| By Material | Steel Aluminum Copper Stainless Steel Others |

| By Application | Body Panels and Structural Components Electrical Connectors and Terminals Chassis and Engine Components Enclosures and Housings Precision Components for Electronics Others |

| By Region | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain |

| By Technology | Mechanical Press Stamping Hydraulic Press Stamping Servo Press Stamping CNC and Automated Stamping Others |

| By Production Process | High-Volume Mass Production Batch Production Prototype and Custom Production Just-in-Time Production Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Metal Stamping | 100 | Production Managers, Quality Control Engineers |

| Aerospace Component Manufacturing | 80 | Design Engineers, Supply Chain Managers |

| Electronics Housing Production | 70 | Product Managers, Manufacturing Engineers |

| Consumer Goods Metal Stamping | 60 | Procurement Specialists, Operations Directors |

| Industrial Equipment Fabrication | 90 | Technical Directors, R&D Managers |

The GCC Metal Stamping Market is valued at approximately USD 4.2 billion, reflecting significant growth driven by increased manufacturing and processing activities, particularly in the automotive and industrial machinery sectors.