Region:Middle East

Author(s):Shubham

Product Code:KRAB7471

Pages:88

Published On:October 2025

By Type:The market is segmented into various types of footwear, including Sneakers, Sandals, Boots, Loafers, Heels, Flats, and Others. Sneakers have gained immense popularity due to their versatility and comfort, appealing to a wide demographic. Sandals and Heels are also significant, particularly among women, who often seek stylish options for various occasions. Boots and Loafers cater to both men and women, with a focus on fashion and functionality. The "Others" category includes niche products that cater to specific consumer preferences.

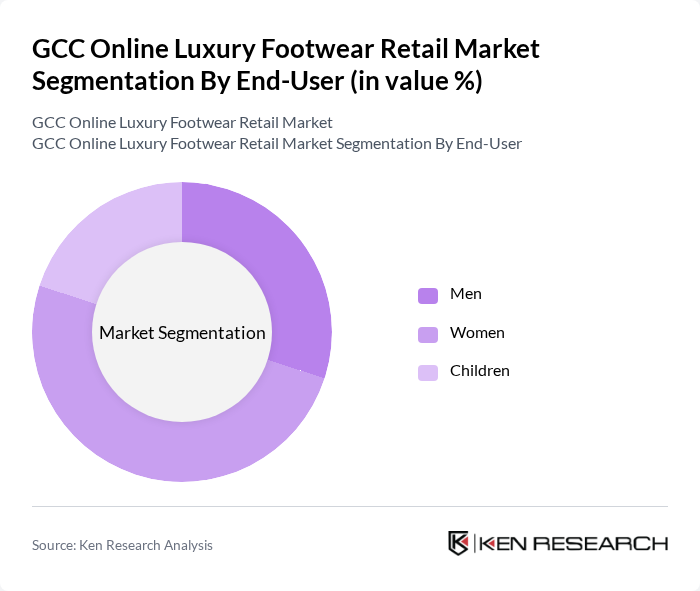

By End-User:The market is segmented by end-user into Men, Women, and Children. Women represent the largest segment, driven by a diverse range of luxury footwear options that cater to various occasions, from casual to formal. Men’s footwear is also significant, with increasing interest in stylish and comfortable options. The children’s segment, while smaller, is growing as parents seek high-quality, fashionable footwear for their kids.

The GCC Online Luxury Footwear Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Harithy Company, Chalhoub Group, Al-Futtaim Group, Azadea Group, Al Tayer Group, Majid Al Futtaim, Al Jaber Group, Landmark Group, Al Sayegh Group, Al Mufeed Group, Al Maktoum Group, Al Qudra Holding contribute to innovation, geographic expansion, and service delivery in this space.

The GCC online luxury footwear market is poised for continued growth, driven by evolving consumer preferences and technological advancements. As digital shopping becomes increasingly prevalent, brands are expected to enhance their online presence and invest in personalized shopping experiences. Additionally, the integration of augmented reality and artificial intelligence in e-commerce platforms will likely reshape consumer interactions, making the shopping experience more engaging and tailored to individual preferences, thus fostering brand loyalty.

| Segment | Sub-Segments |

|---|---|

| By Type | Sneakers Sandals Boots Loafers Heels Flats Others |

| By End-User | Men Women Children |

| By Sales Channel | Online Retailers Brand Websites Social Media Platforms Marketplaces |

| By Price Range | Premium Mid-range Budget |

| By Brand Popularity | High-end Luxury Brands Emerging Luxury Brands Established Brands |

| By Material | Leather Synthetic Fabric |

| By Occasion | Casual Formal Sports Seasonal |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Footwear Consumers | 150 | Affluent Individuals, Fashion Enthusiasts |

| Online Retail Executives | 100 | eCommerce Managers, Digital Marketing Directors |

| Fashion Industry Experts | 80 | Fashion Designers, Trend Analysts |

| Luxury Brand Representatives | 70 | Brand Managers, Sales Directors |

| Market Analysts | 60 | Market Research Analysts, Economic Consultants |

The GCC Online Luxury Footwear Retail Market is valued at approximately USD 2.5 billion, driven by increasing disposable incomes and a growing preference for online shopping among consumers seeking high-quality, branded products.