Region:Middle East

Author(s):Rebecca

Product Code:KRAB7534

Pages:96

Published On:October 2025

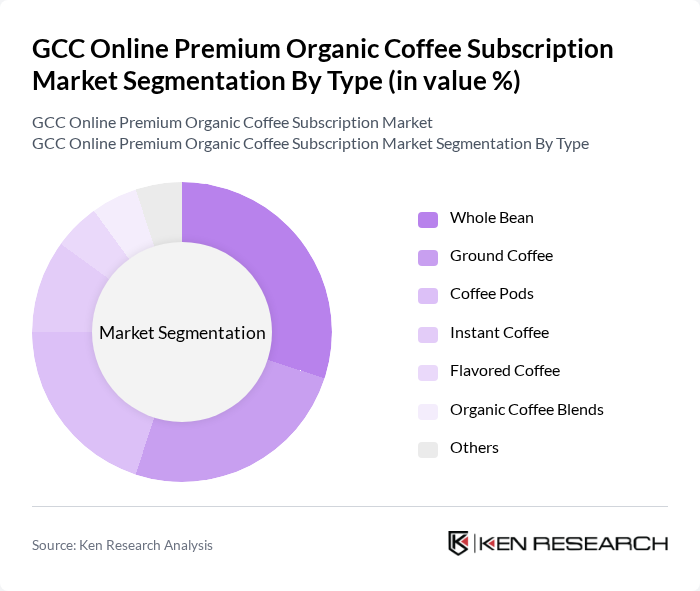

By Type:The market is segmented into various types of coffee products, including Whole Bean, Ground Coffee, Coffee Pods, Instant Coffee, Flavored Coffee, Organic Coffee Blends, and Others. Among these, Whole Bean and Ground Coffee are particularly popular due to their freshness and flavor retention, appealing to consumers who prioritize quality. Coffee Pods are also gaining traction due to their convenience, especially among busy professionals.

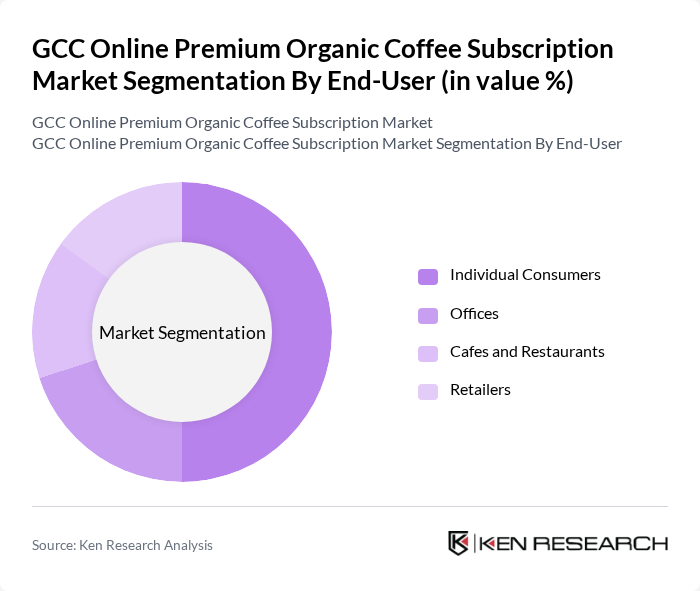

By End-User:The end-user segmentation includes Individual Consumers, Offices, Cafes and Restaurants, and Retailers. Individual Consumers dominate the market as the primary subscribers, driven by the growing trend of home brewing and the desire for premium coffee experiences. Offices and Cafes also contribute significantly, as they seek to provide high-quality coffee options to employees and customers, respectively.

The GCC Online Premium Organic Coffee Subscription Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nespresso, Blue Bottle Coffee, Illycaffè, Lavazza, Peet's Coffee, Stumptown Coffee Roasters, Death Wish Coffee, Kicking Horse Coffee, Verve Coffee Roasters, Counter Culture Coffee, Trade Coffee, Atlas Coffee Club, Grounds for Change, Coffee Bean Direct, Fresh Roasted Coffee LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC online premium organic coffee subscription market appears promising, driven by evolving consumer preferences and technological advancements. As health consciousness continues to rise, more consumers are expected to seek organic options, while e-commerce growth will facilitate easier access to these products. Additionally, the integration of innovative subscription models and personalized offerings will likely enhance customer retention and satisfaction, positioning the market for sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Whole Bean Ground Coffee Coffee Pods Instant Coffee Flavored Coffee Organic Coffee Blends Others |

| By End-User | Individual Consumers Offices Cafes and Restaurants Retailers |

| By Sales Channel | Online Retail Subscription Services Direct Sales Third-Party Marketplaces |

| By Price Range | Premium Mid-Range Budget |

| By Packaging Type | Eco-Friendly Packaging Standard Packaging Bulk Packaging |

| By Subscription Model | Fixed Subscription Flexible Subscription Gift Subscription |

| By Region | UAE Saudi Arabia Qatar Kuwait Oman Bahrain Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Coffee Subscription Users | 150 | Regular Subscribers, Occasional Buyers |

| Organic Coffee Retailers | 100 | Store Managers, E-commerce Directors |

| Coffee Roasters and Producers | 80 | Business Owners, Production Managers |

| Consumer Behavior Analysts | 60 | Market Researchers, Trend Analysts |

| Health and Wellness Influencers | 50 | Bloggers, Social Media Influencers |

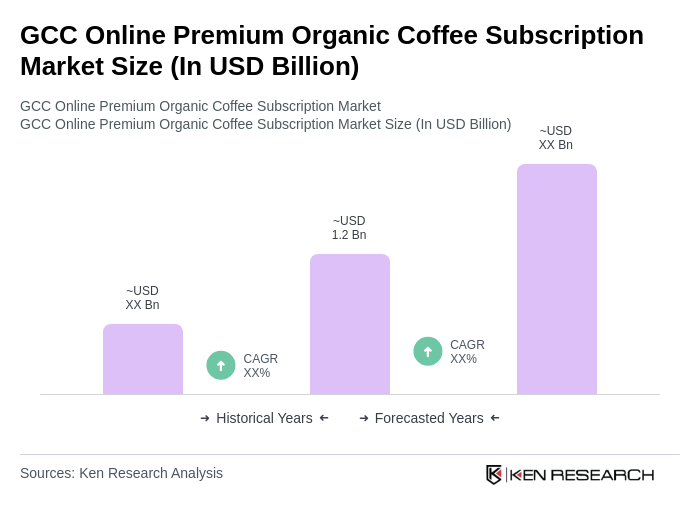

The GCC Online Premium Organic Coffee Subscription Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing consumer demand for high-quality organic products and the convenience of subscription services.