Region:Middle East

Author(s):Rebecca

Product Code:KRAD8181

Pages:83

Published On:December 2025

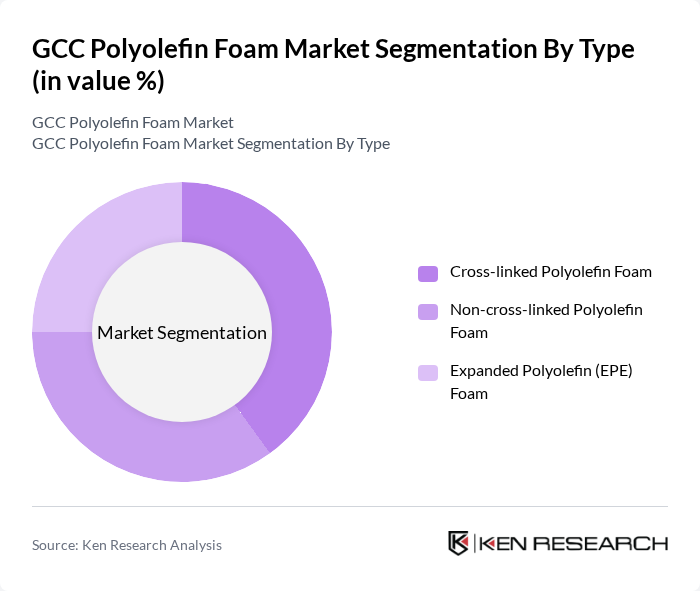

By Type:The market is segmented into three main types: Cross-linked Polyolefin Foam, Non-cross-linked Polyolefin Foam, and Expanded Polyolefin (EPE) Foam. Cross-linked Polyolefin Foam is gaining traction due to its superior durability and resistance to chemicals, making it ideal for automotive and construction applications. Non-cross-linked Polyolefin Foam is favored for its lightweight properties and cost-effectiveness, while Expanded Polyolefin Foam is widely used in packaging due to its cushioning capabilities.

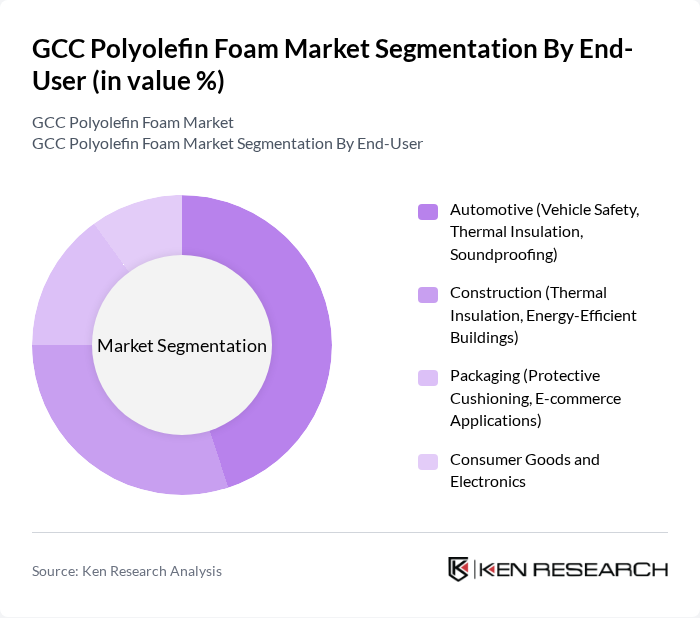

By End-User:The end-user segmentation includes Automotive, Construction, Packaging, and Consumer Goods and Electronics. The automotive sector is the largest consumer of polyolefin foam, driven by the need for lightweight materials that enhance fuel efficiency and safety. The construction industry follows closely, utilizing these foams for thermal insulation and energy-efficient building solutions. Packaging applications are also significant, particularly in e-commerce, where protective cushioning is essential.

The GCC Polyolefin Foam Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Dow Inc., Huntsman Corporation, INEOS Group Holdings S.A., SABIC (Saudi Basic Industries Corporation), Armacell International S.A., Sealed Air Corporation, Zotefoams plc, Recticel NV/SA, JSP Corporation, UFP Technologies Inc., FoamPartner Group, RMAX LLC, Cellofoam North America Inc., K-Flex S.r.l. contribute to innovation, geographic expansion, and service delivery in this space.

The GCC polyolefin foam market is poised for significant growth, driven by technological advancements and a shift towards sustainable materials. As manufacturers innovate in production techniques, the quality and application range of polyolefin foams are expected to expand. Additionally, the increasing integration of smart technologies in construction and automotive sectors will further enhance the demand for these materials. The market is likely to see a rise in eco-friendly product offerings, aligning with global sustainability trends and consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Cross-linked Polyolefin Foam Non-cross-linked Polyolefin Foam Expanded Polyolefin (EPE) Foam |

| By End-User | Automotive (Vehicle Safety, Thermal Insulation, Soundproofing) Construction (Thermal Insulation, Energy-Efficient Buildings) Packaging (Protective Cushioning, E-commerce Applications) Consumer Goods and Electronics |

| By Application | Thermal Insulation Cushioning and Impact Protection Soundproofing and Acoustic Damping Vibration Isolation |

| By Density | Low Density (Below 50 kg/m³) Medium Density (50-100 kg/m³) High Density (Above 100 kg/m³) |

| By Material Composition | Petroleum-Based Polyolefin Foam Bio-Based and Sustainable Polyolefin Foam Recycled Polyolefin Foam |

| By Region | Saudi Arabia United Arab Emirates (UAE) Qatar Kuwait Bahrain Oman |

| By Manufacturing Process | Extrusion Injection Molding Compression Molding |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Applications | 100 | Product Engineers, Procurement Managers |

| Packaging Solutions | 80 | Packaging Designers, Supply Chain Managers |

| Construction Materials | 90 | Project Managers, Material Suppliers |

| Consumer Goods | 70 | Brand Managers, Product Development Leads |

| Insulation Products | 60 | Technical Sales Representatives, R&D Managers |

The GCC Polyolefin Foam Market is valued at approximately USD 585 million, reflecting a significant growth trend driven by the demand for lightweight and energy-efficient materials across various industries, including automotive, construction, and packaging.