Region:Middle East

Author(s):Rebecca

Product Code:KRAB7543

Pages:91

Published On:October 2025

By Type:The market is segmented into various types of energy drinks, including carbonated, non-carbonated, organic, sugar-free, functional, energy shots, and others. Among these, carbonated energy drinks have gained significant popularity due to their refreshing taste and wide availability. Non-carbonated options are also on the rise, appealing to health-conscious consumers. Organic and sugar-free variants are increasingly favored as consumers become more aware of health and wellness trends.

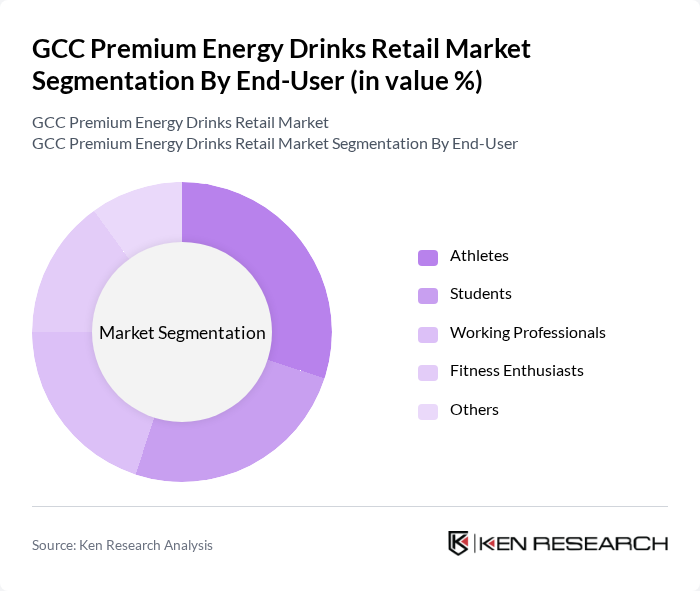

By End-User:The end-user segmentation includes athletes, students, working professionals, fitness enthusiasts, and others. Athletes and fitness enthusiasts are the primary consumers, as they seek energy drinks to enhance performance and recovery. Working professionals also contribute significantly to the market, driven by the need for energy boosts during long working hours. The growing trend of fitness and health awareness among students is further propelling the demand for energy drinks.

The GCC Premium Energy Drinks Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Red Bull GmbH, Monster Beverage Corporation, PepsiCo, Inc., The Coca-Cola Company, Rockstar, Inc., NOS Energy Drink, 5-hour Energy, Celsius Holdings, Inc., Bang Energy, Hype Energy, Xyience Energy, EBOOST, Raze Energy, Adrenaline Shoc, V8 Energy contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC premium energy drinks market appears promising, driven by evolving consumer preferences and technological advancements. As health-consciousness continues to rise, brands are expected to innovate with functional ingredients and sustainable practices. Additionally, the integration of digital marketing strategies will enhance brand visibility and consumer engagement. The market is likely to see increased collaboration with fitness and wellness brands, further solidifying the connection between energy drinks and healthy lifestyles, thus expanding consumer reach and market penetration.

| Segment | Sub-Segments |

|---|---|

| By Type | Carbonated Energy Drinks Non-Carbonated Energy Drinks Organic Energy Drinks Sugar-Free Energy Drinks Functional Energy Drinks Energy Shots Others |

| By End-User | Athletes Students Working Professionals Fitness Enthusiasts Others |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail Health and Fitness Stores Others |

| By Packaging Type | Cans Bottles Tetra Packs Others |

| By Price Range | Premium Mid-Range Economy Others |

| By Flavor | Citrus Berry Tropical Others |

| By Region | GCC Countries Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Outlets Selling Premium Energy Drinks | 150 | Store Managers, Category Buyers |

| Health and Fitness Enthusiasts | 100 | Gym Members, Sports Coaches |

| Online Retail Platforms | 80 | E-commerce Managers, Digital Marketing Specialists |

| Distribution Channels for Energy Drinks | 70 | Logistics Managers, Supply Chain Coordinators |

| Consumer Preferences and Trends | 120 | General Consumers, Health-Conscious Shoppers |

The GCC Premium Energy Drinks Retail Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by increasing consumer demand for energy-boosting beverages, particularly among young adults and professionals focused on performance and wellness.