Region:Middle East

Author(s):Dev

Product Code:KRAD0486

Pages:98

Published On:August 2025

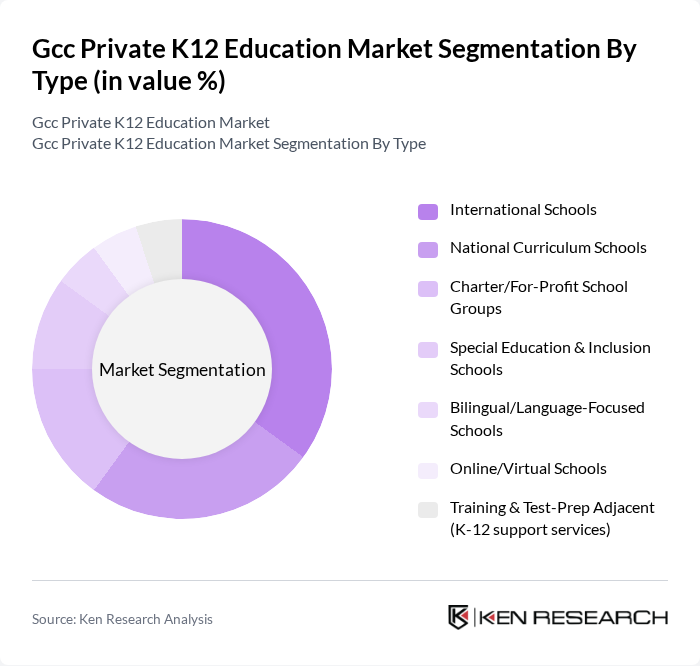

By Type:The market is segmented into various types of educational institutions, including International Schools, National Curriculum Schools, Charter/For-Profit School Groups, Special Education & Inclusion Schools, Bilingual/Language-Focused Schools, Online/Virtual Schools, and Training & Test-Prep Adjacent (K-12 support services). Each type caters to different educational needs and preferences, reflecting the diverse landscape of private education in the GCC region .

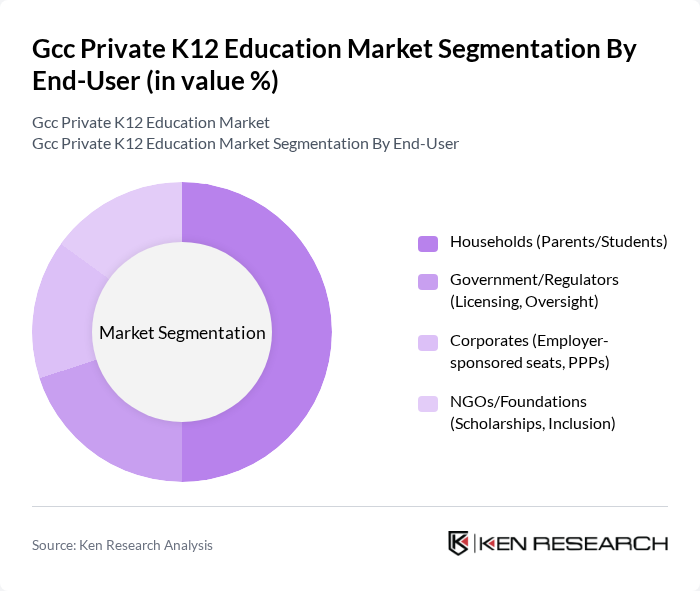

By End-User:The end-user segmentation includes Households (Parents/Students), Government/Regulators (Licensing, Oversight), Corporates (Employer-sponsored seats, PPPs), and NGOs/Foundations (Scholarships, Inclusion). This segmentation highlights the various stakeholders involved in the private K12 education market, each with distinct needs and contributions to the educational ecosystem .

The GCC Private K12 Education Market is characterized by a dynamic mix of regional and international players. Leading participants such as GEMS Education, SABIS Education (The International School of Choueifat network), Aldar Education (UAE), Taaleem Holdings (UAE), Nord Anglia Education, Cognita Schools, Kings’ Education (Dubai), Bloom Education (incl. Brighton College schools in UAE), Innoventures Education (Dubai International Academy, Raffles), Al Najah Education (UAE), Al?Hekma International School (Bahrain), Ajyal International School (Abu Dhabi), Repton Family of Schools (Dubai, Abu Dhabi, Al Barsha), Doha British School (Qatar), Qatar International School (Qatar) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the GCC private K12 education market appears promising, driven by ongoing investments in educational technology and infrastructure. As governments continue to prioritize education, the integration of digital learning tools is expected to enhance teaching methodologies and student engagement. Furthermore, the increasing emphasis on STEM and bilingual education will likely shape curricula, catering to the evolving needs of a diverse student population, thus fostering a more competitive educational landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | International Schools National Curriculum Schools Charter/For?Profit School Groups Special Education & Inclusion Schools Bilingual/Language-Focused Schools Online/Virtual Schools Training & Test-Prep Adjacent (K-12 support services) |

| By End-User | Households (Parents/Students) Government/Regulators (Licensing, Oversight) Corporates (Employer-sponsored seats, PPPs) NGOs/Foundations (Scholarships, Inclusion) |

| By Curriculum | British (IGCSE/A-Levels) American (AP/Common Core) International Baccalaureate (IB) National/MOE (Saudi, UAE, Qatar, Oman, Bahrain, Kuwait) Indian (CBSE/ICSE) Others (French, German, Canadian, etc.) |

| By Location | Tier-1 Cities (Riyadh, Dubai, Abu Dhabi, Doha, Kuwait City, Manama) Tier-2/3 Cities and Emerging Suburbs Remote/Peripheral Areas |

| By Fee Structure | Premium (USD 15,000+ per annum) Mid-Market (USD 6,000–14,999) Value/Low-Fee (Below USD 6,000) |

| By School Size | Small (<1,000 students) Medium (1,000–2,000 students) Large (>2,000 students) |

| By Ownership | Independently Owned Schools Chains/Groups & Franchises Non-Profit/Charitable Trusts |

| By Country | Saudi Arabia United Arab Emirates Qatar Oman Bahrain Kuwait |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Private K12 School Administrators | 90 | Principals, School Directors |

| Parents of Private K12 Students | 140 | Parents, Guardians |

| Educators in Private K12 Schools | 80 | Teachers, Curriculum Coordinators |

| Education Policy Makers | 60 | Government Officials, Education Consultants |

| Private Education Investors | 40 | Investors, Financial Analysts |

The GCC Private K12 Education Market is valued at approximately USD 34 billion, driven by population growth, higher disposable incomes, and a preference for high-quality international curricula in private schools across major GCC cities.