Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4859

Pages:82

Published On:December 2025

Market.png)

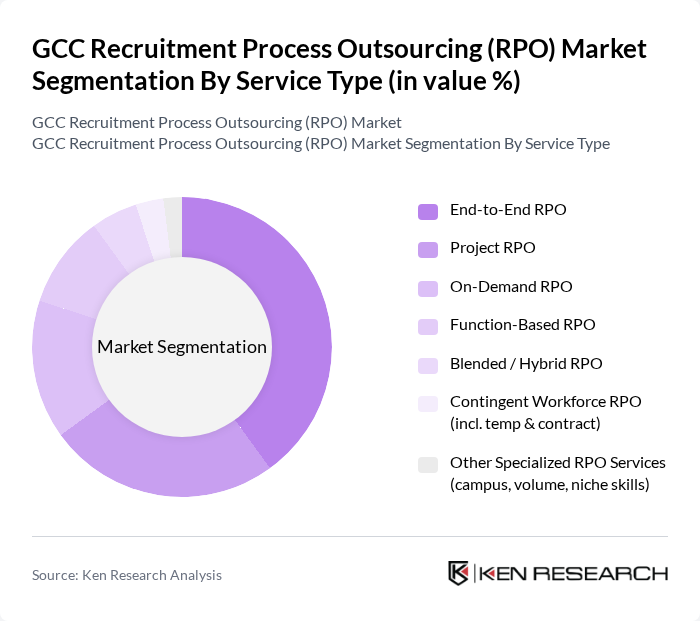

By Service Type:The service type segmentation of the RPO market includes various models tailored to meet specific client needs. The dominant sub-segment is End-to-End RPO, which offers comprehensive recruitment solutions from workforce planning and sourcing to assessment, selection, and onboarding, often supported by embedded onsite teams and technology platforms. This model is favored by large enterprises and regional headquarters seeking to outsource their entire recruitment process to enhance efficiency, standardize processes across countries, and reduce time-to-hire and cost-to-hire. Other notable sub-segments include Project RPO, which is used for defined hiring campaigns such as large expansion programs or new project mobilizations, and On-Demand RPO, which provides flexible, short-term support for spikes in hiring demand or specific roles. Function-Based RPO focuses on particular functions like IT, engineering, or shared services; Blended / Hybrid RPO combines traditional RPO with contingent workforce management; and specialized RPO services address campus recruitment, high-volume hiring, and niche skills in sectors such as energy, construction, and healthcare.

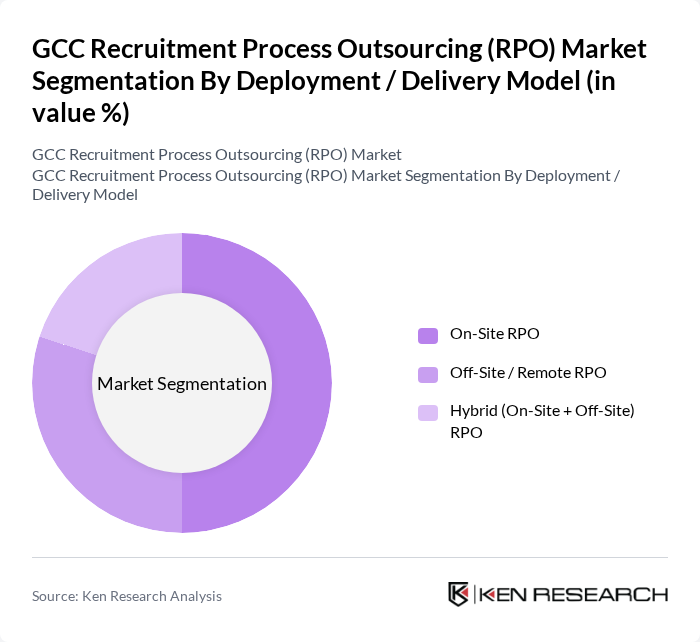

By Deployment / Delivery Model:The deployment model segmentation includes On-Site RPO, Off-Site / Remote RPO, and Hybrid RPO. The On-Site RPO sub-segment is currently leading the market, as many organizations in the GCC prefer having recruitment teams embedded within their operations, especially for large nationalization programs and project-based industries, to ensure alignment with company culture, stakeholder engagement, and immediate responsiveness to hiring needs. Off-Site RPO is gaining traction due to its cost-effectiveness, access to regional delivery centers, and ability to leverage remote sourcing teams, while Hybrid RPO offers flexibility by combining both approaches, allowing critical roles to be handled onsite and volume or specialized sourcing to be managed offsite.

The GCC Recruitment Process Outsourcing (RPO) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Adecco Middle East (The Adecco Group), ManpowerGroup Middle East, Randstad MENA, Michael Page / PageGroup Middle East, Hays Middle East, Robert Walters Middle East, Robert Half UAE, Korn Ferry Middle East, Allegis Global Solutions (Middle East), Cielo (Middle East & Emerging Markets), Brunel International Middle East, NES Fircroft Middle East, TASC Outsourcing (UAE), Bayt.com, Tanqeeb / GulfTalent contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC RPO market appears promising, driven by ongoing technological advancements and a growing emphasis on data-driven recruitment strategies. As organizations increasingly adopt AI and automation, the efficiency of recruitment processes is expected to improve significantly. Furthermore, the rise of remote work arrangements will likely reshape talent acquisition, allowing RPO providers to tap into a broader talent pool, enhancing their service offerings and market reach in the region.

| Segment | Sub-Segments |

|---|---|

| By Service Type | End-to-End RPO Project RPO On-Demand RPO Function-Based RPO Blended / Hybrid RPO Contingent Workforce RPO (incl. temp & contract) Other Specialized RPO Services (campus, volume, niche skills) |

| By Deployment / Delivery Model | On-Site RPO Off-Site / Remote RPO Hybrid (On-Site + Off-Site) RPO |

| By Industry Vertical | BFSI (Banking, Financial Services & Insurance) Information Technology & Telecom Oil & Gas, Energy & Utilities Healthcare & Life Sciences Government & Public Sector Construction, Real Estate & Infrastructure Retail, E?commerce & Consumer Goods Manufacturing & Industrial Hospitality, Travel & Tourism Education & Training Others |

| By Service Scope | Sourcing & Talent Mapping Screening, Assessment & Shortlisting Interview Management & Selection Support Offer Management & Onboarding Support Employer Branding & Recruitment Marketing Talent Analytics & Advisory Compliance & Background Screening Others |

| By Geography | United Arab Emirates Saudi Arabia Qatar Kuwait Oman Bahrain |

| By Client Size | Large Enterprises (1,000+ employees) Upper Mid-Market (500–999 employees) Mid-Market (100–499 employees) Small Enterprises & Startups (<100 employees) |

| By Recruitment Channel / Technology | ATS-Driven & Digital Recruitment Platforms Online Job Portals & Aggregators Social Media & Professional Networks Recruitment & Executive Search Agencies Employee Referrals & Internal Talent Pools Campus & Early-Talent Recruitment Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Sector Recruitment | 60 | HR Managers, Recruitment Specialists |

| IT and Technology Staffing | 50 | Talent Acquisition Leads, IT Directors |

| Construction and Engineering Hiring | 40 | Project Managers, HR Directors |

| Hospitality and Tourism Recruitment | 40 | Operations Managers, HR Coordinators |

| Financial Services Talent Acquisition | 50 | Recruitment Managers, Compliance Officers |

The GCC Recruitment Process Outsourcing (RPO) Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the demand for skilled labor and advancements in recruitment technologies.