GCC RegTech Solutions Market Overview

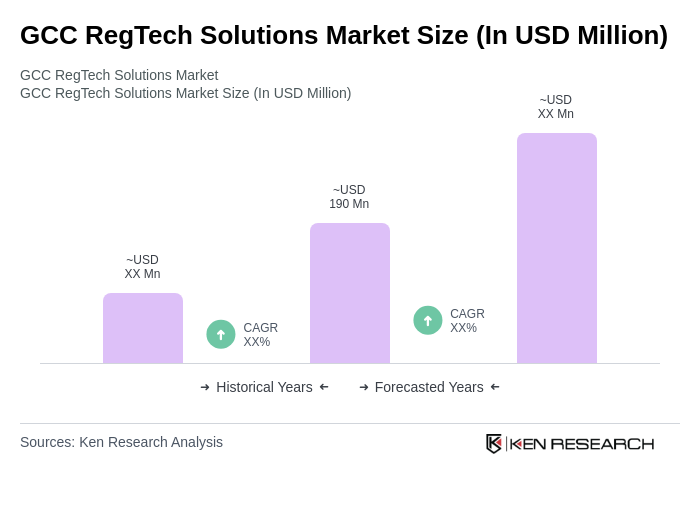

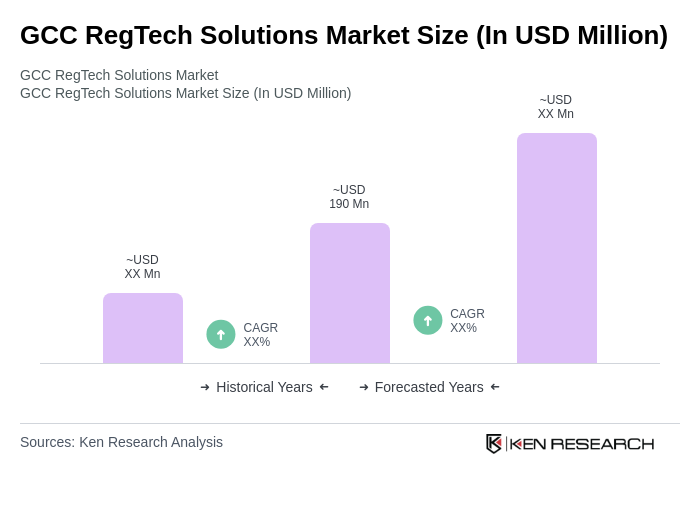

- The GCC RegTech Solutions Market is valued at USD 190 million, based on a five-year historical analysis. This growth is primarily driven by increasing regulatory requirements, the need for financial institutions to enhance compliance and risk management processes, and the accelerating adoption of digital transactions. The rise in digital payments, open banking frameworks, and stricter enforcement of anti-money laundering (AML) and know-your-customer (KYC) norms have further fueled demand for innovative regulatory technology solutions. Advanced technologies such as artificial intelligence, machine learning, and cloud computing are reshaping compliance and risk management practices, enabling real-time monitoring and predictive analytics .

- Key players in this market include the United Arab Emirates and Saudi Arabia, which dominate due to their robust financial sectors and proactive regulatory frameworks. The UAE's strategic initiatives to become a global financial hub and Saudi Arabia's Vision 2030 plan, which emphasizes modernization, digital transformation, and compliance, contribute significantly to their leadership in the RegTech space. Both countries have invested in digital infrastructure and regulatory sandboxes to foster innovation in financial technology .

- In 2023, the Central Bank of the UAE implemented the "Guidance for Anti-Money Laundering and Combating the Financing of Terrorism for Financial Institutions," issued by the Central Bank of the UAE. This framework mandates financial institutions to adopt advanced technologies for transaction monitoring and customer due diligence, including automated AML screening and real-time risk assessment. The regulation requires compliance with enhanced reporting standards and the use of RegTech platforms for ongoing monitoring and suspicious activity detection .

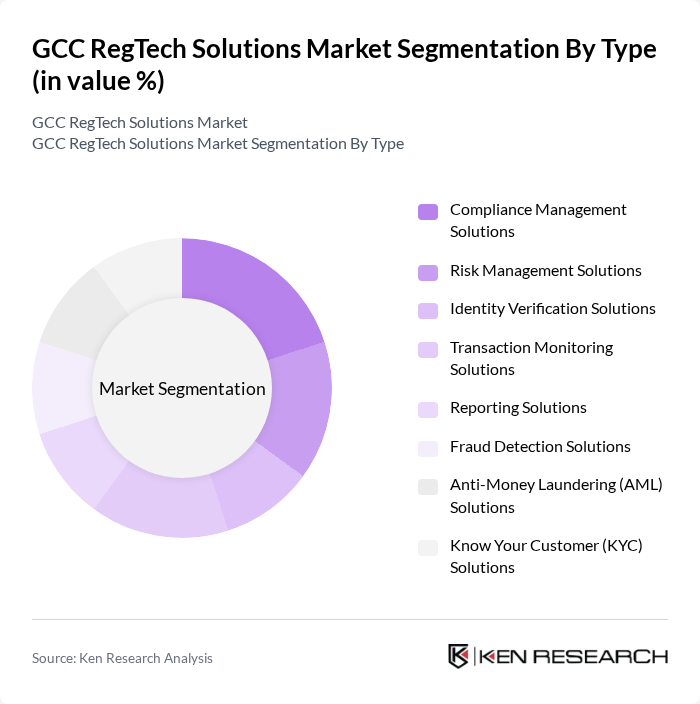

GCC RegTech Solutions Market Segmentation

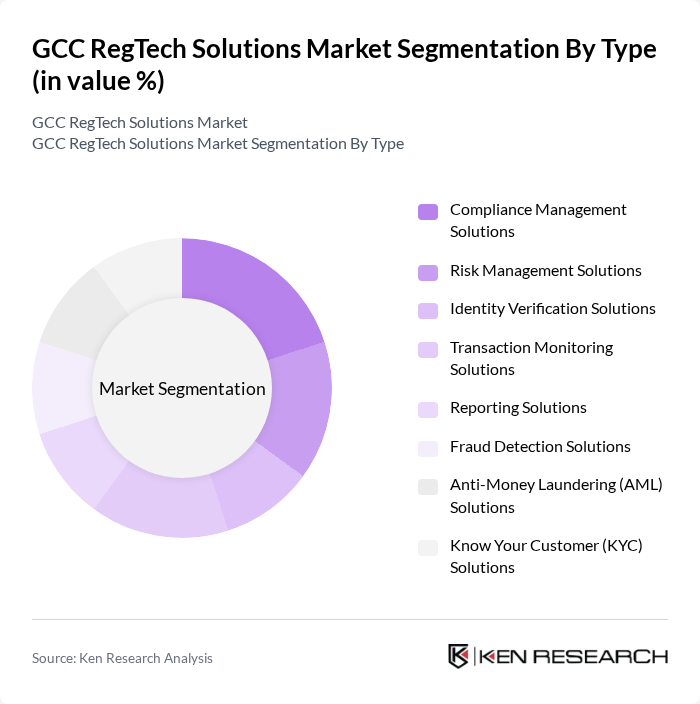

By Type:The market can be segmented into various types of solutions that address distinct regulatory needs. The primary subsegments include Compliance Management Solutions, Risk Management Solutions, Identity Verification Solutions, Transaction Monitoring Solutions, Reporting Solutions, Fraud Detection Solutions, Anti-Money Laundering (AML) Solutions, and Know Your Customer (KYC) Solutions. These solutions enable financial institutions to automate compliance processes, enhance risk assessment, improve customer onboarding, and ensure regulatory reporting accuracy. Technologies such as AI, machine learning, and cloud-based platforms underpin these solutions, supporting scalability and real-time analytics .

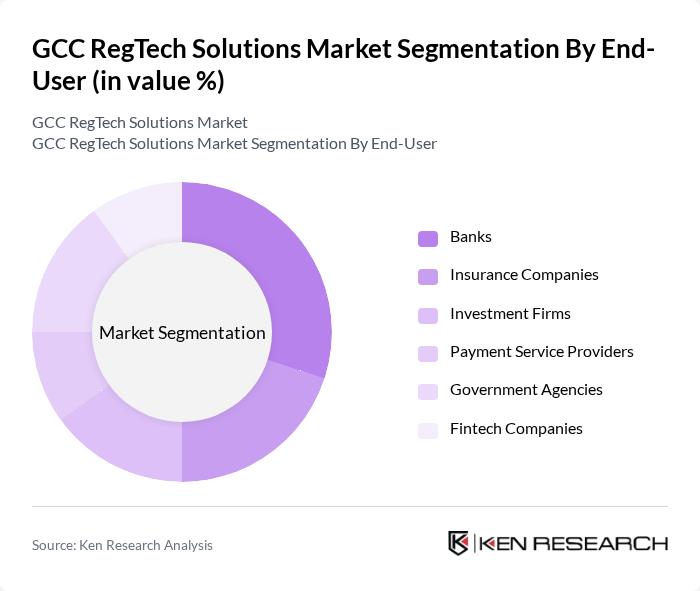

By End-User:The end-user segmentation includes sectors utilizing RegTech solutions: Banks, Insurance Companies, Investment Firms, Payment Service Providers, Government Agencies, and Fintech Companies. Banks and insurance companies represent the largest share due to high compliance demands and exposure to financial crime risks. Investment firms, payment service providers, and fintech companies increasingly adopt RegTech for transaction monitoring, fraud detection, and regulatory reporting. Government agencies leverage these platforms to supervise financial institutions and enforce compliance standards .

GCC RegTech Solutions Market Competitive Landscape

The GCC RegTech Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fenergo, ComplyAdvantage, NICE Actimize, Amlify, RiskScreen, SAS Institute, Oracle Financial Services, Refinitiv, ACTICO GmbH, Verafin, InfrasoftTech, Quantexa, LexisNexis Risk Solutions, and Palantir Technologies contribute to innovation, geographic expansion, and service delivery in this space.

GCC RegTech Solutions Market Industry Analysis

Growth Drivers

- Increasing Regulatory Compliance Requirements:The GCC region has seen a significant rise in regulatory compliance requirements, with the number of regulations increasing by 30% from 2018 to 2023. This surge is driven by the need for financial institutions to adhere to international standards, such as the Basel III framework, which mandates higher capital requirements. As of the future, the total compliance costs for banks in the GCC are projected to reach approximately USD 1.5 billion, highlighting the urgent need for RegTech solutions to streamline compliance processes.

- Adoption of Digital Transformation in Financial Services:The digital transformation wave in the GCC financial services sector is accelerating, with investments in technology expected to exceed USD 10 billion in the future. This shift is fueled by the increasing demand for efficient, customer-centric services. As banks and financial institutions adopt digital solutions, the need for RegTech to ensure compliance with evolving regulations becomes critical, driving market growth. The integration of digital tools is projected to enhance operational efficiency by 25% across the sector.

- Enhanced Focus on Data Privacy and Security:With data breaches costing companies an average of USD 3.86 million per incident globally, the GCC is prioritizing data privacy and security. In the future, the region is expected to invest over USD 1 billion in cybersecurity measures, including RegTech solutions that ensure compliance with data protection regulations. The implementation of stringent data privacy laws, similar to GDPR, is driving organizations to adopt advanced technologies to safeguard sensitive information, further propelling the RegTech market.

Market Challenges

- High Implementation Costs:The initial costs associated with implementing RegTech solutions can be prohibitive, with estimates suggesting that financial institutions may incur expenses ranging from USD 500,000 to USD 2 million per project. This financial burden can deter smaller firms from adopting necessary technologies, limiting market growth. As of the future, the average return on investment for RegTech solutions is projected to take up to three years, making immediate adoption challenging for many organizations.

- Lack of Skilled Workforce:The GCC region faces a significant skills gap in the RegTech sector, with a shortage of qualified professionals estimated at 60,000 in the future. This lack of expertise hampers the effective implementation and management of RegTech solutions. Organizations are struggling to find talent proficient in both regulatory requirements and technology, which is essential for maximizing the benefits of RegTech. Consequently, this challenge may slow down the adoption of innovative compliance solutions across the region.

GCC RegTech Solutions Market Future Outlook

The future of the GCC RegTech solutions market appears promising, driven by technological advancements and increasing regulatory pressures. As organizations prioritize compliance and risk management, the integration of artificial intelligence and machine learning into RegTech solutions is expected to enhance efficiency and accuracy. Furthermore, collaboration between financial institutions and regulatory bodies will likely foster innovation, leading to the development of more robust compliance frameworks. This evolving landscape will create a fertile ground for growth and investment in the RegTech sector.

Market Opportunities

- Growth in Fintech Startups:The GCC region is witnessing a surge in fintech startups, with over 400 new companies established recently. This growth presents a significant opportunity for RegTech solutions to cater to the compliance needs of these agile firms. As fintechs often lack the resources to manage regulatory requirements, partnerships with RegTech providers can enhance their operational capabilities and market competitiveness.

- Expansion of Cloud-Based Solutions:The shift towards cloud-based solutions is gaining momentum, with the GCC cloud computing market projected to reach USD 10 billion in the future. This trend offers RegTech companies the chance to develop scalable, cost-effective compliance solutions that can be easily integrated into existing systems. The flexibility and accessibility of cloud technologies will enable organizations to respond swiftly to regulatory changes, enhancing overall compliance efficiency.