GCC Resilient Flooring Market Overview

- The GCC Resilient Flooring Market is valued at USD 1.1 billion, based on a five-year historical analysis, reflecting its share within the broader Middle East and global resilient flooring markets. This growth is primarily driven by increasing urbanization, rising disposable incomes, and a growing preference for durable and low-maintenance flooring solutions across GCC economies, supported by large-scale residential and commercial construction activity. The market has seen a surge in demand for resilient flooring products, particularly in the residential and commercial sectors, as consumers and developers seek sustainable, easy-to-maintain, and aesthetically pleasing options, including vinyl, rubber, and other resilient materials.

- Key players in this market include Saudi Arabia and the United Arab Emirates, which dominate due to their rapid infrastructure development and significant investments in construction projects, particularly in housing, hospitality, healthcare, education, and retail. The UAE's focus on luxury real estate, high-end hospitality, and mixed-use developments, along with Saudi Arabia's Vision 2030 initiative and giga-projects such as NEOM and The Red Sea developments, further enhance the demand for resilient flooring solutions in high-traffic, design-focused spaces, making these countries pivotal in the GCC market landscape.

- Across the GCC, green building frameworks and national building codes increasingly emphasize eco-friendly and low-emission construction materials, including flooring, thereby supporting the uptake of resilient flooring products that comply with these requirements. A key reference framework is the Estidama Pearl Rating System introduced under the Abu Dhabi Urban Planning Council’s building regulations in 2010, which sets mandatory sustainability criteria for government and large private projects, including requirements related to material environmental performance, indoor air quality, and low-VOC finishes, directly influencing flooring specifications. Similar green building codes and standards in Saudi Arabia, Qatar, and other GCC states encourage the use of recyclable, low-VOC, and durable resilient flooring materials that help projects achieve their targeted rating levels.

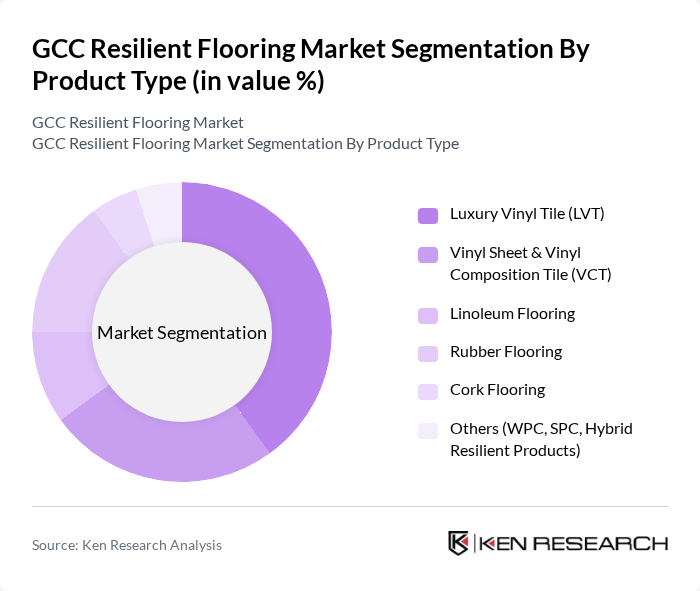

GCC Resilient Flooring Market Segmentation

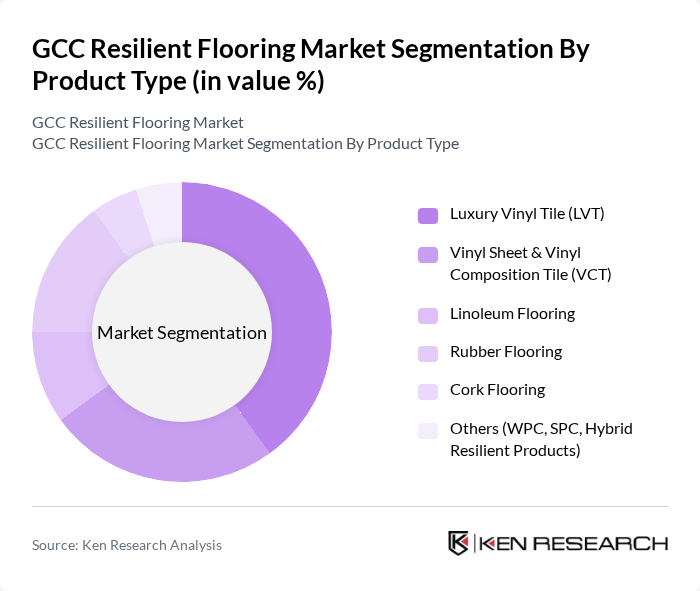

By Product Type:The product type segmentation includes Luxury Vinyl Tile (LVT), Vinyl Sheet & Vinyl Composition Tile (VCT), Linoleum Flooring, Rubber Flooring, Cork Flooring, and Others (WPC, SPC, Hybrid Resilient Products). Among these, Luxury Vinyl Tile (LVT) is the leading sub-segment due to its versatility, aesthetic appeal, and ease of installation, in line with global trends where flexible and rigid LVT together account for the largest share of resilient flooring revenues. The growing trend of home renovation, rising adoption of wood- and stone-look designs, and the increasing popularity of LVT in commercial spaces such as retail, hospitality, and offices contribute to its dominance in the market, with click-lock and loose-lay systems further supporting faster installation in GCC projects.

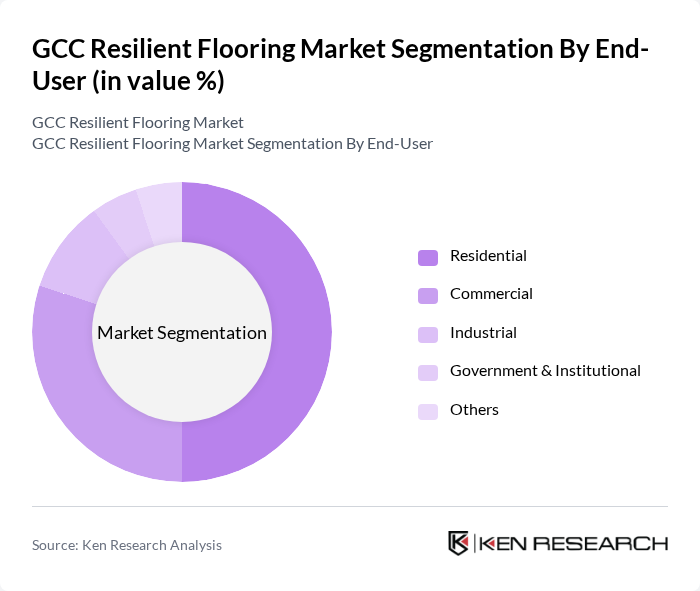

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Government & Institutional, and Others. The residential segment is the largest due to the increasing trend of home improvement and renovation projects across GCC cities, supported by rising household incomes and expanding middle-class populations. Consumers are increasingly opting for resilient flooring solutions that offer durability, water and stain resistance, acoustic comfort, and aesthetic appeal, driving the growth of this segment, while commercial applications such as offices, healthcare, and education also show strong uptake due to lifecycle cost advantages and easier maintenance.

GCC Resilient Flooring Market Competitive Landscape

The GCC Resilient Flooring Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tarkett S.A., Gerflor Group, Forbo Flooring Systems, Armstrong Flooring, Inc., Mohawk Industries, Inc., Shaw Industries Group, Inc., Interface, Inc., LG Hausys (LX Hausys), Polyflor Ltd, Beaulieu International Group, MAPEI S.p.A., Ecore International, Rak Ceramics PJSC, Al Sorayai Group, Saudi Ceramics Company contribute to innovation, geographic expansion, and service delivery in this space.

GCC Resilient Flooring Market Industry Analysis

Growth Drivers

- Increasing Demand for Sustainable Flooring Solutions:The GCC region is witnessing a significant shift towards sustainable flooring options, driven by a growing consumer preference for eco-friendly materials. In future, the market for sustainable flooring is projected to reach approximately $1.3 billion, reflecting a 15% increase from the previous year. This trend is supported by government initiatives promoting green building practices, which aim to reduce carbon footprints and enhance energy efficiency in construction projects across the region.

- Rising Construction Activities in the GCC Region:The GCC construction sector is expected to grow substantially, with investments projected to exceed $220 billion in future. This surge is fueled by major infrastructure projects, including the World Expo 2025 in Dubai and various urban development initiatives. As construction activities ramp up, the demand for resilient flooring solutions is anticipated to rise, driven by the need for durable and aesthetically pleasing materials in both residential and commercial spaces.

- Technological Advancements in Flooring Materials:Innovations in flooring technology are enhancing the performance and appeal of resilient flooring options. In future, the introduction of new materials, such as improved vinyl and rubber composites, is expected to increase market penetration by 25%. These advancements not only improve durability and maintenance but also offer enhanced design flexibility, catering to the evolving preferences of consumers and architects in the GCC region.

Market Challenges

- High Initial Costs of Resilient Flooring Materials:One of the primary challenges facing the GCC resilient flooring market is the high upfront cost associated with premium materials. For instance, high-quality vinyl flooring can cost up to $6 per square foot, which may deter budget-conscious consumers and contractors. This financial barrier is particularly pronounced in a region where traditional flooring options, such as ceramic tiles, remain more affordable and widely accepted.

- Limited Availability of Skilled Labor for Installation:The GCC region is experiencing a shortage of skilled labor capable of installing advanced resilient flooring systems. In future, it is estimated that the construction sector will face a labor gap of approximately 35,000 skilled workers. This shortage can lead to project delays and increased labor costs, ultimately hindering the adoption of resilient flooring solutions in both residential and commercial projects.

GCC Resilient Flooring Market Future Outlook

The future of the GCC resilient flooring market appears promising, driven by increasing investments in sustainable construction and innovative flooring technologies. As the region continues to prioritize eco-friendly building practices, the demand for resilient flooring solutions is expected to rise significantly. Additionally, the integration of smart technologies into flooring products will likely enhance user experience and functionality, further propelling market growth. Stakeholders should remain vigilant to capitalize on these evolving trends and consumer preferences.

Market Opportunities

- Expansion of Green Building Initiatives:The GCC's commitment to sustainable development presents a significant opportunity for resilient flooring manufacturers. With over 55% of new construction projects in future expected to adhere to green building standards, companies that align their products with these initiatives can capture a larger market share and enhance their brand reputation.

- Growing E-commerce Platforms for Flooring Products:The rise of e-commerce in the GCC region is transforming how consumers purchase flooring materials. In future, online sales of flooring products are projected to reach $350 million, providing manufacturers with a direct channel to reach consumers. This shift allows for greater market penetration and the ability to showcase innovative flooring solutions effectively.