Region:Middle East

Author(s):Shubham

Product Code:KRAD3662

Pages:100

Published On:November 2025

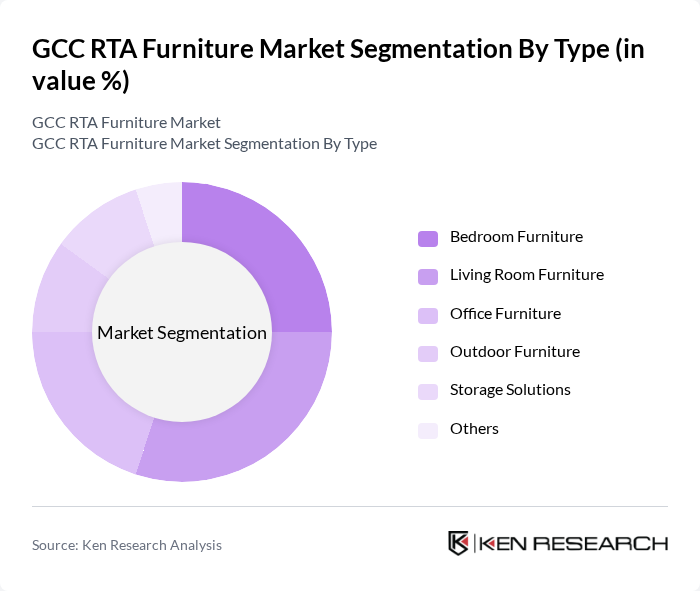

By Type:The market is segmented into various types of furniture, including bedroom furniture, living room furniture, office furniture, outdoor furniture, storage solutions, and others. Each type caters to different consumer needs and preferences, with specific trends influencing their popularity.

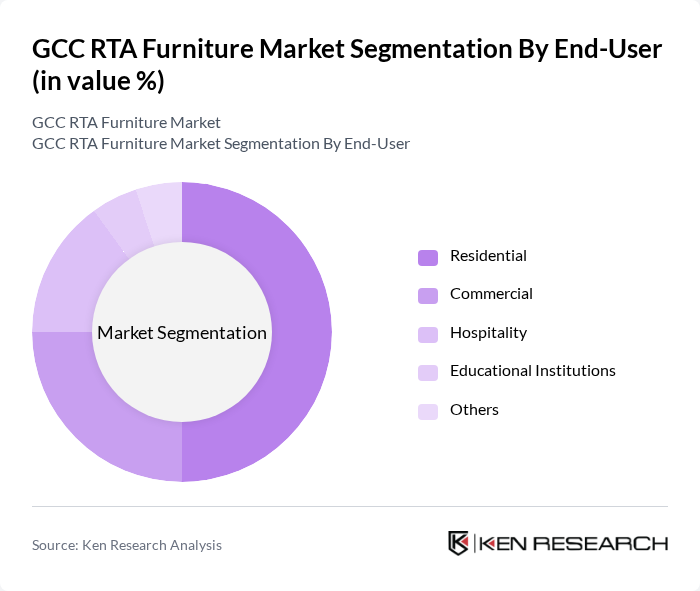

By End-User:The end-user segmentation includes residential, commercial, hospitality, educational institutions, and others. Each segment has distinct requirements and purchasing behaviors, influencing the types of RTA furniture that are in demand.

The GCC RTA Furniture Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA, Home Centre, Pan Emirates, Al-Futtaim Group, Landmark Group, Muji, The One, Danube Home, Royal Furniture, Aati Furniture, Home Box, Mamas & Papas, Al Nahda Furniture, Al-Muhaidib Group, Al-Hokair Group contribute to innovation, geographic expansion, and service delivery in this space.

The GCC RTA furniture market is poised for dynamic growth, driven by evolving consumer preferences towards convenience and sustainability. As urbanization continues to rise, the demand for innovative, space-saving solutions will increase. Additionally, the integration of technology in furniture design, such as smart features, is expected to gain traction. Companies that adapt to these trends and invest in sustainable practices will likely capture a larger share of the market, ensuring long-term viability and competitiveness.

| Segment | Sub-Segments |

|---|---|

| By Type | Bedroom Furniture Living Room Furniture Office Furniture Outdoor Furniture Storage Solutions Others |

| By End-User | Residential Commercial Hospitality Educational Institutions Others |

| By Distribution Channel | Online Retail Offline Retail Wholesale Direct Sales Others |

| By Material | Wood Metal Plastic Fabric Others |

| By Price Range | Budget Mid-range Premium Luxury Others |

| By Design Style | Contemporary Traditional Industrial Scandinavian Others |

| By Region | UAE Saudi Arabia Qatar Kuwait Oman Bahrain |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Purchases | 120 | Homeowners, Interior Designers |

| Commercial Furniture Solutions | 90 | Office Managers, Facility Coordinators |

| Online Furniture Retail Trends | 60 | E-commerce Managers, Digital Marketing Specialists |

| Luxury Furniture Market Insights | 50 | High-end Retailers, Luxury Brand Managers |

| Sustainable Furniture Preferences | 40 | Eco-conscious Consumers, Sustainability Advocates |

The GCC RTA Furniture Market is valued at approximately USD 5.2 billion, driven by factors such as urbanization, rising disposable incomes, and a growing trend towards home improvement and interior design.