Region:Middle East

Author(s):Geetanshi

Product Code:KRAC8311

Pages:93

Published On:November 2025

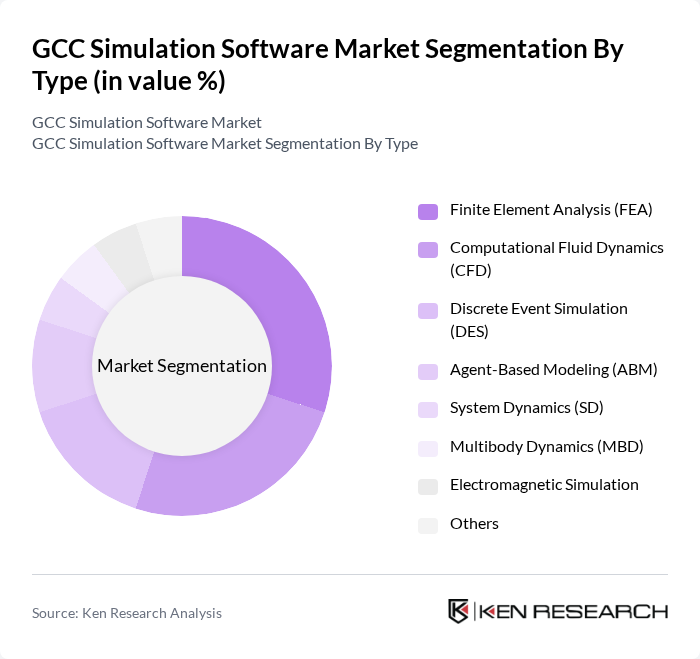

By Type:The market is segmented into various types of simulation software, including Finite Element Analysis (FEA), Computational Fluid Dynamics (CFD), Discrete Event Simulation (DES), Agent-Based Modeling (ABM), System Dynamics (SD), Multibody Dynamics (MBD), Electromagnetic Simulation, and Others. Each type serves distinct purposes across different industries, with FEA and CFD being the most widely adopted due to their critical roles in engineering, design, and virtual prototyping. The adoption of cloud-based and AI-integrated simulation tools is also rising, particularly in manufacturing and automotive applications .

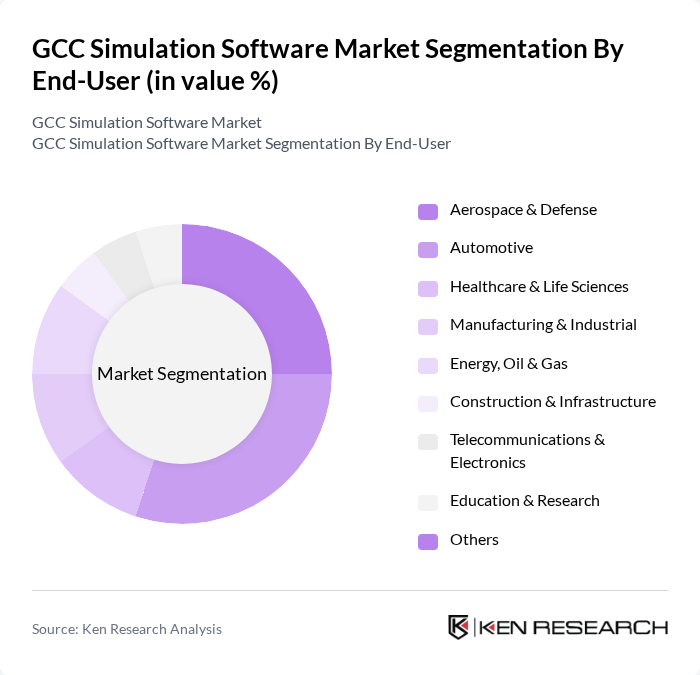

By End-User:The end-user segmentation includes Aerospace & Defense, Automotive, Healthcare & Life Sciences, Manufacturing & Industrial, Energy, Oil & Gas, Construction & Infrastructure, Telecommunications & Electronics, Education & Research, and Others. The automotive and aerospace sectors are the largest consumers of simulation software, driven by the need for precision, efficiency in design and testing, and regulatory compliance. The healthcare sector is also witnessing increased adoption for medical device design and virtual clinical trials, while manufacturing and energy sectors leverage simulation for process optimization and risk mitigation .

The GCC Simulation Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as ANSYS, Inc., Siemens Digital Industries Software, Dassault Systèmes, Altair Engineering, Inc., Autodesk, Inc., COMSOL AB, PTC Inc., MathWorks, Inc., Hexagon AB, ESI Group, MSC Software Corporation, Bentley Systems, Incorporated, Rockwell Automation, Inc., SAP SE, IBM Corporation, Simul8 Corporation, SimScale GmbH, OpenCFD Ltd. (ESI Group), Simio LLC, Dassault Systèmes (CATIA, SIMULIA) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the GCC simulation software market appears promising, driven by technological advancements and increasing industry adoption. As organizations prioritize efficiency and innovation, the integration of artificial intelligence and machine learning into simulation tools is expected to enhance capabilities significantly. Furthermore, the growing emphasis on sustainability will likely lead to the development of simulation solutions that optimize resource use and minimize environmental impact, positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Finite Element Analysis (FEA) Computational Fluid Dynamics (CFD) Discrete Event Simulation (DES) Agent-Based Modeling (ABM) System Dynamics (SD) Multibody Dynamics (MBD) Electromagnetic Simulation Others |

| By End-User | Aerospace & Defense Automotive Healthcare & Life Sciences Manufacturing & Industrial Energy, Oil & Gas Construction & Infrastructure Telecommunications & Electronics Education & Research Others |

| By Industry Vertical | Oil & Gas Construction Telecommunications Education Electronics & Semiconductor Transportation & Logistics Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Application | Product Design & Development Process Optimization Training & Simulation Risk Assessment Engineering, Research & Testing Planning & Logistics Management AI Training & Autonomous Systems Others |

| By Geographic Presence | UAE Saudi Arabia Qatar Kuwait Oman Bahrain Others |

| By Customer Size | Large Enterprises Medium Enterprises Small Enterprises Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Simulation Software | 100 | Production Managers, Process Engineers |

| Healthcare Simulation Applications | 80 | Healthcare IT Directors, Clinical Operations Managers |

| Education Sector Simulation Tools | 60 | Academic Administrators, IT Coordinators |

| Energy Sector Simulation Solutions | 90 | Energy Analysts, Project Managers |

| Transportation and Logistics Simulation | 50 | Logistics Managers, Supply Chain Analysts |

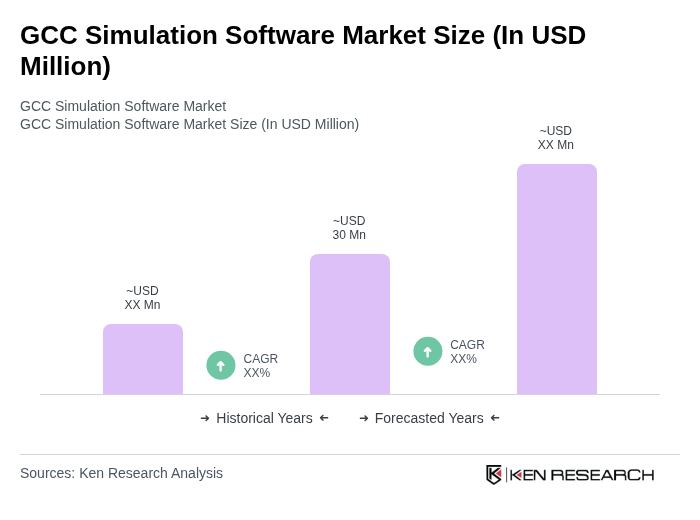

The GCC Simulation Software Market is currently valued at approximately USD 30 million, reflecting a five-year historical analysis. This growth is attributed to the increasing adoption of advanced technologies across various sectors, including aerospace, automotive, and healthcare.