Region:Middle East

Author(s):Dev

Product Code:KRAD3431

Pages:84

Published On:November 2025

Market.png)

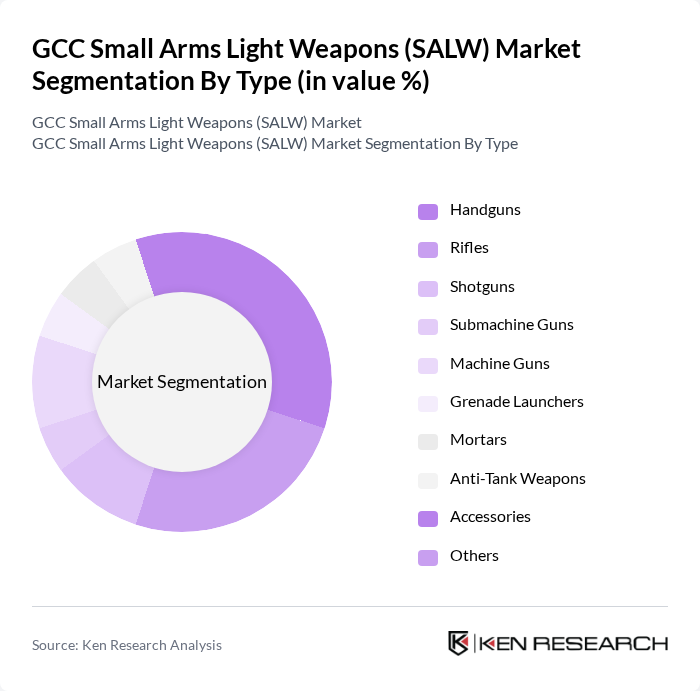

By Type:The market is segmented into various types of small arms and light weapons, including handguns, rifles, shotguns, submachine guns, machine guns, grenade launchers, mortars, anti-tank weapons, accessories, and others. Among these, handguns and rifles are the most prominent due to their versatility and widespread use in both military and civilian applications. The demand for handguns is particularly driven by personal protection needs, while rifles are favored for military and law enforcement purposes. The prominence of handguns and rifles aligns with global and regional trends, where these categories account for the largest share of procurement and usage in both defense and civilian sectors .

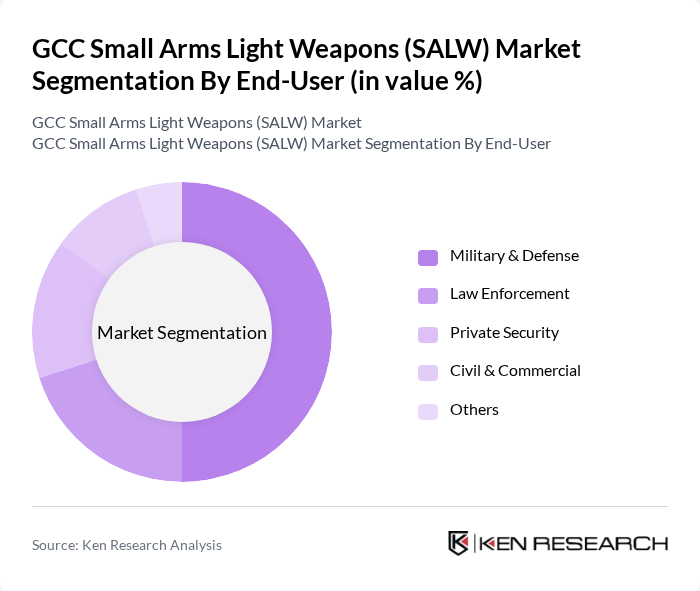

By End-User:The end-user segmentation includes military & defense, law enforcement, private security, civil & commercial, and others. The military & defense sector is the largest consumer of SALW, driven by ongoing conflicts and the need for enhanced security measures. Law enforcement agencies also contribute significantly to the market, as they require reliable and effective weapons for maintaining public safety. Private security and civil segments are growing, reflecting increased demand for personal protection and commercial security solutions .

The GCC Small Arms Light Weapons (SALW) Market is characterized by a dynamic mix of regional and international players. Leading participants such as FN Herstal, Heckler & Koch, SIG Sauer, Beretta Holding S.p.A., Colt's Manufacturing Company LLC, Israel Weapon Industries (IWI), CZ Group (?eská zbrojovka Group), Zastava Arms, Steyr Arms GmbH, Taurus Armas S.A., Kalashnikov Concern, Caracal International LLC, Al Jaber Group (AJB Defense), EDGE Group (Abu Dhabi), Rheinmetall AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC SALW market appears promising, driven by ongoing military modernization efforts and the integration of advanced technologies. As regional conflicts persist, governments are likely to prioritize investments in defense capabilities, fostering a conducive environment for SALW manufacturers. Additionally, the increasing focus on smart weaponry and AI integration in defense systems will shape product development. This trend, coupled with the growth of private security sectors, will create new avenues for market expansion and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Handguns Rifles Shotguns Submachine Guns Machine Guns Grenade Launchers Mortars Anti-Tank Weapons Accessories Others |

| By End-User | Military & Defense Law Enforcement Private Security Civil & Commercial Others |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman |

| By Application | Defense Law Enforcement Personal Protection Training and Simulation Others |

| By Distribution Channel | Direct Sales Government Procurement Distributors Retail Stores Online Sales Others |

| By Technology | Conventional Weapons Smart Weapons Modular Weapons Others |

| By Policy Support | Government Contracts Subsidies for Local Manufacturers Tax Incentives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Military Procurement Departments | 60 | Procurement Officers, Defense Analysts |

| Law Enforcement Agencies | 50 | Police Chiefs, Tactical Unit Leaders |

| Private Security Firms | 40 | Security Managers, Operations Directors |

| Manufacturers of SALW | 40 | Product Managers, Sales Directors |

| Distributors and Retailers | 40 | Sales Managers, Supply Chain Coordinators |

The GCC Small Arms Light Weapons (SALW) Market is valued at approximately USD 1.1 billion, driven by increased defense budgets, regional security concerns, and rising demand for personal protection among civilians.