Region:Middle East

Author(s):Shubham

Product Code:KRAB7103

Pages:94

Published On:October 2025

By Type:The market is segmented into various types of prefabricated housing solutions, including Modular Homes, Panelized Homes, Pre-Cast Concrete Homes, Steel Frame Homes, Timber Frame Homes, Hybrid Homes, and Others. Among these, Modular Homes are gaining significant traction due to their flexibility, speed of construction, and cost-effectiveness. The demand for Modular Homes is driven by consumer preferences for customizable living spaces and the need for rapid housing solutions in urban areas.

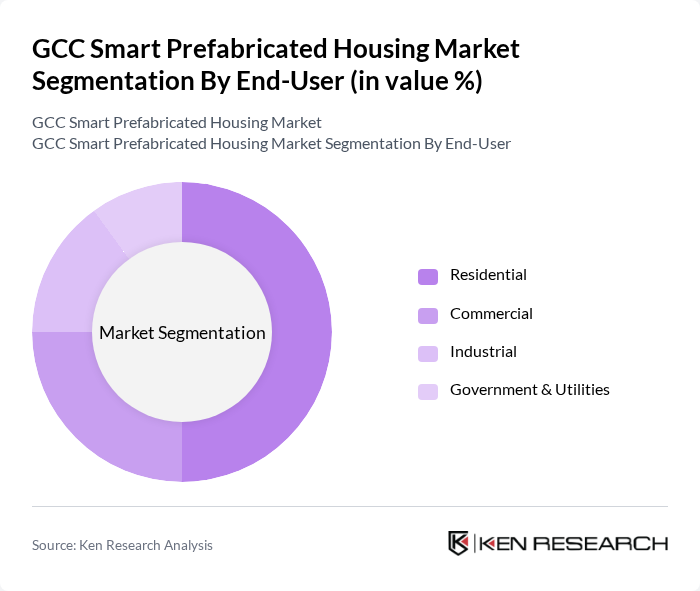

By End-User:The market is categorized based on end-users, including Residential, Commercial, Industrial, and Government & Utilities. The Residential segment dominates the market, driven by the increasing demand for affordable housing solutions and the growing trend of urbanization. Consumers are increasingly opting for prefabricated homes due to their cost-effectiveness and shorter construction times, making this segment a key driver of market growth.

The GCC Smart Prefabricated Housing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Habtoor Group, Al Futtaim Group, Al Jaber Group, Al Maktoum Group, Al Qudra Holding, Al Shafar Group, Emaar Properties, Gulf Prefabricated Buildings, Katerra, Modular Building Institute, Saudi Arabian Oil Company (Saudi Aramco), Shapoorji Pallonji Group, TAV Construction, and Zamil Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC smart prefabricated housing market appears promising, driven by increasing urbanization and a growing emphasis on sustainability. As governments continue to invest in infrastructure and affordable housing, the market is likely to see a surge in demand for innovative construction methods. Furthermore, the integration of smart technologies will enhance the appeal of prefabricated homes, aligning with consumer preferences for energy efficiency and modern living. This evolving landscape presents significant opportunities for growth and collaboration among stakeholders.

| Segment | Sub-Segments |

|---|---|

| By Type | Modular Homes Panelized Homes Pre-Cast Concrete Homes Steel Frame Homes Timber Frame Homes Hybrid Homes Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Single-Family Homes Multi-Family Units Temporary Housing Solutions Disaster Relief Housing |

| By Sales Channel | Direct Sales Online Sales Distributors Retail Outlets |

| By Distribution Mode | Direct Shipping Local Warehousing Third-Party Logistics |

| By Price Range | Budget Homes Mid-Range Homes Luxury Homes |

| By Policy Support | Subsidies Tax Exemptions Grants for Sustainable Housing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Real Estate Developers | 100 | Project Managers, Business Development Executives |

| Construction Firms | 80 | Site Managers, Operations Directors |

| Architectural Firms | 60 | Lead Architects, Design Engineers |

| Government Housing Authorities | 50 | Policy Makers, Urban Planners |

| Potential Homeowners | 120 | First-time Buyers, Investors |

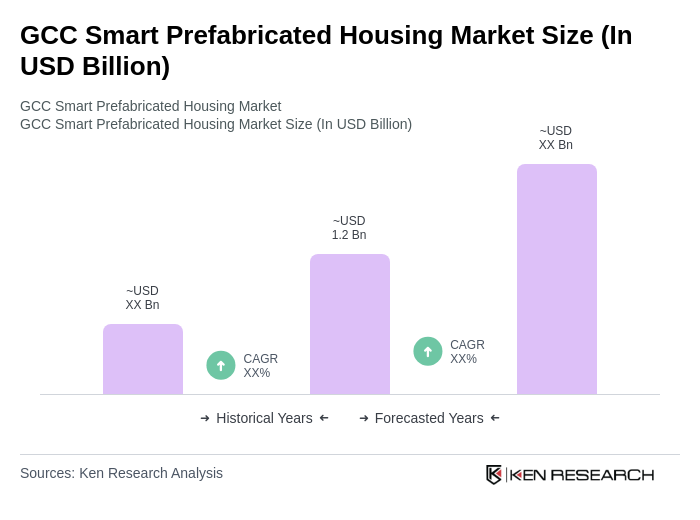

The GCC Smart Prefabricated Housing Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by urbanization, government initiatives for sustainable housing, and the demand for affordable housing solutions in the region.