Region:Middle East

Author(s):Rebecca

Product Code:KRAD4893

Pages:97

Published On:December 2025

Market.png)

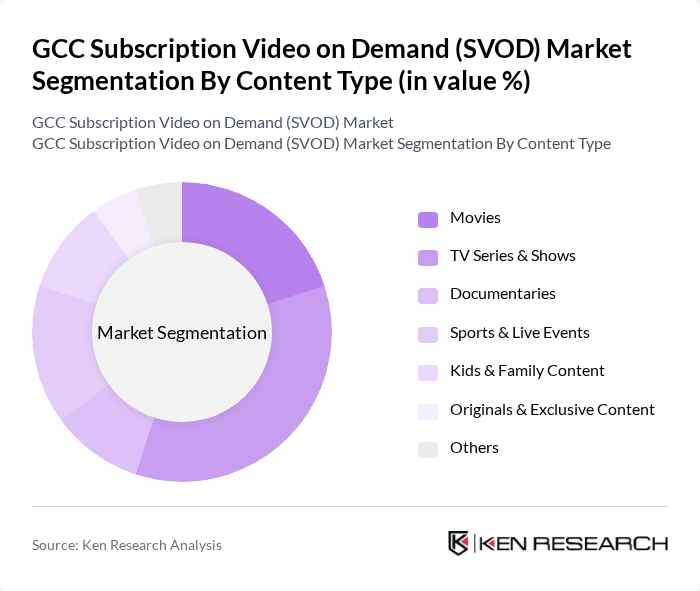

By Content Type:The content type segmentation includes various categories such as Movies, TV Series & Shows, Documentaries, Sports & Live Events, Kids & Family Content, Originals & Exclusive Content, and Others. Among these, TV Series & Shows have emerged as the leading sub-segment, driven by the increasing demand for binge-watching and the popularity of serialized storytelling, which is consistent with global SVOD consumption patterns where series account for a major share of viewing time. The rise of platforms producing exclusive series and originals, particularly Arabic-language dramas, comedies, and Ramadan-season series in the GCC, has further solidified this segment's dominance, appealing to diverse audience preferences and encouraging continuous subscription retention.

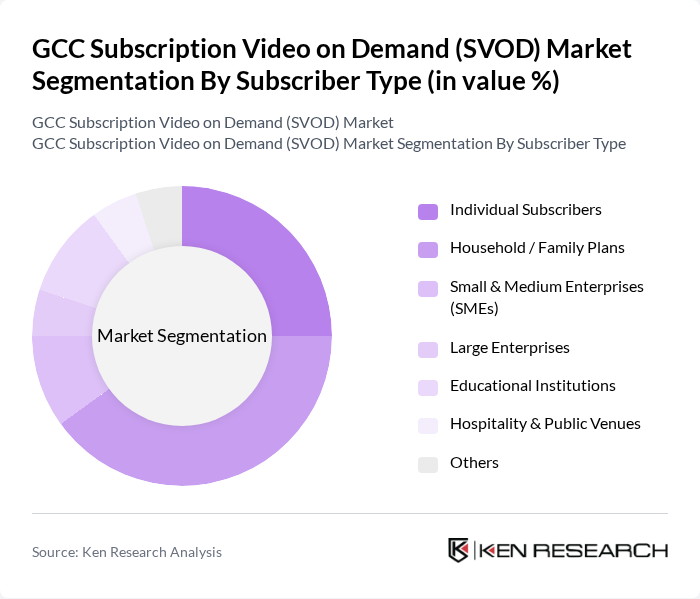

By Subscriber Type:The subscriber type segmentation encompasses Individual Subscribers, Household / Family Plans, Small & Medium Enterprises (SMEs), Large Enterprises, Educational Institutions, Hospitality & Public Venues, and Others. The Household / Family Plans sub-segment is currently leading the market, as families prefer shared subscriptions for cost-effectiveness, multiple user profiles, and access across several devices, which mirrors global SVOD subscription behavior dominated by multi-user plans. This trend is further supported by the increasing number of family-oriented and kids’ content offerings, multi-screen bundles with telecom operators, and integrated billing partnerships between SVOD platforms and GCC mobile and pay-TV operators.

The GCC Subscription Video on Demand (SVOD) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Netflix, OSN Streaming, Shahid VIP (MBC Group), STARZPLAY Arabia, Amazon Prime Video, Disney+, Apple TV+, YouTube Premium, beIN CONNECT (beIN Media Group), TOD (beIN Media Group), Jawwy TV (stc TV), Eros Now, ZEE5, Viu, STARZPLAY-powered Operator Platforms & White Labels contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC SVOD market appears promising, driven by technological advancements and evolving consumer preferences. As 5G technology becomes more widespread, streaming quality will improve, enhancing user experiences. Additionally, the integration of artificial intelligence for personalized content recommendations is expected to boost viewer engagement. With a growing focus on regional content production, SVOD platforms are likely to expand their offerings, catering to diverse audiences and solidifying their market presence in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Content Type | Movies TV Series & Shows Documentaries Sports & Live Events Kids & Family Content Originals & Exclusive Content Others |

| By Subscriber Type | Individual Subscribers Household / Family Plans Small & Medium Enterprises (SMEs) Large Enterprises Educational Institutions Hospitality & Public Venues Others |

| By Country | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain |

| By Access Device | Smartphones Tablets Smart TVs Streaming Media Devices (Dongles/Boxes) PCs & Laptops Gaming Consoles Others |

| By Use Case | Home Entertainment In-Transit & Mobile Viewing Education & E-Learning Corporate Training & Communication Hospitality & Tourism Others |

| By Revenue Model | Pure Subscription (SVOD) Hybrid (SVOD + AVOD) Bundled with Telecom / Pay TV Transactional / Add-on Content Others |

| By Partnership & Policy Support | Telecom & ISP Partnerships Device & OEM Partnerships Government & Regulatory Support Local Content & Production Partnerships Tax Incentives & Investment Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| SVOD User Experience | 150 | Regular SVOD Subscribers, Content Consumers |

| Content Production Insights | 100 | Producers, Directors, Content Creators |

| Market Trends Analysis | 80 | Media Analysts, Industry Experts |

| Advertising and Monetization Strategies | 70 | Marketing Managers, Ad Sales Executives |

| Consumer Preferences and Behavior | 120 | General Consumers, Focus Group Participants |

The GCC Subscription Video on Demand (SVOD) market is valued at approximately USD 1.4 billion, driven by factors such as high-speed internet penetration, smart device proliferation, and a growing consumer preference for on-demand content.