Region:Middle East

Author(s):Geetanshi

Product Code:KRAC0984

Pages:84

Published On:October 2025

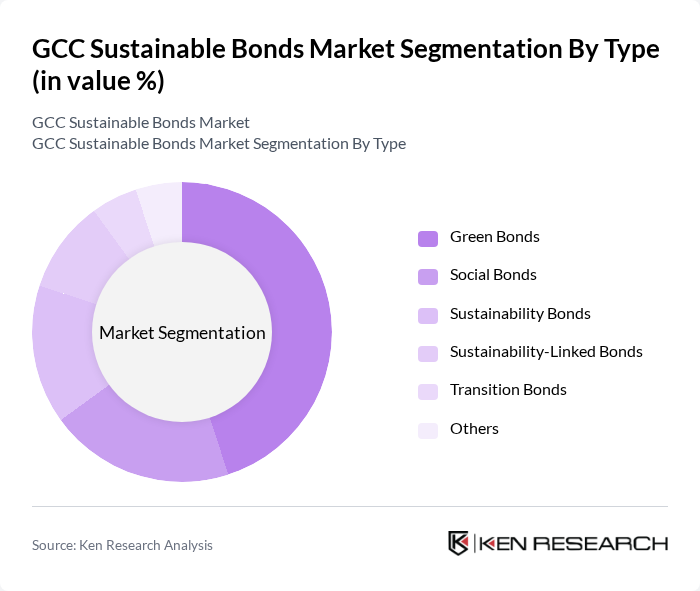

By Type:The market is segmented into various types of sustainable bonds, including Green Bonds, Social Bonds, Sustainability Bonds, Sustainability-Linked Bonds, Transition Bonds, and Others. Among these, Green Bonds have emerged as the dominant segment, driven by increasing investments in renewable energy and sustainable infrastructure projects. The growing emphasis on climate change mitigation and environmental sustainability has led to a surge in demand for Green Bonds, making them a preferred choice for investors seeking to align their portfolios with sustainable practices. Globally, Green Bonds represented around 68% of labeled sustainable bond issuances in the first half of 2025, with Sustainability Bonds and Social Bonds also gaining traction, particularly in emerging markets.

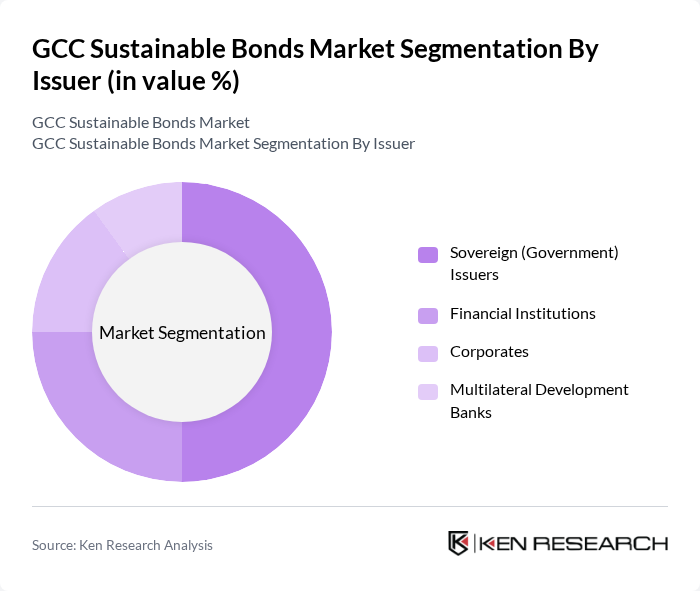

By Issuer:The market is also segmented by issuer types, including Sovereign (Government) Issuers, Financial Institutions, Corporates, and Multilateral Development Banks. Sovereign issuers have taken the lead in the sustainable bonds market, primarily due to their ability to mobilize large amounts of capital for national projects aimed at sustainability. Government-backed initiatives and policies have facilitated the issuance of bonds, making them a reliable source of funding for various sustainable development projects. In advanced markets, sovereign issuers account for a significant share of labeled sustainable bond markets, though in emerging markets, the share is somewhat lower but still substantial.

The GCC Sustainable Bonds Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abu Dhabi Investment Authority, Qatar Investment Authority, Public Investment Fund (Saudi Arabia), Dubai Investments, Gulf Investment Corporation, Emirates NBD, First Abu Dhabi Bank, Abu Dhabi Commercial Bank, Qatar National Bank, Bank of Bahrain and Kuwait, Al Baraka Banking Group, Mashreq Bank, Arab National Bank, Saudi British Bank (SABB), National Bank of Kuwait contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC sustainable bonds market appears promising, driven by increasing government support and a growing emphasis on sustainability. As countries in the region implement more robust green financing frameworks, the market is expected to attract a wider range of investors. Additionally, the integration of technology in bond issuance processes will enhance transparency and efficiency, further bolstering investor confidence. The trend towards sustainability-linked bonds is also likely to gain traction, aligning financial returns with positive environmental impacts.

| Segment | Sub-Segments |

|---|---|

| By Type | Green Bonds Social Bonds Sustainability Bonds Sustainability-Linked Bonds Transition Bonds Others |

| By Issuer | Sovereign (Government) Issuers Financial Institutions Corporates Multilateral Development Banks |

| By Investment Source | Domestic Investors Foreign Institutional Investors Public-Private Partnerships (PPP) Government Schemes |

| By Use of Proceeds | Renewable Energy Projects Sustainable Infrastructure Clean Transportation Water and Waste Management Green Buildings Social Development Projects |

| By Risk Profile | Investment Grade Non-Investment Grade |

| By Country | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Issuers of Sustainable Bonds | 100 | CFOs, Treasury Managers |

| Investment Firms Focused on ESG | 70 | Portfolio Managers, ESG Analysts |

| Regulatory Bodies and Financial Authorities | 40 | Policy Makers, Compliance Officers |

| Financial Institutions Underwriting Bonds | 60 | Investment Bankers, Risk Managers |

| Consultants in Sustainable Finance | 50 | Consultants, Sustainability Advisors |

The GCC Sustainable Bonds Market is valued at approximately USD 120 billion, reflecting significant growth driven by increased awareness of environmental sustainability and government initiatives promoting green financing.