Region:Middle East

Author(s):Geetanshi

Product Code:KRAD1177

Pages:95

Published On:November 2025

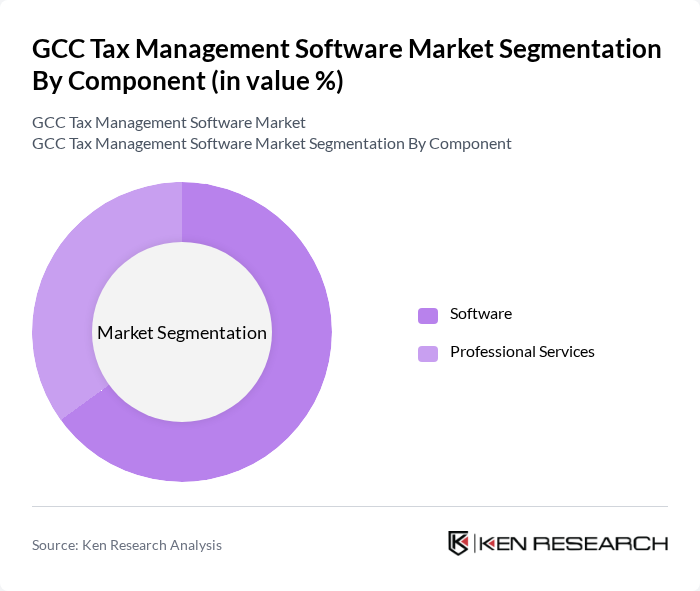

By Component:This segmentation includes Software and Professional Services. The Software segment is leading due to the increasing demand for automated solutions that enhance efficiency and accuracy in tax management. Professional Services are also essential, providing necessary support and expertise to businesses navigating complex tax regulations. Cloud-based deployment and AI-driven compliance monitoring are notable trends in the software segment, while professional services increasingly focus on implementation, training, and ongoing support for regulatory updates.

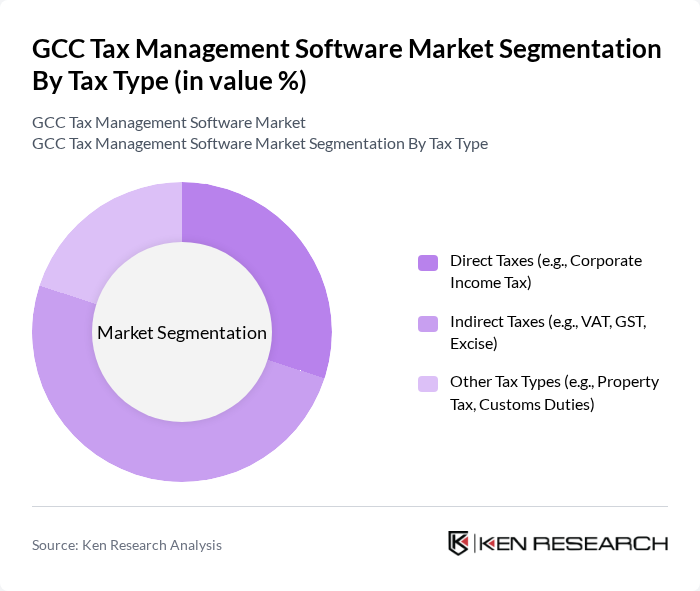

By Tax Type:This segmentation includes Direct Taxes, Indirect Taxes, and Other Tax Types. The Indirect Taxes segment, particularly VAT and GST, is dominating the market due to the recent implementation of VAT in several GCC countries, which has increased the demand for tax management solutions to ensure compliance and accurate reporting. The introduction of digital VAT reporting and e-invoicing requirements has further accelerated adoption in this segment. Direct tax solutions are gaining traction with the rollout of corporate tax regimes in select GCC countries, while other tax types such as customs duties and property tax are supported through specialized modules in leading platforms.

The GCC Tax Management Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Thomson Reuters, Wolters Kluwer, Intuit Inc., Avalara, Inc., Xero Limited, TaxJar (a Stripe company), CCH Tagetik (Wolters Kluwer), Vertex Inc., Sage Group plc, BlackLine, Inc., QuickBooks (Intuit), FreshBooks, Zoho Corporation, Tally Solutions Pvt. Ltd., SNI (SNI e-Invoicing & Tax Compliance), Emaratech (Dubai-based tax & e-services provider), FTA (Federal Tax Authority UAE - e-Services), EY (Ernst & Young - GCC tax technology) contribute to innovation, geographic expansion, and service delivery in this space.

The GCC Tax Management Software Market is poised for significant evolution, driven by technological advancements and regulatory changes. As businesses increasingly adopt cloud-based solutions, the market is expected to witness a shift towards more integrated and user-friendly platforms. Additionally, the growing emphasis on automation and enhanced analytics capabilities will likely reshape how companies manage their tax obligations, fostering a more efficient and compliant environment. This transformation will create new avenues for innovation and collaboration within the industry.

| Segment | Sub-Segments |

|---|---|

| By Component | Software Professional Services |

| By Tax Type | Direct Taxes (e.g., Corporate Income Tax) Indirect Taxes (e.g., VAT, GST, Excise) Other Tax Types (e.g., Property Tax, Customs Duties) |

| By Deployment Mode | On-Premise Solutions Cloud-Based Solutions Hybrid Solutions |

| By Organization Size | Large Enterprises Small and Medium Enterprises (SMEs) |

| By Industry Vertical | BFSI (Banking, Financial Services, Insurance) Healthcare Retail Manufacturing Energy & Utilities Other Verticals |

| By Functionality | Tax Compliance Software Tax Planning Software Tax Preparation Software E-Filing Software Consulting Services Implementation Services Support and Maintenance Services |

| By Geographic Presence | UAE Saudi Arabia Qatar Kuwait Oman Bahrain |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Tax Compliance | 120 | Tax Managers, CFOs |

| SME Tax Software Adoption | 100 | Business Owners, Financial Controllers |

| Government Taxation Authorities | 80 | Tax Officers, Policy Makers |

| Consulting Firms Specializing in Tax Solutions | 70 | Tax Consultants, Software Analysts |

| Financial Institutions Utilizing Tax Management Software | 90 | Compliance Officers, IT Managers |

The GCC Tax Management Software Market is valued at approximately USD 540 million, driven by the increasing complexity of tax regulations and the digital transformation of financial processes across the region.