Region:Middle East

Author(s):Dev

Product Code:KRAC4109

Pages:87

Published On:October 2025

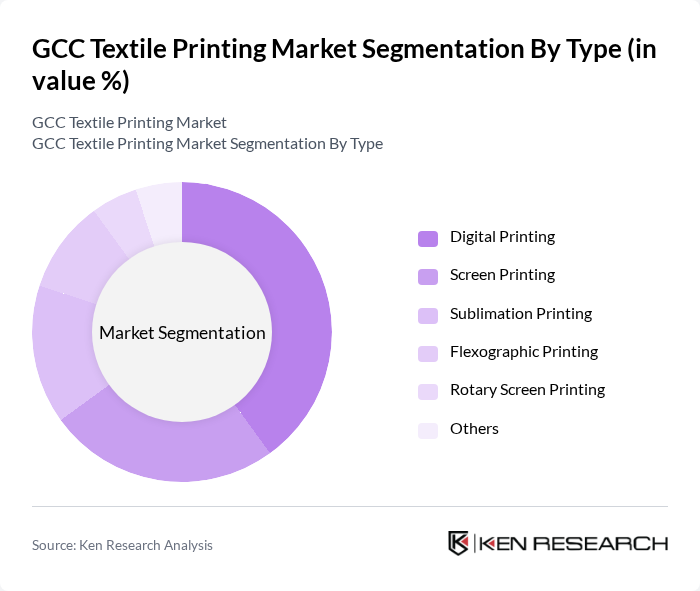

By Type:The textile printing market is segmented into Digital Printing, Screen Printing, Sublimation Printing, Flexographic Printing, Rotary Screen Printing, and Others. Among these, Digital Printing is gaining significant traction due to its ability to produce high-quality prints with quick turnaround times and minimal waste. The demand for personalized and on-demand textile products is driving the growth of this segment, as consumers increasingly seek unique designs and customization options. The adoption of digital printing is also supported by advancements in inkjet technology and the shift toward sustainable, water-based inks .

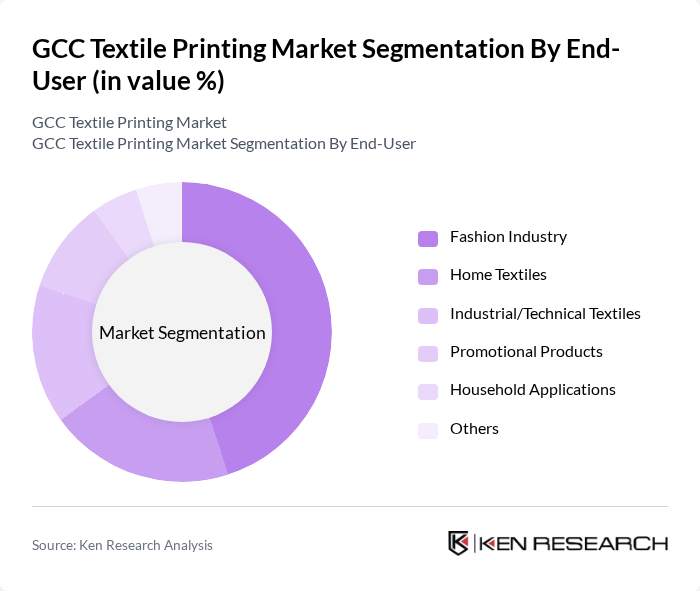

By End-User:The end-user segmentation includes the Fashion Industry, Home Textiles, Industrial/Technical Textiles, Promotional Products, Household Applications, and Others. The Fashion Industry remains the leading segment, driven by the increasing demand for innovative designs, rapid fashion cycles, and the influence of fast fashion and e-commerce. The need for quick, efficient, and sustainable textile printing solutions is particularly pronounced in this segment, making it a primary driver of market growth .

The GCC Textile Printing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Unirab & Polvara Spinning Weaving & Silk, AMCO (Arab Manufacturing Company), Misr Amreya Spinning and Weaving, Al Kifah Printing Solutions, Al Mufeed Printing Press, Al Jazeera Printing Press, Al Fajer Establishment, Al Noor Printing Press, Al Ameen Printing Press, Al Hekma Printing Press, Al Qasr Printing Press, Al Rashed Printing Press, Al Sadiq Printing Press, Al Waha Printing Press, Print Arabia, PrintWorks Dubai, Emirates Printing Press, Zahran Printing & Packaging, Gulf Printing & Packaging Co., and Al Ghurair Printing & Publishing LLC contribute to innovation, geographic expansion, and service delivery in this space.

The GCC textile printing market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, companies are likely to adopt eco-friendly practices, enhancing their market appeal. Additionally, the integration of artificial intelligence in design processes is expected to streamline operations and improve product offerings. These trends indicate a dynamic future, where adaptability and innovation will be crucial for success in the competitive landscape of textile printing.

| Segment | Sub-Segments |

|---|---|

| By Type | Digital Printing Screen Printing Sublimation Printing Flexographic Printing Rotary Screen Printing Others |

| By End-User | Fashion Industry Home Textiles Industrial/Technical Textiles Promotional Products Household Applications Others |

| By Material | Cotton Polyester Silk Nylon Synthetic Blends Wool Others |

| By Application | Apparel Home Furnishings Technical Textiles Fashion Accessories Hygiene Products Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Wholesale Others |

| By Region | UAE Saudi Arabia Qatar Kuwait Oman Bahrain Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Textile Printing Companies | 75 | Production Managers, Technical Directors |

| Fashion Retailers | 65 | Merchandise Managers, Brand Strategists |

| Textile Designers | 55 | Creative Directors, Design Managers |

| Suppliers of Printing Materials | 45 | Sales Managers, Product Development Specialists |

| Industry Experts and Consultants | 40 | Market Analysts, Industry Advisors |

The GCC Textile Printing Market is valued at approximately USD 1.3 billion, reflecting a significant growth trend driven by increasing demand for customized textile products and advancements in digital printing technologies.