Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7339

Pages:95

Published On:October 2025

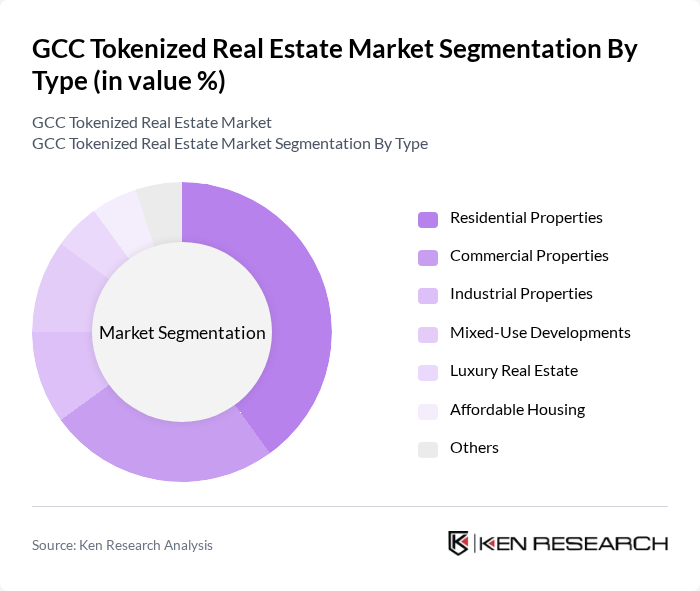

By Type:The market is segmented into various types, including Residential Properties, Commercial Properties, Industrial Properties, Mixed-Use Developments, Luxury Real Estate, Affordable Housing, and Others. Each of these segments caters to different investor needs and preferences, with residential properties being the most sought after due to the growing demand for housing solutions in urban areas.

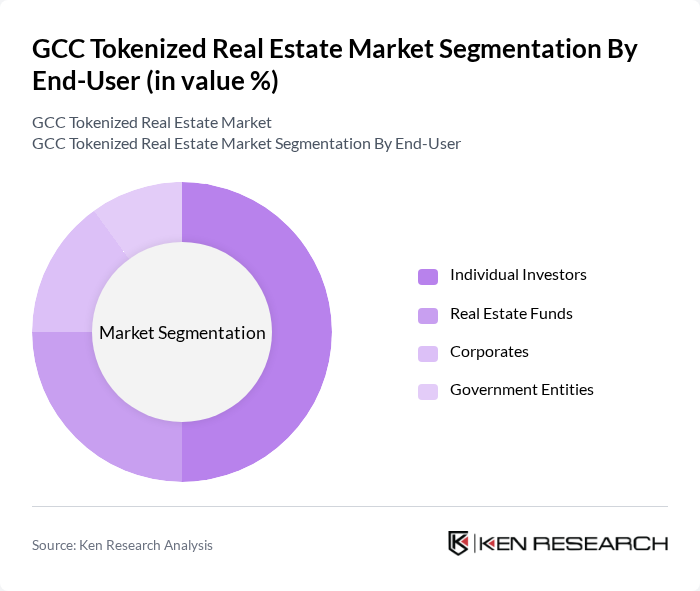

By End-User:The end-user segmentation includes Individual Investors, Real Estate Funds, Corporates, and Government Entities. Individual investors dominate the market as they seek accessible investment opportunities in real estate through tokenization, which allows for lower entry costs and diversified portfolios.

The GCC Tokenized Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Propy Inc., Real Estate Token, Harbor Platform, SolidBlock, Slice, TokenEstate, RealtyBits, Red Swan, Smartlands, Brickblock, Myco, Blockimmo, Tokenomy, BitRent, RealT contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC tokenized real estate market appears promising, driven by increasing technological adoption and a growing interest in innovative investment models. As regulatory frameworks evolve, more investors are likely to engage with tokenized assets, enhancing market liquidity. Additionally, the integration of advanced technologies, such as artificial intelligence and smart contracts, will streamline property management and transactions, further attracting institutional investors and fostering a more robust market environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Properties Commercial Properties Industrial Properties Mixed-Use Developments Luxury Real Estate Affordable Housing Others |

| By End-User | Individual Investors Real Estate Funds Corporates Government Entities |

| By Investment Size | Small Investments Medium Investments Large Investments |

| By Geographic Focus | Urban Areas Suburban Areas Rural Areas |

| By Investment Horizon | Short-Term Investments Medium-Term Investments Long-Term Investments |

| By Risk Appetite | High-Risk Investors Moderate-Risk Investors Low-Risk Investors |

| By Policy Support | Subsidized Investments Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Real Estate Developers | 100 | CEOs, Project Managers, Investment Analysts |

| Investors in Tokenized Real Estate | 80 | High Net-Worth Individuals, Institutional Investors |

| Blockchain Technology Experts | 60 | Blockchain Developers, Financial Technology Consultants |

| Regulatory Authorities | 50 | Policy Makers, Compliance Officers |

| Property Management Firms | 70 | Operations Managers, Asset Managers |

The GCC Tokenized Real Estate Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by blockchain technology adoption and increasing interest in fractional ownership models among investors.