Region:Middle East

Author(s):Geetanshi

Product Code:KRAD5979

Pages:81

Published On:December 2025

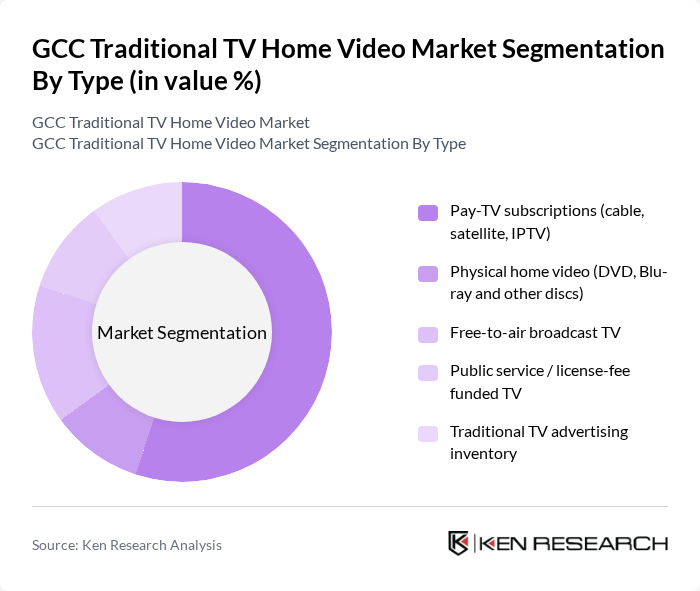

By Type:The segmentation by type includes various subsegments such as Pay-TV subscriptions (cable, satellite, IPTV), Physical home video (DVD, Blu-ray and other discs), Free-to-air broadcast TV, Public service / license-fee funded TV, and Traditional TV advertising inventory. Among these, Pay-TV subscriptions dominate the market due to the increasing preference for premium content and exclusive channels, which cater to diverse viewer interests. The convenience of bundled services and the availability of high-definition content further drive consumer adoption in this segment.

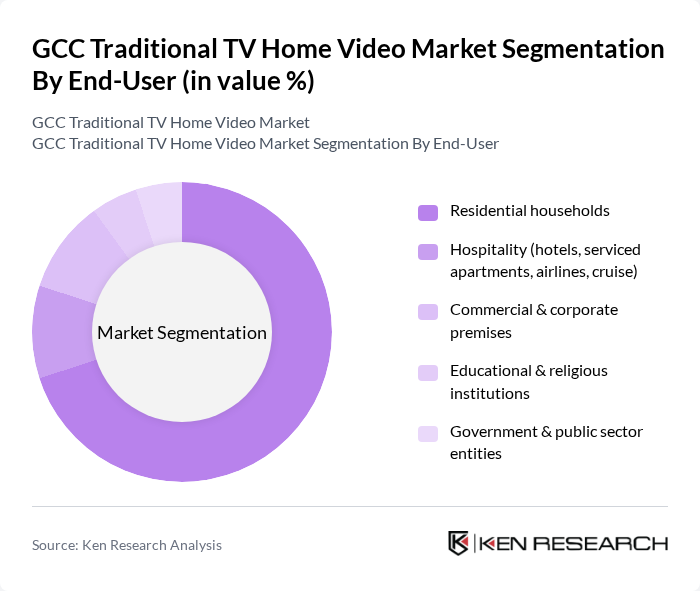

By End-User:The end-user segmentation includes Residential households, Hospitality (hotels, serviced apartments, airlines, cruise), Commercial & corporate premises, Educational & religious institutions, and Government & public sector entities. Residential households represent the largest segment, driven by the increasing number of households acquiring pay-TV subscriptions and the growing trend of binge-watching. The demand for family-oriented content and the rise of smart TVs have also contributed to the expansion of this segment.

The GCC Traditional TV Home Video Market is characterized by a dynamic mix of regional and international players. Leading participants such as OSN Group (Orbit Showtime Network), MBC Group, beIN Media Group, Rotana Media Group, Abu Dhabi Media, Dubai Media Incorporated, Saudi Broadcasting Authority (SBA) – Saudi TV, Qatar Media Corporation, Kuwait Television (Ministry of Information – Kuwait TV), Oman TV (Public Authority for Radio and Television), Bahrain Radio and Television Corporation (BRTC), Al Jazeera Media Network, Al Arabiya (Saudi Research and Media Group), Saudi Sports Company (SSC), Etisalat by e& (eLife TV and related TV services) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC traditional TV home video market appears to be shaped by technological advancements and evolving consumer preferences. As high-definition and 4K content become standard, traditional video formats may struggle to compete. However, the increasing demand for localized content presents opportunities for growth. Additionally, partnerships with local creators can enhance content diversity, appealing to niche demographics and potentially revitalizing interest in home video products.

| Segment | Sub-Segments |

|---|---|

| By Type | Pay-TV subscriptions (cable, satellite, IPTV) Physical home video (DVD, Blu-ray and other discs) Free-to-air broadcast TV Public service / license-fee funded TV Traditional TV advertising inventory |

| By End-User | Residential households Hospitality (hotels, serviced apartments, airlines, cruise) Commercial & corporate premises Educational & religious institutions Government & public sector entities |

| By Genre | Drama & series Movies Sports News & current affairs Kids & family Religious & cultural programming |

| By Distribution Channel | Direct-to-home (DTH) satellite Cable & IPTV operators Free-to-air terrestrial networks Physical retail (electronics & media stores) Online & telco bundles (for traditional TV packages) |

| By Region | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain |

| By Consumer Demographics | Age groups Income levels Household size National vs expatriate households Urban vs rural |

| By Content Format | Standard definition (SD) High definition (HD) K / Ultra HD D & specialty broadcast formats Time-shifted / catch-up TV |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Home Video Purchases | 120 | Household Decision Makers, Media Consumers |

| Retail Distribution Channels | 100 | Retail Managers, Sales Executives |

| Content Production Insights | 80 | Producers, Directors, Content Creators |

| Market Trends in Streaming vs. Traditional | 110 | Media Analysts, Industry Experts |

| Consumer Preferences for Formats | 90 | Film Enthusiasts, Genre-Specific Viewers |

The GCC Traditional TV Home Video Market is valued at approximately USD 2.8 billion, reflecting a five-year historical analysis. This growth is driven by increasing demand for diverse content and the rise of pay-TV subscriptions across the region.