GCC Vegan Women's Fashion Market Overview

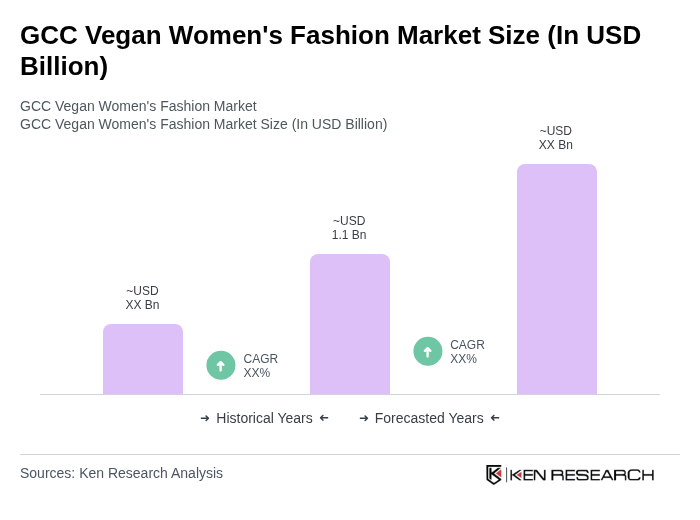

- The GCC Vegan Women's Fashion Market is valued at USD 1.1 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer awareness regarding sustainable fashion, a rising demand for cruelty-free and eco-friendly products, and the influence of global trends towards ethical consumption. The market is witnessing a notable shift as consumers increasingly opt for vegan alternatives, supported by the expansion of vegan brands and a growing focus on material innovation, such as plant-based leathers and recycled fabrics. E-commerce growth and social media advocacy are further accelerating market adoption.

- Key players in this market include the UAE, Saudi Arabia, and Qatar, which dominate due to their affluent consumer base and heightened interest in sustainable lifestyles. Urban centers like Dubai and Riyadh are experiencing a surge in vegan fashion brands and retail outlets, driven by a young, environmentally conscious population. Regional initiatives and collaborations with international brands are fostering a vibrant vegan fashion ecosystem, with local designers increasingly launching vegan collections to cater to evolving preferences.

- The UAE Cabinet issued Cabinet Decision No. 77 of 2023 on the Regulation of the Use of Sustainable Products and Materials in the Retail Sector, mandating that fashion retailers disclose the environmental impact of their products. This regulation requires retailers to provide clear labeling on materials, production processes, and environmental footprints, aiming to increase transparency and promote sustainable practices in alignment with national sustainability strategies.

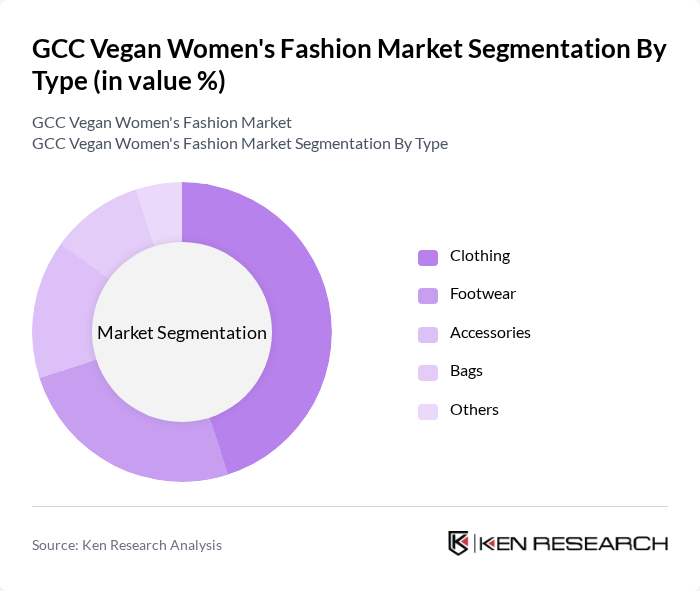

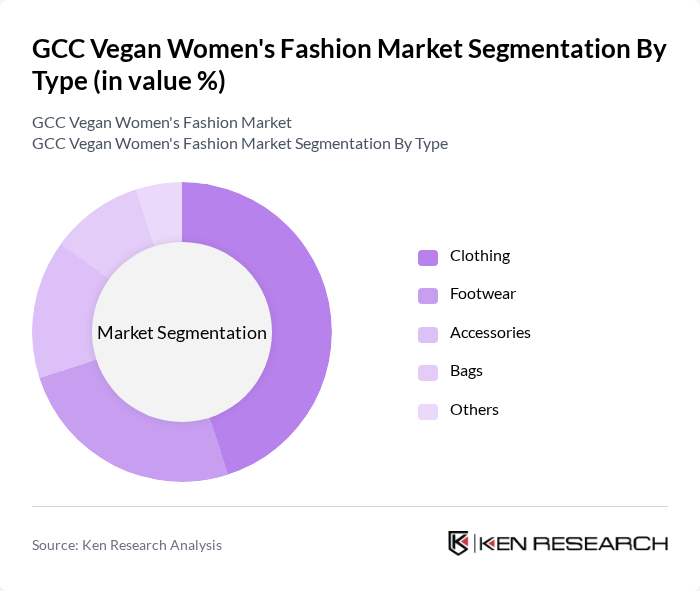

GCC Vegan Women's Fashion Market Segmentation

By Type:The market is segmented into Clothing, Footwear, Accessories, Bags, and Others. Among these, Clothing remains the leading sub-segment, driven by heightened demand for stylish, sustainable apparel and the proliferation of brands offering vegan options. Consumers are prioritizing garments made from eco-friendly and innovative materials, such as plant-based fibers and recycled synthetics. Footwear and Accessories are also experiencing robust growth, as consumers seek comprehensive vegan wardrobes. The trend toward holistic sustainable fashion continues to reshape preferences, cementing Clothing as the dominant category.

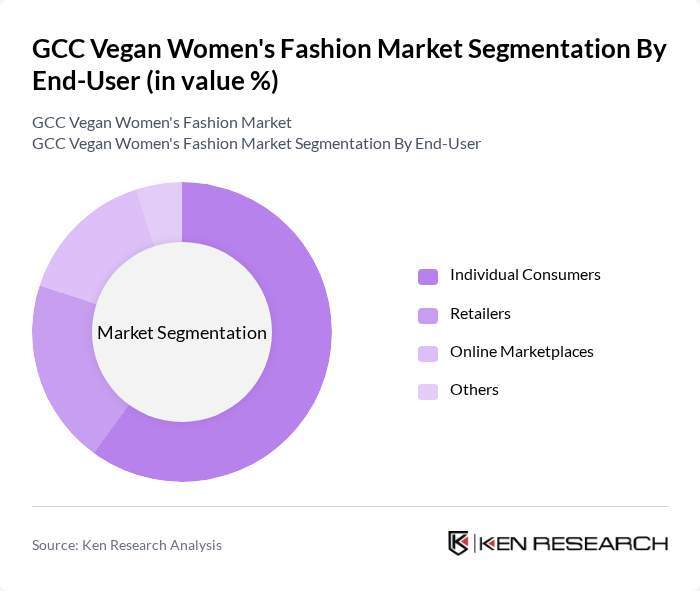

By End-User:The market is segmented into Individual Consumers, Retailers, Online Marketplaces, and Others. Individual Consumers dominate the market, propelled by the rise of ethical consumerism and increasing preference for vegan fashion products. Retailers are expanding their vegan offerings to meet this demand, while Online Marketplaces are gaining traction as preferred channels for vegan fashion purchases. The post-pandemic shift to digital shopping has further accelerated the growth of online sales, making e-commerce a critical driver in the segment.

GCC Vegan Women's Fashion Market Competitive Landscape

The GCC Vegan Women's Fashion Market is characterized by a dynamic mix of regional and international players. Leading participants such as Stella McCartney, Reformation, Veja, Matt & Nat, Amour Vert, People Tree, TOMS, Nuuwaï, EcoVessel, The Honest Company, Pangaia, Allbirds, Outerknown, Girlfriend Collective, 108 Collective, Zara (Sustainable Collection), H&M Conscious Collection, Namshi (E-commerce Platform), Noon (E-commerce Platform), Ounass (Luxury E-commerce Platform), The Modist (Regional Sustainable Fashion Platform), Dukkan (UAE-based Sustainable Fashion Marketplace), S*uce (Saudi-based Vegan Fashion Brand), Almaz (Qatar-based Sustainable Fashion Brand), L’azurde (Saudi-based Jewelry Brand with Vegan Offerings) contribute to innovation, geographic expansion, and service delivery in this space.

GCC Vegan Women's Fashion Market Industry Analysis

Growth Drivers

- Increasing Consumer Awareness of Sustainability:The GCC region has seen a significant rise in consumer awareness regarding sustainability, with 70% of consumers prioritizing eco-friendly products in their purchasing decisions. This shift is supported by a report from the World Bank indicating that 61% of consumers are willing to pay more for sustainable fashion. As awareness grows, brands that align with these values are likely to capture a larger market share, driving growth in the vegan women's fashion sector.

- Rising Demand for Ethical Fashion:The demand for ethical fashion in the GCC is projected to increase, with a survey revealing that 66% of consumers prefer brands that demonstrate ethical practices. This trend is bolstered by the UAE's commitment to sustainability, as evidenced by the government's investment of $1.1 billion in sustainable initiatives. As consumers seek transparency and ethical sourcing, vegan fashion brands are well-positioned to meet this growing demand, enhancing market growth.

- Expansion of E-commerce Platforms:E-commerce in the GCC is expected to reach $30 billion, driven by a 32% increase in online shopping habits. This growth is facilitated by improved internet penetration, which stands at 99% in the region. As more consumers turn to online platforms for their shopping needs, vegan women's fashion brands can leverage this trend to expand their reach and accessibility, significantly contributing to market growth.

Market Challenges

- Limited Availability of Vegan Materials:The GCC faces challenges in sourcing vegan materials, with only 16% of local suppliers offering sustainable alternatives. This scarcity can hinder production capabilities and limit the variety of products available to consumers. As brands strive to meet the growing demand for vegan fashion, the lack of accessible materials poses a significant challenge that could impact market growth and innovation.

- Higher Production Costs Compared to Conventional Fashion:The production costs for vegan fashion are approximately 22% higher than those for conventional fashion due to the sourcing of sustainable materials and ethical labor practices. This cost disparity can deter brands from fully committing to vegan lines, especially in a competitive market where price sensitivity is prevalent. As a result, this challenge may slow the adoption of vegan fashion in the GCC.

GCC Vegan Women's Fashion Market Future Outlook

The future of the GCC vegan women's fashion market appears promising, driven by increasing consumer demand for sustainable and ethical products. As e-commerce continues to expand, brands that effectively utilize online platforms will likely thrive. Additionally, the integration of innovative materials and technologies will enhance product offerings. With government support for sustainable practices, the market is poised for growth, fostering a more environmentally conscious fashion landscape in the region.

Market Opportunities

- Growth of Vegan Lifestyle Influencers:The rise of vegan lifestyle influencers, with a combined following of over 6 million in the GCC, presents a unique opportunity for brands to reach targeted audiences. Collaborations with these influencers can enhance brand visibility and credibility, driving consumer interest and sales in the vegan women's fashion sector.

- Development of Innovative Vegan Materials:The ongoing research and development of innovative vegan materials, such as lab-grown leather and plant-based textiles, are set to revolutionize the market. With investments in sustainable material technology projected to exceed $600 million, brands that adopt these innovations can differentiate themselves and attract environmentally conscious consumers.