Region:Middle East

Author(s):Geetanshi

Product Code:KRAD5976

Pages:92

Published On:December 2025

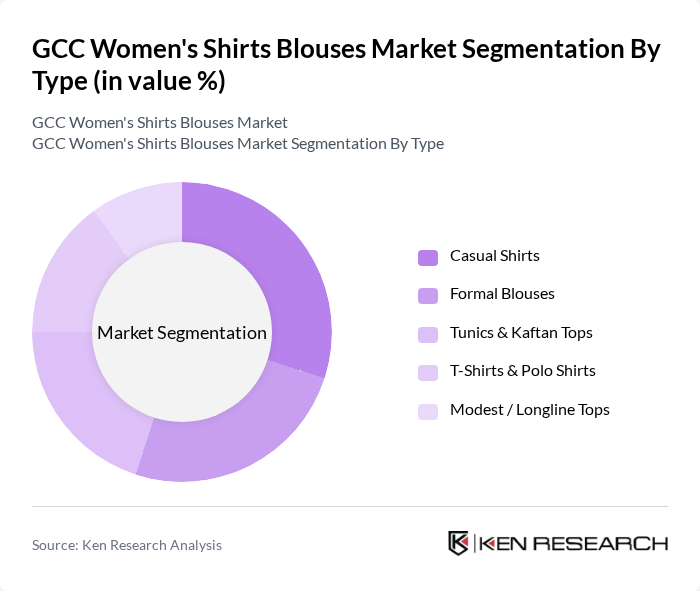

By Type:The market is segmented into various types of women's shirts and blouses, including Casual Shirts, Formal Blouses, Tunics & Kaftan Tops, T-Shirts & Polo Shirts, and Modest / Longline Tops. Casual Shirts are particularly popular due to their versatility and comfort, appealing to a wide range of consumers. Formal Blouses are favored in professional settings, while Tunics & Kaftan Tops cater to cultural preferences. T-Shirts & Polo Shirts are staples in casual wear, and Modest / Longline Tops are increasingly sought after for their stylish yet conservative designs.

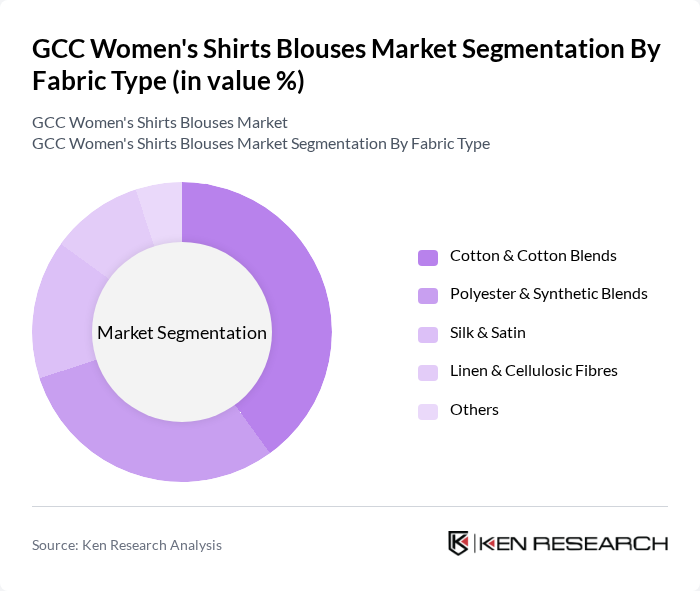

By Fabric Type:The market is also segmented by fabric type, including Cotton & Cotton Blends, Polyester & Synthetic Blends, Silk & Satin, Linen & Cellulosic Fibres (Viscose, Modal, Lyocell), and Others (Denim, Chiffon, Organza, Mixed). Cotton & Cotton Blends dominate the market due to their comfort and breathability, making them ideal for the hot climate of the GCC. Polyester & Synthetic Blends are popular for their durability and ease of care, while Silk & Satin are preferred for formal occasions. Linen is favored for its lightweight properties, and other fabrics cater to niche markets.

The GCC Women's Shirts Blouses Market is characterized by a dynamic mix of regional and international players. Leading participants such as Landmark Group (Splash, Max Fashion, Centrepoint), Alshaya Group (H&M, Monsoon, NEXT, Dorothy Perkins), Majid Al Futtaim (Mall-based Fashion Franchises), Apparel Group (Aeropostale, Nine West, Tommy Hilfiger), Azadea Group (Zara, Bershka, Pull&Bear, Oysho), Al-Futtaim Group (Marks & Spencer, GUESS), Redtag (BMA International), R&B Fashion (Apparel Group), Ounass (Al Tayer Insignia), Namshi, Noon.com Fashion, H&M (GCC Operations), Zara (GCC Operations), Mango (GCC Operations), SHEIN (GCC Online Operations) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC women's shirts and blouses market appears promising, driven by evolving consumer preferences and technological advancements. The increasing focus on sustainability and ethical fashion is likely to shape product offerings, with brands prioritizing eco-friendly materials. Additionally, the rise of social media influencers will continue to impact purchasing decisions, creating opportunities for brands to engage with consumers directly. As e-commerce expands, companies that leverage data analytics to understand consumer behavior will be well-positioned to thrive in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Casual Shirts Formal Blouses Tunics & Kaftan Tops T-Shirts & Polo Shirts Modest / Longline Tops |

| By Fabric Type | Cotton & Cotton Blends Polyester & Synthetic Blends Silk & Satin Linen & Cellulosic Fibres (Viscose, Modal, Lyocell) Others (Denim, Chiffon, Organza, Mixed) |

| By Distribution Channel | Online Retail (Marketplaces & Brand E?commerce) Hypermarkets & Supermarkets Department Stores Specialty Fashion & Mono?brand Stores Outlet & Discount Stores |

| By Price Range | Budget / Value Mid-Range Premium Luxury & Designer Private Label / Fast Fashion |

| By Occasion | Casual & Everyday Wear Work Wear / Office Wear Evening & Party Wear Sports & Athleisure Tops Formal & Event Wear |

| By Age Group | Teens (13–19 Years) Young Adults (20–34 Years) Middle-Aged Women (35–54 Years) Seniors (55+ Years) |

| By Region | UAE Saudi Arabia Qatar Kuwait Oman Bahrain Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Outlets in Major GCC Cities | 120 | Store Managers, Sales Associates |

| Online Fashion Retailers | 90 | E-commerce Managers, Digital Marketing Specialists |

| Consumer Focus Groups | 60 | Female Shoppers, Fashion Enthusiasts |

| Fashion Industry Experts | 40 | Fashion Designers, Trend Analysts |

| Wholesale Distributors | 70 | Distribution Managers, Procurement Officers |

The GCC Women's Shirts Blouses Market is valued at approximately USD 1.1 billion, reflecting a significant growth driven by factors such as increasing disposable incomes, a rising population of working women, and a growing demand for fashionable clothing options.