Region:Europe

Author(s):Dev

Product Code:KRAB3681

Pages:84

Published On:October 2025

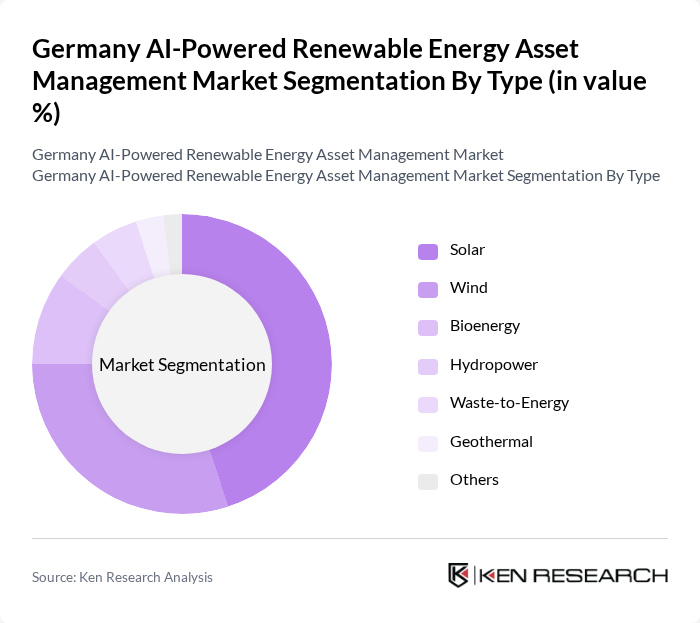

By Type:The market is segmented into various types, including Solar, Wind, Bioenergy, Hydropower, Waste-to-Energy, Geothermal, and Others. Among these, Solar and Wind are the most prominent segments, driven by technological advancements and increasing investments in renewable energy infrastructure.

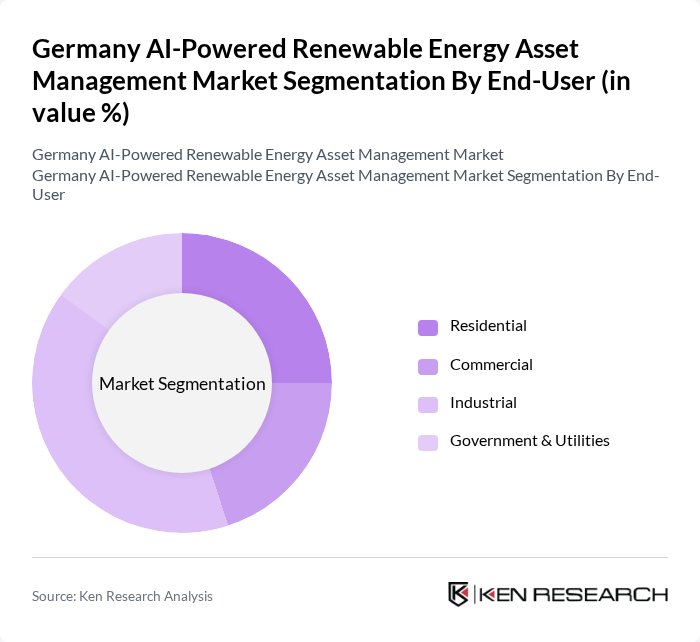

By End-User:The market is categorized into Residential, Commercial, Industrial, and Government & Utilities. The Industrial segment leads the market due to the high energy consumption and the need for efficient energy management solutions in manufacturing processes.

The Germany AI-Powered Renewable Energy Asset Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, EnBW Energie Baden-Württemberg AG, RWE AG, Vattenfall GmbH, E.ON SE, Nordex SE, SMA Solar Technology AG, BayWa r.e. renewable energy GmbH, Enercon GmbH, Juwi AG, First Solar, Inc., Canadian Solar Inc., ABB Ltd., GE Renewable Energy, TotalEnergies SE contribute to innovation, geographic expansion, and service delivery in this space.

The future of the AI-powered renewable energy asset management market in Germany appears promising, driven by ongoing technological advancements and a strong regulatory framework. As the country aims for carbon neutrality by future, the integration of AI with renewable energy systems will become increasingly vital. The focus on energy efficiency and sustainability will likely lead to greater investments in smart grid technologies and data analytics, enhancing the overall management of renewable assets and fostering innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Solar Wind Bioenergy Hydropower Waste-to-Energy Geothermal Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Grid-Connected Off-Grid Rooftop Installations Utility-Scale Projects |

| By Investment Source | Domestic FDI PPP Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Feed-in Tariffs |

| By Technology | Photovoltaic Concentrated Solar Power (CSP) Onshore Wind Offshore Wind |

| By Distribution Mode | Direct Sales Online Sales Distributors Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Solar Energy Asset Management | 100 | Asset Managers, Operations Directors |

| Wind Farm Management Solutions | 80 | Technical Managers, Project Leads |

| AI Integration in Energy Monitoring | 70 | Data Scientists, IT Managers |

| Regulatory Compliance in Renewable Energy | 60 | Compliance Officers, Policy Advisors |

| Investment Strategies in Renewable Assets | 90 | Investment Analysts, Financial Advisors |

The Germany AI-Powered Renewable Energy Asset Management Market is valued at approximately USD 5 billion, reflecting significant growth driven by the adoption of AI technologies to optimize renewable energy operations and enhance efficiency.