Region:Europe

Author(s):Dev

Product Code:KRAD0420

Pages:93

Published On:August 2025

By Type:The market can be segmented into various types of services that cater to the logistics needs of the automotive industry. The subsegments include Transportation Management, Warehousing and Distribution, Freight Forwarding, Packaging and Value-Added Services, Reverse Logistics, Inbound to Manufacturing, and Inventory Management and Order Fulfillment. Among these, Transportation Management is currently the leading subsegment, driven by the increasing complexity of supply chains and the need for efficient route planning and fleet management.

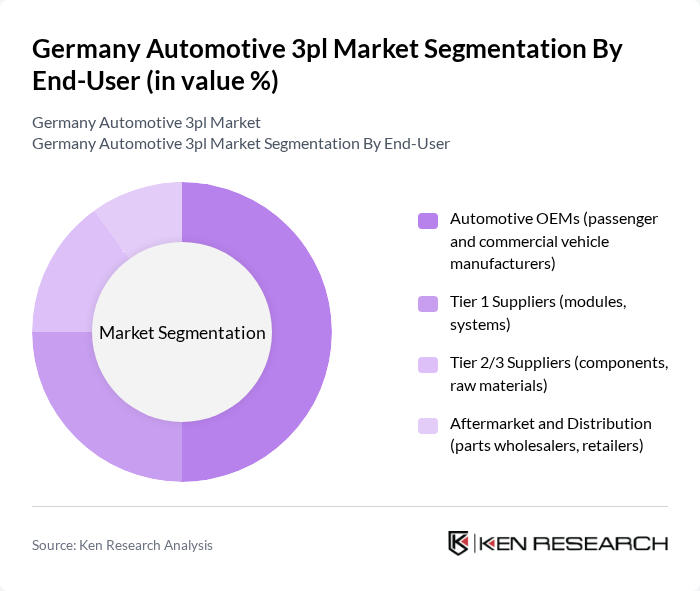

By End-User:The automotive 3PL market is segmented by end-users, which include Automotive OEMs, Tier 1 Suppliers, Tier 2/3 Suppliers, and Aftermarket and Distribution. The Automotive OEMs segment is the most significant, as these manufacturers require extensive logistics support for both production and distribution. The trend towards electric vehicles and the need for efficient supply chains further bolster the demand for logistics services tailored to OEMs, with German OEMs and suppliers investing heavily in electrification and digital supply networks.

The Germany Automotive 3PL market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain (Deutsche Post DHL Group), DB Schenker, Kuehne+Nagel, GEODIS, DSV, CEVA Logistics, Rhenus Logistics, Hellmann Worldwide Logistics, BLG LOGISTICS Group, and Nippon Express contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive 3PL market in Germany is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As the industry embraces digitalization, logistics providers will increasingly adopt smart technologies to enhance efficiency and transparency. Additionally, the focus on sustainability will lead to the development of eco-friendly logistics solutions, aligning with regulatory requirements and consumer expectations. This dynamic environment presents both challenges and opportunities for growth, shaping the future landscape of automotive logistics in Germany.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Management Warehousing and Distribution Freight Forwarding Packaging and Value-Added Services (kitting, labeling, sequencing) Reverse Logistics (returns, core recovery, recycling) Inbound to Manufacturing (JIT/JIS, line-side delivery) Inventory Management and Order Fulfillment |

| By End-User | Automotive OEMs (passenger and commercial vehicle manufacturers) Tier 1 Suppliers (modules, systems) Tier 2/3 Suppliers (components, raw materials) Aftermarket and Distribution (parts wholesalers, retailers) |

| By Distribution Mode | Road Rail Air Sea/Inland Waterways |

| By Service Model | Traditional 3PL Lead Logistics Provider (4PL) |

| By Customer Type | B2B B2C (aftermarket e-commerce, direct-to-consumer parts) |

| By Geographic Coverage | National (Germany-wide networks) Cross-Border EU (DACH, Benelux, CEE corridors) |

| By Pricing Model | Contract Logistics (rate cards, lane-based) Pay-as-you-go/Variable Gainshare/Outcome-based Subscription/Managed services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturing Logistics | 120 | Logistics Managers, Supply Chain Directors |

| Parts Distribution and Warehousing | 100 | Warehouse Managers, Operations Supervisors |

| Aftermarket Services and Returns | 80 | Customer Service Managers, Procurement Officers |

| Electric Vehicle Supply Chain | 70 | Supply Chain Managers, Sustainability Officers |

| Logistics Technology Integration | 90 | IT Managers, Logistics Analysts |

The Germany Automotive 3PL market is valued at approximately EUR 10 billion, reflecting the significant role of logistics in the automotive sector, driven by increasing demand for efficient solutions and the rise of e-commerce.