Region:Europe

Author(s):Shubham

Product Code:KRAB6169

Pages:95

Published On:October 2025

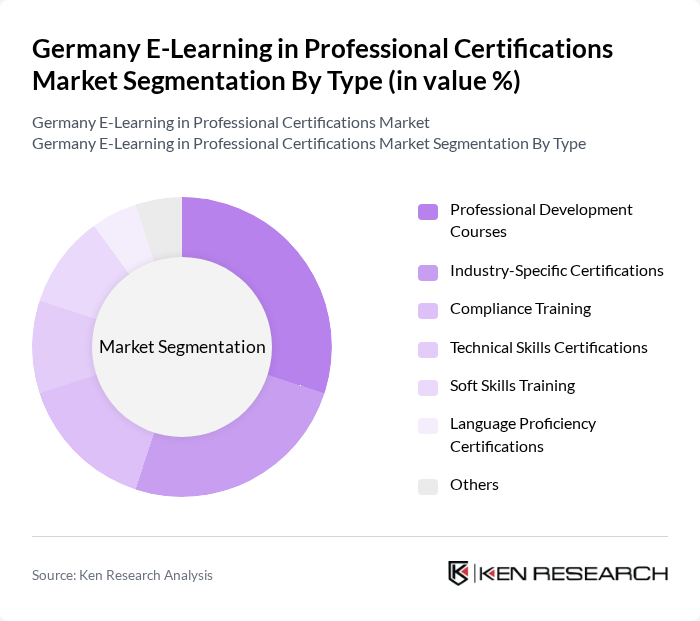

By Type:The market is segmented into various types of certifications, each catering to different professional needs. Among these, Professional Development Courses and Industry-Specific Certifications are particularly prominent. Professional Development Courses are favored for their broad applicability across various sectors, while Industry-Specific Certifications are gaining traction as industries seek specialized skills. The demand for Compliance Training is also significant, driven by regulatory requirements across sectors.

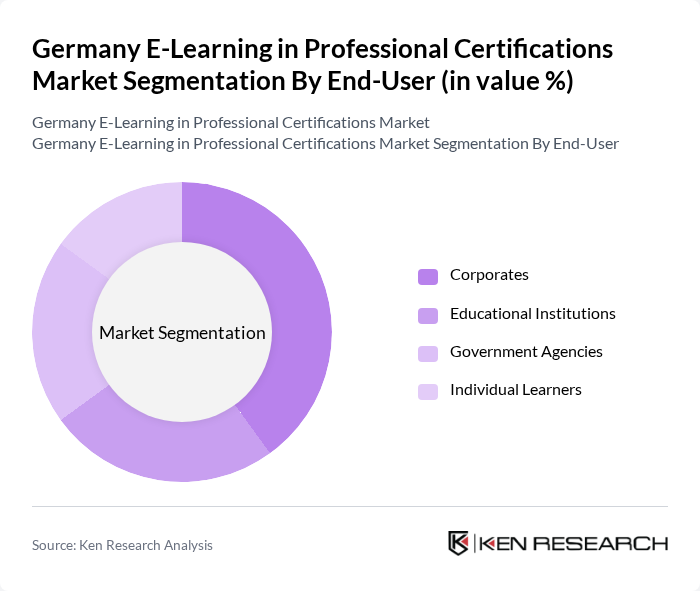

By End-User:The end-user segmentation reveals a diverse range of consumers, including Corporates, Educational Institutions, Government Agencies, and Individual Learners. Corporates are the largest segment, driven by the need for employee training and development. Educational Institutions are increasingly adopting e-learning solutions to complement traditional teaching methods, while Government Agencies are focusing on upskilling their workforce. Individual Learners are also a growing segment, motivated by personal development and career advancement.

The Germany E-Learning in Professional Certifications Market is characterized by a dynamic mix of regional and international players. Leading participants such as Coursera Inc., Udacity Inc., LinkedIn Learning, Skillshare Inc., edX Inc., Pluralsight Inc., Alison, FutureLearn, Khan Academy, OpenClassrooms, Simplilearn, General Assembly, Codecademy, HubSpot Academy, Microsoft Learn contribute to innovation, geographic expansion, and service delivery in this space.

The future of the e-learning market in Germany appears promising, driven by technological advancements and evolving workforce needs. As organizations increasingly prioritize employee development, the demand for innovative learning solutions will likely rise. Furthermore, the integration of artificial intelligence and personalized learning experiences is expected to enhance engagement and effectiveness. With government support and a focus on digital education, the market is set to evolve, catering to diverse learner needs and preferences in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Professional Development Courses Industry-Specific Certifications Compliance Training Technical Skills Certifications Soft Skills Training Language Proficiency Certifications Others |

| By End-User | Corporates Educational Institutions Government Agencies Individual Learners |

| By Delivery Mode | Online Self-Paced Learning Live Virtual Classes Blended Learning Mobile Learning |

| By Certification Level | Entry-Level Certifications Mid-Level Certifications Advanced-Level Certifications |

| By Industry | Information Technology Healthcare Finance Engineering |

| By Duration | Short Courses (Less than 3 months) Medium Courses (3-6 months) Long Courses (More than 6 months) |

| By Pricing Model | Subscription-Based Pay-Per-Course Freemium Model Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| IT Professional Certifications | 150 | IT Managers, Software Developers |

| Finance and Accounting Certifications | 100 | Accountants, Financial Analysts |

| Healthcare Certifications | 80 | Healthcare Professionals, Administrators |

| Project Management Certifications | 70 | Project Managers, Team Leaders |

| Marketing and Sales Certifications | 90 | Marketing Managers, Sales Executives |

The Germany E-Learning in Professional Certifications Market is valued at approximately USD 7 billion, reflecting significant growth driven by the demand for upskilling and reskilling in a rapidly evolving job market.