Region:Europe

Author(s):Geetanshi

Product Code:KRAB4510

Pages:97

Published On:October 2025

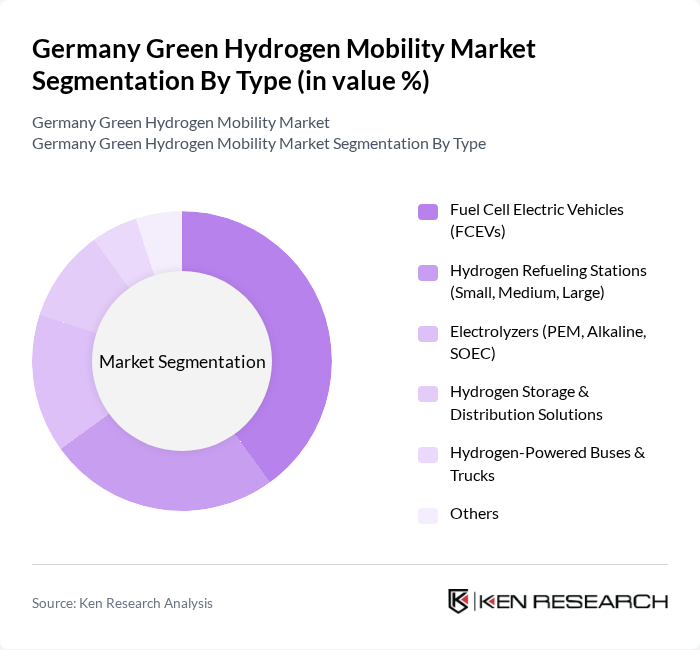

By Type:The market is segmented into Fuel Cell Electric Vehicles (FCEVs), Hydrogen Refueling Stations (Small, Medium, Large), Electrolyzers (PEM, Alkaline, SOEC), Hydrogen Storage & Distribution Solutions, Hydrogen-Powered Buses & Trucks, and Others. Among these, Fuel Cell Electric Vehicles (FCEVs) are leading the market due to their increasing adoption by public transit agencies and logistics operators, supported by government incentives, improved vehicle range, and expanding refueling infrastructure .

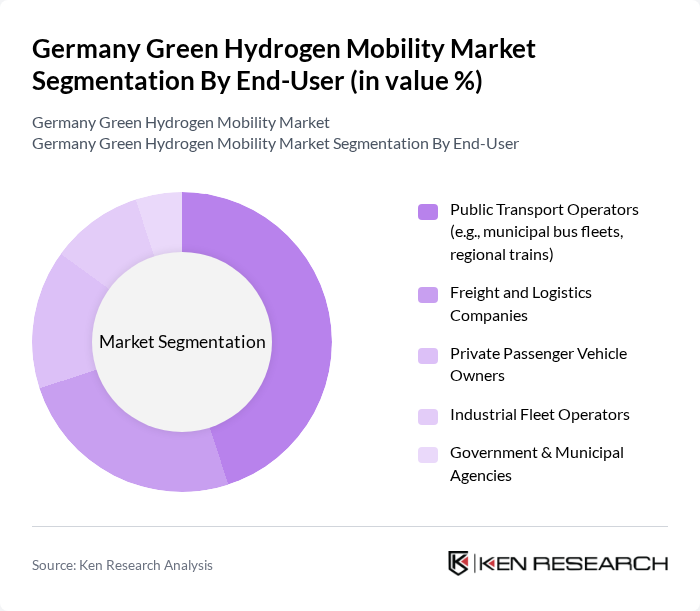

By End-User:The end-user segmentation includes Public Transport Operators (e.g., municipal bus fleets, regional trains), Freight and Logistics Companies, Private Passenger Vehicle Owners, Industrial Fleet Operators, and Government & Municipal Agencies. Public Transport Operators remain the dominant segment, as German cities increasingly integrate hydrogen-powered buses and trains into their fleets to meet sustainability targets, comply with emission reduction mandates, and improve urban air quality .

The Germany Green Hydrogen Mobility Market is characterized by a dynamic mix of regional and international players. Leading participants such as Linde plc, Air Liquide S.A., Siemens Energy AG, Nel ASA, Plug Power Inc., Ballard Power Systems Inc., Toyota Motor Corporation, Daimler Truck AG, Hyundai Motor Company, Shell plc, BMW AG, Volkswagen AG, Fraunhofer UMSICHT, H2 MOBILITY Deutschland GmbH & Co. KG, Hydrogenious LOHC Technologies GmbH, Westfalen Gruppe, RWE AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the green hydrogen mobility market in Germany appears promising, driven by increasing investments in renewable energy and a strong commitment to sustainability. As the government implements its National Hydrogen Strategy, the integration of hydrogen solutions into public transport systems is expected to expand significantly. Additionally, the growth of Hydrogen as a Service (HaaS) models will facilitate access to hydrogen technologies, further accelerating market adoption and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Fuel Cell Electric Vehicles (FCEVs) Hydrogen Refueling Stations (Small, Medium, Large) Electrolyzers (PEM, Alkaline, SOEC) Hydrogen Storage & Distribution Solutions Hydrogen-Powered Buses & Trucks Others |

| By End-User | Public Transport Operators (e.g., municipal bus fleets, regional trains) Freight and Logistics Companies Private Passenger Vehicle Owners Industrial Fleet Operators Government & Municipal Agencies |

| By Application | Urban Mobility (city buses, taxis, car-sharing) Long-Distance & Heavy-Duty Transport (trucks, trains) Emergency & Utility Vehicles Maritime & Aviation Pilots Others |

| By Investment Source | Private Investments Government Funding & Grants Public-Private Partnerships EU & International Funding Programs |

| By Policy Support | Subsidies for Green Hydrogen Production Tax Incentives for Hydrogen Mobility Solutions Research & Innovation Grants Regulatory Support for Infrastructure Development |

| By Distribution Channel | Direct Sales (OEMs to Fleet Operators) Online Platforms & Digital Marketplaces Partnerships with Automotive Dealers & Energy Providers |

| By Market Maturity | Emerging Regions (Eastern Germany, rural areas) Established Urban Markets (Berlin, Hamburg, Munich, Frankfurt) Niche & Pilot Projects |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Transport Operators | 100 | Fleet Managers, Operations Directors |

| Logistics and Delivery Services | 80 | Logistics Coordinators, Supply Chain Managers |

| Automotive Manufacturers | 60 | Product Development Engineers, R&D Managers |

| Hydrogen Infrastructure Providers | 50 | Business Development Managers, Project Engineers |

| Government and Regulatory Bodies | 40 | Policy Advisors, Energy Analysts |

The Germany Green Hydrogen Mobility Market is valued at approximately USD 10 billion, driven by increasing demand for sustainable transportation, government initiatives, and advancements in hydrogen technology.