Region:Europe

Author(s):Dev

Product Code:KRAA5627

Pages:97

Published On:September 2025

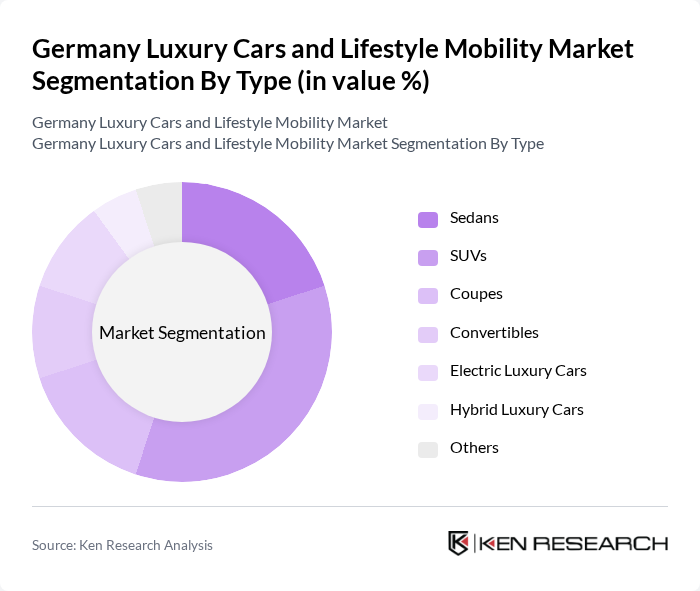

By Type:The luxury cars market can be segmented into various types, including sedans, SUVs, coupes, convertibles, electric luxury cars, hybrid luxury cars, and others. Each of these segments caters to different consumer preferences and lifestyle choices, with SUVs and electric luxury cars currently leading the market due to their popularity and demand for sustainability.

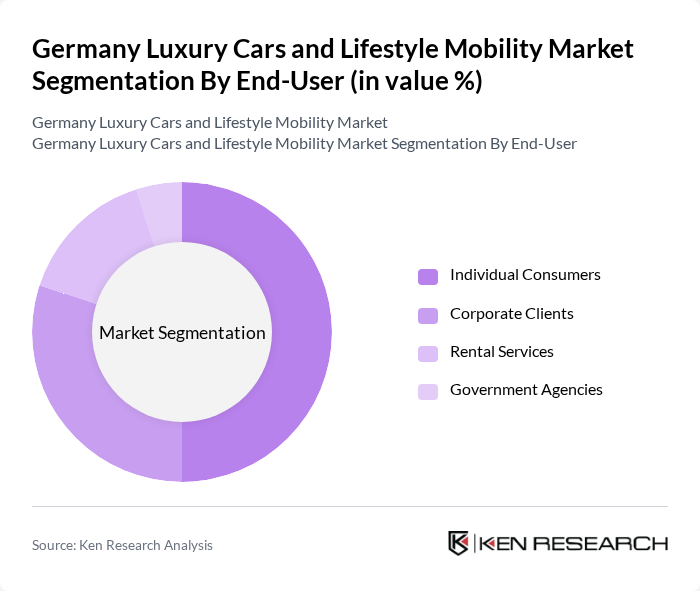

By End-User:The market can be segmented based on end-users, including individual consumers, corporate clients, rental services, and government agencies. Individual consumers and corporate clients are the primary drivers of demand, with a growing trend towards luxury rentals for special occasions and corporate events.

The Germany Luxury Cars and Lifestyle Mobility Market is characterized by a dynamic mix of regional and international players. Leading participants such as BMW AG, Mercedes-Benz AG, Audi AG, Porsche AG, Volkswagen AG, Tesla, Inc., Rolls-Royce Motor Cars, Bentley Motors Limited, Maserati S.p.A., Aston Martin Lagonda Global Holdings plc, Lamborghini S.p.A., Ferrari N.V., Jaguar Land Rover, McLaren Automotive, Bugatti Automobiles S.A.S. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the luxury car market in Germany appears promising, driven by technological advancements and changing consumer preferences. As electric vehicle infrastructure expands, more consumers will likely transition to electric luxury cars. Additionally, the rise of subscription-based ownership models is expected to reshape how consumers engage with luxury vehicles, offering flexibility and convenience. Brands that prioritize sustainability and personalized experiences will likely capture a larger share of the market, aligning with evolving consumer values and expectations.

| Segment | Sub-Segments |

|---|---|

| By Type | Sedans SUVs Coupes Convertibles Electric Luxury Cars Hybrid Luxury Cars Others |

| By End-User | Individual Consumers Corporate Clients Rental Services Government Agencies |

| By Price Range | Below €50,000 €50,000 - €100,000 €100,000 - €200,000 Above €200,000 |

| By Sales Channel | Direct Sales Dealerships Online Platforms Auctions |

| By Distribution Mode | Retail Wholesale Online Sales |

| By Customer Demographics | Age Group (18-30, 31-50, 51+) Gender Income Level |

| By Lifestyle Preferences | Eco-conscious Consumers Luxury Experience Seekers Tech-savvy Consumers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Car Ownership Trends | 150 | Luxury Car Owners, Automotive Enthusiasts |

| Consumer Preferences in Mobility Solutions | 100 | Affluent Consumers, Lifestyle Influencers |

| Electric Vehicle Adoption in Luxury Segment | 80 | EV Owners, Sustainability Advocates |

| Luxury Lifestyle and Mobility Integration | 70 | Luxury Brand Managers, Mobility Service Providers |

| Market Trends in Luxury Automotive Financing | 60 | Financial Advisors, Automotive Finance Executives |

The Germany Luxury Cars and Lifestyle Mobility Market is valued at approximately EUR 30 billion, driven by increasing disposable incomes and a growing demand for high-end vehicles, particularly electric and hybrid models.