Region:Europe

Author(s):Geetanshi

Product Code:KRAA4552

Pages:90

Published On:September 2025

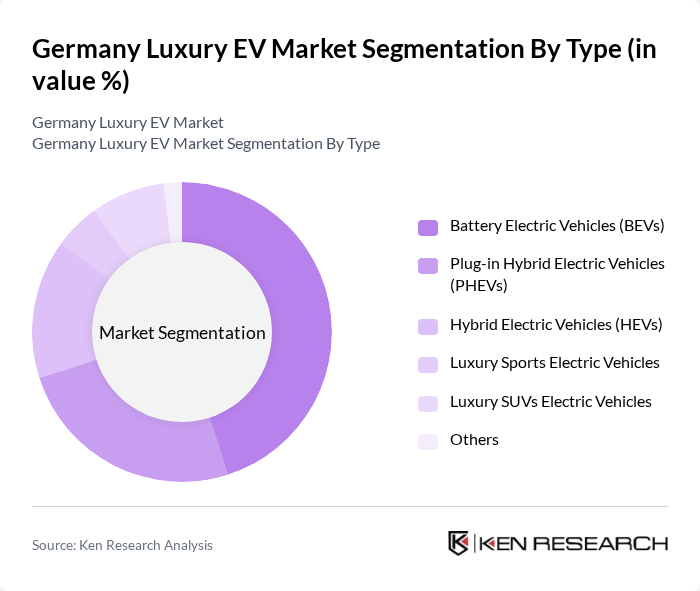

By Type:The luxury EV market is segmented into Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), Hybrid Electric Vehicles (HEVs), Luxury Sports Electric Vehicles, Luxury SUVs Electric Vehicles, and Others. BEVs currently lead the segment, driven by their zero-emission operation, lower maintenance requirements, and the expansion of fast-charging infrastructure. PHEVs and HEVs remain popular among consumers seeking extended range and flexibility, while luxury SUVs and sports models attract buyers seeking performance and advanced features.

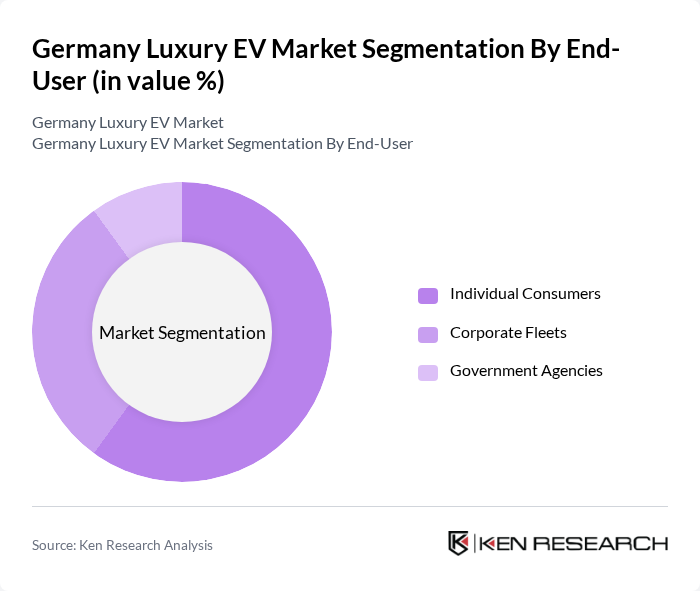

By End-User:The market is also segmented by end-users: Individual Consumers, Corporate Fleets, and Government Agencies. Individual consumers are the primary drivers, motivated by environmental consciousness, premium features, and advanced technology. Corporate fleets are increasingly adopting luxury EVs to meet sustainability targets and benefit from favorable tax treatment, while government agencies are investing in electric vehicles to comply with public sector emission mandates.

The Germany Luxury EV Market is characterized by a dynamic mix of regional and international players. Leading participants such as BMW AG, Mercedes-Benz AG, Audi AG, Porsche AG, Volkswagen AG, Tesla, Inc., Jaguar Land Rover Limited, Polestar Automotive Holding UK PLC, Lucid Motors, Inc., NIO Inc., BYD Company Limited, Fisker Inc., Rolls-Royce Motor Cars Limited, Maserati S.p.A., Lexus (Toyota Motor Corporation) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the luxury EV market in Germany appears promising, driven by technological advancements and changing consumer preferences. As battery technology improves, the range and efficiency of luxury electric vehicles are expected to enhance, addressing consumer concerns. Additionally, the integration of smart technologies and autonomous features will likely attract younger buyers, further expanding the market. With continued government support and infrastructure development, the luxury EV segment is poised for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Battery Electric Vehicles (BEVs) Plug-in Hybrid Electric Vehicles (PHEVs) Hybrid Electric Vehicles (HEVs) Luxury Sports Electric Vehicles Luxury SUVs Electric Vehicles Others |

| By End-User | Individual Consumers Corporate Fleets Government Agencies |

| By Price Range | Below €50,000 €50,000 - €100,000 €100,000 - €200,000 Above €200,000 |

| By Sales Channel | Direct Sales Dealerships Online Platforms |

| By Region | Northern Germany Southern Germany Eastern Germany Western Germany |

| By Charging Type | Home Charging Public Charging Fast Charging |

| By Battery Capacity | Below 50 kWh kWh - 100 kWh Above 100 kWh |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury EV Consumer Insights | 120 | Affluent Consumers, Luxury Car Owners |

| Automotive Industry Expert Opinions | 60 | Automotive Analysts, Industry Consultants |

| Luxury Brand Executives | 40 | Marketing Directors, Product Managers |

| Government Policy Makers | 40 | Regulatory Officials, Environmental Policy Experts |

| Charging Infrastructure Stakeholders | 50 | Infrastructure Developers, Energy Sector Executives |

The Germany Luxury EV Market is valued at approximately USD 18 billion, reflecting a significant portion of the broader electric vehicle market, which is valued at nearly USD 98 billion. This growth is driven by increasing consumer demand for sustainable transportation and government incentives.