Region:Europe

Author(s):Dev

Product Code:KRAA1586

Pages:89

Published On:August 2025

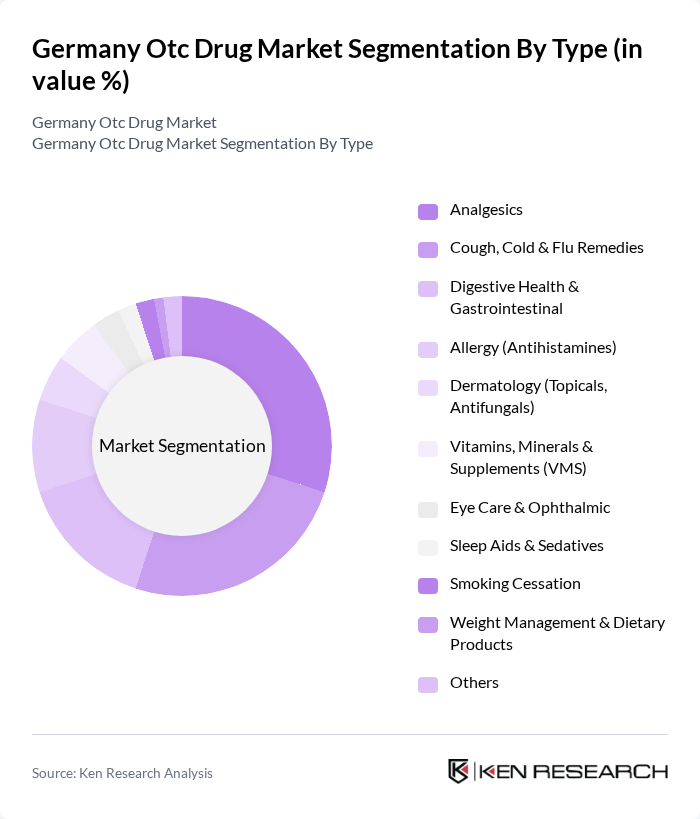

By Type:The OTC drug market can be segmented into various types, including analgesics, cough, cold & flu remedies, digestive health & gastrointestinal products, allergy medications, dermatology products, vitamins, minerals & supplements, eye care, sleep aids, smoking cessation products, weight management, and others. Among these, analgesics and cough, cold & flu remedies are particularly dominant due to high demand for pain and seasonal symptom relief; VMS and dermatology also see steady demand alongside a growing preference for natural/herbal products .

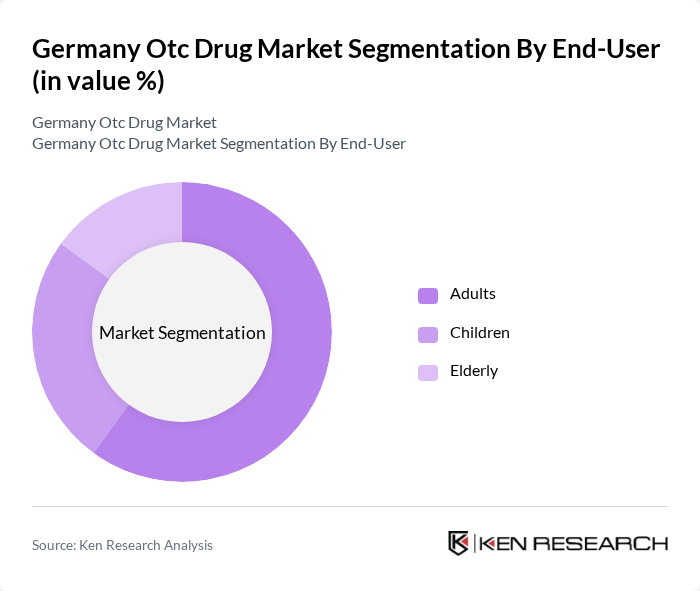

By End-User:The end-user segmentation includes adults, children, and the elderly. Adults represent the largest segment due to higher self-medication propensity and active management of minor conditions, while elderly demand is supported by population aging and chronic symptom management needs; children’s segment reflects parental purchases for common ailments .

The Germany OTC drug market is characterized by a dynamic mix of regional and international players. Leading participants such as Bayer AG (Consumer Health), Sanofi-Aventis Deutschland GmbH, STADA Arzneimittel AG, Hexal AG (a Novartis company), Johnson & Johnson GmbH (Kenvue brands in DE), GlaxoSmithKline Consumer Healthcare GmbH & Co. KG (Haleon), Merck Selbstmedikation GmbH (Procter & Gamble), Pfizer Consumer Healthcare (Germany), Reckitt Deutschland GmbH, Procter & Gamble Service GmbH, Novartis Consumer Health (Germany), Teva GmbH (ratiopharm), Viatris Deutschland GmbH (formerly Mylan), Dr. Willmar Schwabe GmbH & Co. KG, Queisser Pharma GmbH & Co. KG contribute to innovation, geographic expansion, and service delivery in this space .

The future of the German OTC drug market appears promising, driven by increasing health awareness and the aging population. Innovations in product personalization and digital health integration are expected to reshape consumer engagement. Additionally, the rise of e-commerce will facilitate easier access to OTC products, enhancing market penetration. As preventive healthcare gains traction, the demand for OTC solutions will likely continue to grow, presenting opportunities for companies to expand their offerings and reach new consumer segments.

| Segment | Sub-Segments |

|---|---|

| By Type | Analgesics Cough, Cold & Flu Remedies Digestive Health & Gastrointestinal Allergy (Antihistamines) Dermatology (Topicals, Antifungals) Vitamins, Minerals & Supplements (VMS) Eye Care & Ophthalmic Sleep Aids & Sedatives Smoking Cessation Weight Management & Dietary Products Others |

| By End-User | Adults Children Elderly |

| By Distribution Channel | Community Pharmacies/Drugstores (Apotheken/Drogerien) Supermarkets/Hypermarkets (limited OTC assortment) Online Pharmacies (E?pharmacies) Health & Wellness Stores |

| By Product Formulation | Tablets & Capsules Liquids & Syrups Ointments, Creams & Gels Powders & Granules Sprays & Drops (nasal, ophthalmic) |

| By Price Range | Low Price Mid Price Premium Price |

| By Brand Tier | Established Brands Private Label/Generics New Entrants |

| By Consumer Demographics | Gender Income Level Urban vs Rural |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmacy Retail Insights | 150 | Pharmacy Owners, Pharmacists |

| Healthcare Professional Recommendations | 100 | Doctors, Nurses, Healthcare Practitioners |

| Consumer Purchasing Behavior | 140 | General Consumers, Health-Conscious Individuals |

| Market Trends in OTC Products | 80 | Market Analysts, Industry Experts |

| Brand Loyalty and Preferences | 120 | Frequent OTC Users, Brand Managers |

The Germany OTC drug market is valued at approximately EUR 8.6 billion, reflecting a significant growth trend driven by increasing self-medication, health literacy, and an aging population seeking convenient solutions for minor health issues.