Region:Europe

Author(s):Shubham

Product Code:KRAD0747

Pages:86

Published On:August 2025

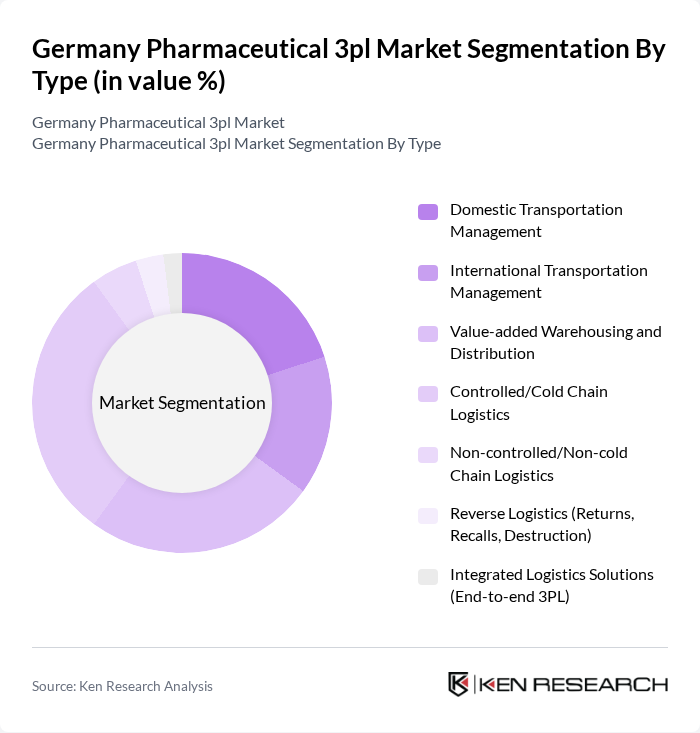

By Type:The market is segmented into various types of logistics services, including domestic and international transportation management, value-added warehousing, and cold chain logistics. Each of these segments plays a crucial role in ensuring the efficient delivery of pharmaceutical products, with cold chain logistics being particularly vital for temperature-sensitive medications.

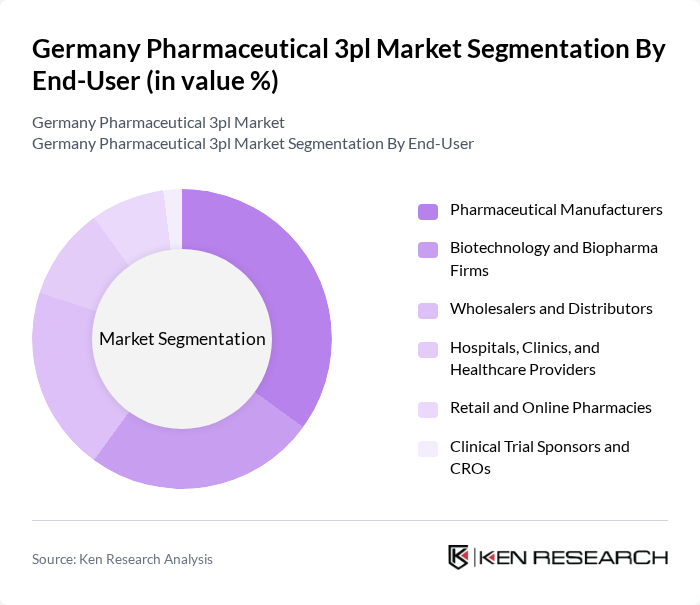

By End-User:The end-user segmentation includes pharmaceutical manufacturers, biotechnology firms, wholesalers, hospitals, and retail pharmacies. Each segment has unique logistics needs, with hospitals and clinics increasingly relying on specialized logistics services to ensure timely access to critical medications.

The Germany Pharmaceutical 3PL market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain (Deutsche Post DHL Group), Kuehne+Nagel, DB Schenker, GEODIS, UPS Healthcare, FedEx Logistics, DSV, CEVA Logistics, Rhenus Logistics, Trans-o-flex Express GmbH & Co. KGaA, Eurotranspharma Deutschland, Pfenning Logistics, Logwin AG, Kühne Logistics University Partners Network (Industry Collaborations), GDP Network Solutions GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the German pharmaceutical 3PL market appears promising, driven by ongoing digital transformation and a focus on sustainability. As companies increasingly adopt AI and automation, operational efficiencies are expected to improve significantly. Furthermore, the growing emphasis on cold chain logistics will enhance the distribution of temperature-sensitive products. These trends indicate a shift towards more integrated and responsive supply chains, positioning 3PL providers as essential partners in the pharmaceutical sector's evolution.

| Segment | Sub-Segments |

|---|---|

| By Type | Domestic Transportation Management International Transportation Management Value-added Warehousing and Distribution Controlled/Cold Chain Logistics Non-controlled/Non-cold Chain Logistics Reverse Logistics (Returns, Recalls, Destruction) Integrated Logistics Solutions (End-to-end 3PL) |

| By End-User | Pharmaceutical Manufacturers Biotechnology and Biopharma Firms Wholesalers and Distributors Hospitals, Clinics, and Healthcare Providers Retail and Online Pharmacies Clinical Trial Sponsors and CROs |

| By Distribution Mode | Direct-to-Pharmacy/Hospital Through Wholesalers Direct-to-Patient/Home Delivery E-commerce and Parcel Networks Cross-border (Intra-EU) Distribution |

| By Service Type | Standard Logistics Services (Pick, Pack, Ship) Specialized Services (Serialization, Clinical Logistics, Qualified Person) Value-added Services (Kitting, Labelling, Repackaging) Custom Integrated Solutions |

| By Packaging Type | Ambient Packaging Refrigerated Packaging (2–8°C) Frozen/Deep-frozen Packaging (-20°C to -80°C) Passive vs Active Temperature-controlled Shippers |

| By Compliance Type | EU GDP-compliant Facilities and Operations ISO 9001/13485 and Other Quality Certifications Regulatory Compliance for Hazardous/Controlled Substances |

| By Price Range | Standard Service Pricing Premium (Specialized/Cold Chain) Pricing Contract Logistics/Integrated Solutions Pricing Spot vs Contract Rates |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Distribution Logistics | 120 | Logistics Managers, Supply Chain Analysts |

| Cold Chain Management | 100 | Operations Managers, Quality Assurance Specialists |

| Regulatory Compliance in Logistics | 80 | Compliance Officers, Regulatory Affairs Managers |

| Pharmaceutical Returns Management | 70 | Returns Managers, Inventory Control Specialists |

| Technology Integration in 3PL | 90 | IT Managers, Logistics Technology Specialists |

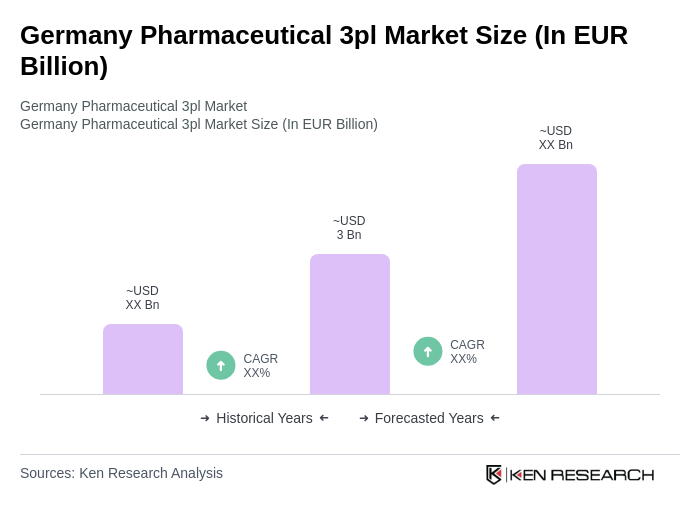

The Germany Pharmaceutical 3PL market is valued at approximately EUR 3 billion, driven by the complexities of regulated supply chains, the growth of e-commerce for medicines, and the need for temperature-sensitive logistics for biologics and vaccines.