Region:Europe

Author(s):Dev

Product Code:KRAB5401

Pages:84

Published On:October 2025

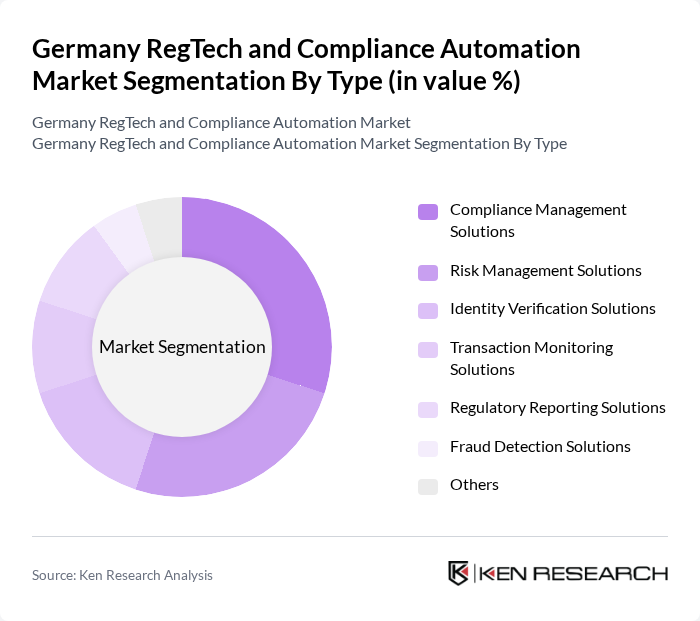

By Type:The market is segmented into various types of solutions that cater to different compliance needs. The primary subsegments include Compliance Management Solutions, Risk Management Solutions, Identity Verification Solutions, Transaction Monitoring Solutions, Regulatory Reporting Solutions, Fraud Detection Solutions, and Others. Each of these subsegments plays a crucial role in addressing specific regulatory challenges faced by organizations.

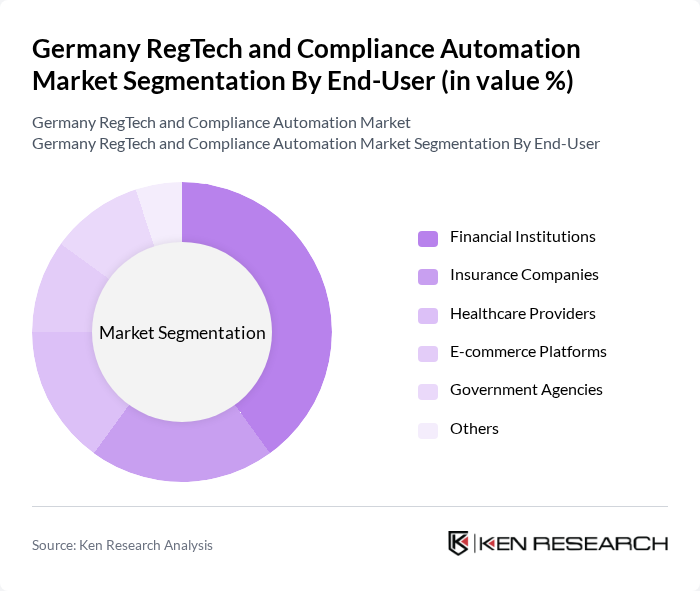

By End-User:The end-user segmentation includes Financial Institutions, Insurance Companies, Healthcare Providers, E-commerce Platforms, Government Agencies, and Others. Each of these sectors has unique compliance requirements, driving the demand for tailored RegTech solutions.

The Germany RegTech and Compliance Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as ComplyAdvantage, Fenergo, Actico, RiskScreen, AxiomSL, LexisNexis Risk Solutions, NICE Actimize, SAS Institute, Wolters Kluwer, Thomson Reuters, Oracle, SAP, IBM, Infor, Compliance.ai contribute to innovation, geographic expansion, and service delivery in this space.

The future of the RegTech and compliance automation market in Germany appears promising, driven by ongoing digital transformation initiatives and the increasing integration of advanced technologies. As organizations prioritize compliance efficiency, the adoption of AI and machine learning is expected to rise significantly. Furthermore, collaboration between RegTech firms and traditional financial institutions will likely enhance innovation, leading to more tailored solutions that address specific regulatory challenges and improve overall compliance effectiveness.

| Segment | Sub-Segments |

|---|---|

| By Type | Compliance Management Solutions Risk Management Solutions Identity Verification Solutions Transaction Monitoring Solutions Regulatory Reporting Solutions Fraud Detection Solutions Others |

| By End-User | Financial Institutions Insurance Companies Healthcare Providers E-commerce Platforms Government Agencies Others |

| By Compliance Area | Data Protection Compliance Financial Compliance Environmental Compliance Health and Safety Compliance Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Organization Size | Large Enterprises Medium Enterprises Small Enterprises |

| By Sales Channel | Direct Sales Online Sales Distributors |

| By Region | North Germany South Germany East Germany West Germany Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Compliance Automation | 100 | Compliance Officers, Risk Managers |

| Insurance Industry RegTech Solutions | 80 | Regulatory Affairs Managers, IT Directors |

| Fintech Startups and Compliance Tools | 70 | Founders, Product Managers |

| Corporate Governance and Risk Management | 60 | Chief Compliance Officers, Legal Advisors |

| Data Privacy and Protection Solutions | 90 | Data Protection Officers, IT Security Managers |

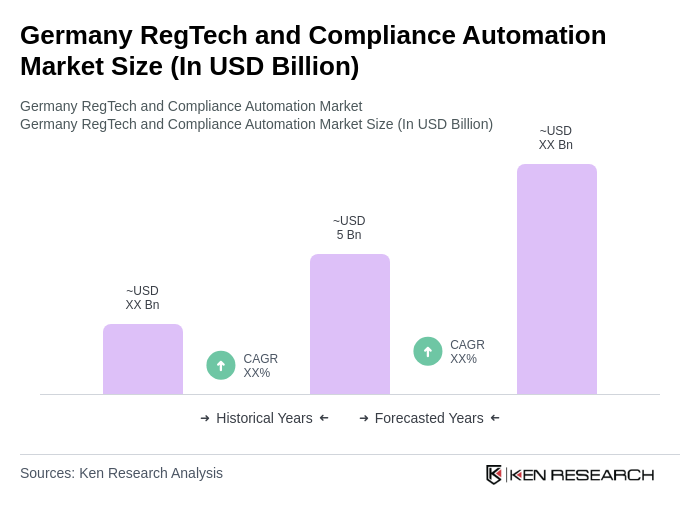

The Germany RegTech and Compliance Automation Market is valued at approximately USD 5 billion, driven by increasing regulatory complexities, the rise of digital financial services, and the demand for cost-effective compliance solutions.