Region:Europe

Author(s):Rebecca

Product Code:KRAA4605

Pages:80

Published On:September 2025

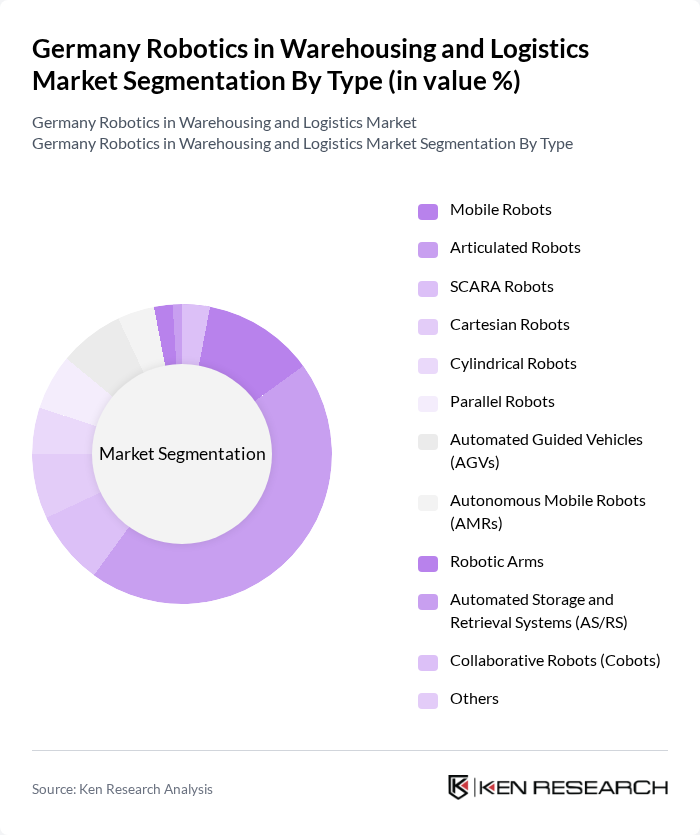

By Type:The robotics market in warehousing and logistics is segmented into various types, including Mobile Robots, Articulated Robots, SCARA Robots, Cartesian Robots, Cylindrical Robots, Parallel Robots, Automated Guided Vehicles (AGVs), Autonomous Mobile Robots (AMRs), Robotic Arms, Automated Storage and Retrieval Systems (AS/RS), Collaborative Robots (Cobots), and Others. Among these,Articulated Robotscommand the largest share, driven by automotive industry requirements for complex assembly operations and precision component handling. Automated Guided Vehicles (AGVs) and Mobile Robots are also experiencing rapid adoption in logistics and e-commerce distribution centers, reflecting the sector’s focus on flexible, scalable automation solutions .

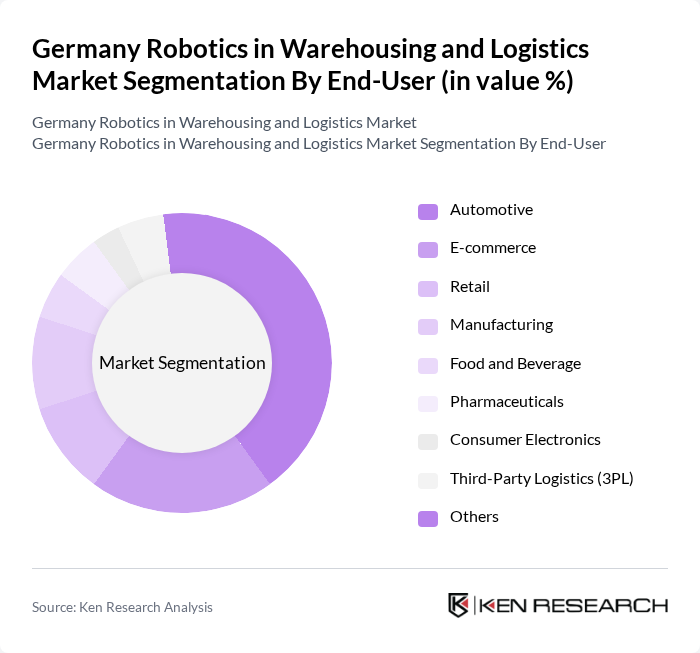

By End-User:The end-user segmentation of the robotics market in warehousing and logistics includes Automotive, E-commerce, Retail, Manufacturing, Food and Beverage, Pharmaceuticals, Consumer Electronics, Third-Party Logistics (3PL), and Others. TheAutomotive sectoris currently the dominant end-user, driven by Germany’s leadership in automotive production and the need for advanced automation in component handling and assembly. E-commerce and Retail are rapidly growing segments, reflecting the surge in online shopping and the need for efficient order fulfillment .

The Germany Robotics in Warehousing and Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as KUKA AG, Siemens AG, ABB Ltd., Dematic GmbH, Jungheinrich AG, Swisslog Holding AG, Bosch Rexroth AG, Schunk GmbH & Co. KG, Festo AG & Co. KG, STILL GmbH, Vanderlande Industries B.V., FANUC Europe Corporation, Locus Robotics, GreyOrange, Geekplus Europe GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the robotics market in Germany's warehousing and logistics sector appears promising, driven by ongoing technological advancements and increasing automation demands. As companies continue to adapt to labor shortages and rising e-commerce activities, the integration of AI and IoT technologies will play a crucial role in enhancing operational efficiency. Furthermore, the focus on sustainability will likely drive innovations in smart warehousing solutions, positioning Germany as a leader in automated logistics solutions in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Robots Articulated Robots SCARA Robots Cartesian Robots Cylindrical Robots Parallel Robots Automated Guided Vehicles (AGVs) Autonomous Mobile Robots (AMRs) Robotic Arms Automated Storage and Retrieval Systems (AS/RS) Collaborative Robots (Cobots) Others |

| By End-User | Automotive E-commerce Retail Manufacturing Food and Beverage Pharmaceuticals Consumer Electronics Third-Party Logistics (3PL) Others |

| By Application | Palletizing and Depalletizing Order Fulfillment Inventory Management Packaging Pick & Place Shipping and Receiving Transportation Others |

| By Payload Capacity | Below 10 kg kg to 80 kg kg to 400 kg kg to 900 kg Above 900 kg |

| By Component | Hardware Software Services Others |

| By Price Range | Low Price Mid Price High Price Others |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automated Warehouse Operations | 100 | Warehouse Managers, Operations Directors |

| Robotics Technology Providers | 80 | Product Managers, Sales Executives |

| Logistics Service Providers | 60 | Supply Chain Managers, Business Development Heads |

| End-user Industry Insights | 50 | Procurement Officers, Logistics Analysts |

| Regulatory and Compliance Insights | 40 | Policy Makers, Compliance Officers |

The Germany Robotics in Warehousing and Logistics Market is valued at approximately USD 910 million, reflecting a significant growth driven by increased automation demand, the rise of e-commerce, and the integration of advanced technologies like AI and IoT.