Region:Europe

Author(s):Dev

Product Code:KRAB0439

Pages:80

Published On:August 2025

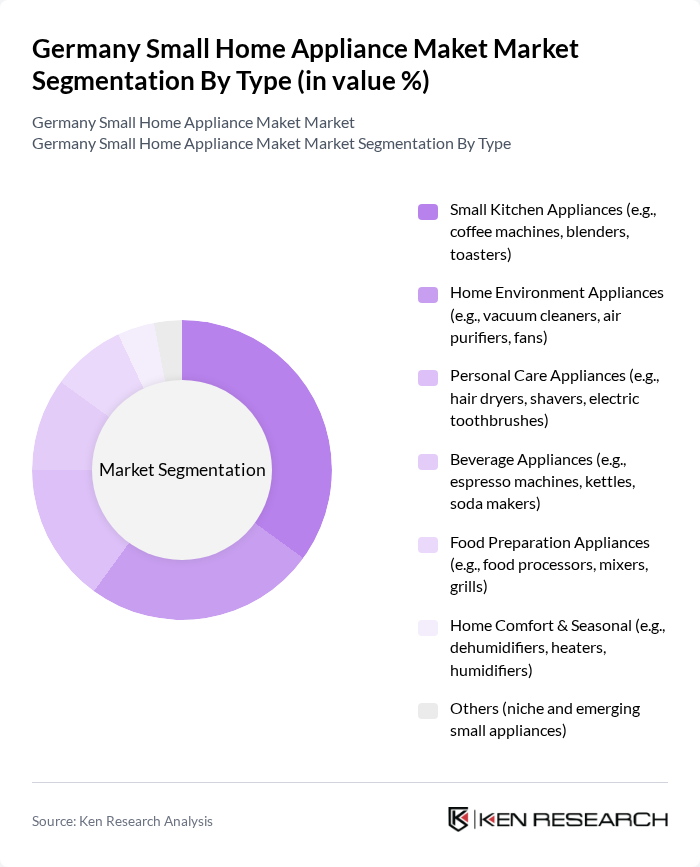

By Type:The small home appliance market can be segmented into various types, including small kitchen appliances, home environment appliances, personal care appliances, beverage appliances, food preparation appliances, home comfort & seasonal appliances, and others. Among these, small kitchen appliances are particularly popular due to their convenience and versatility, with demand reinforced by health-oriented cooking and premium coffee culture, while home environment devices (e.g., vacuum cleaners, air purifiers, fans) benefit from efficiency features and smart integration.

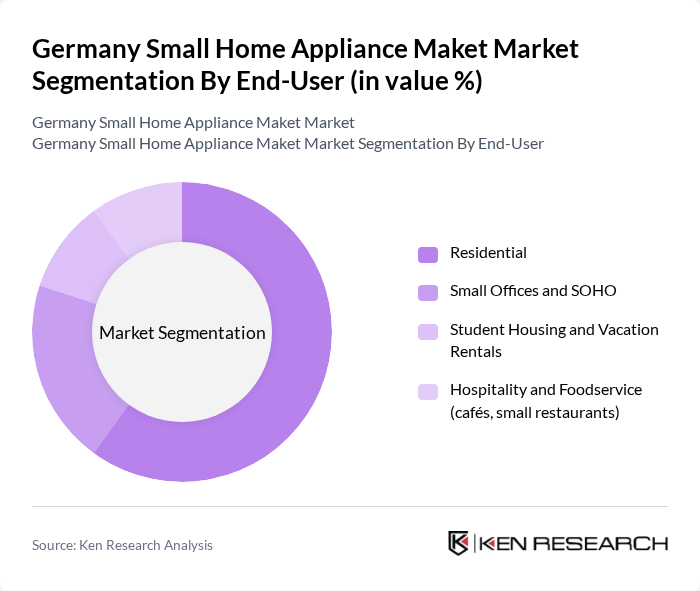

By End-User:The end-user segmentation includes residential consumers, small offices and SOHO, student housing and vacation rentals, and hospitality and foodservice sectors. The residential segment is the largest, supported by the high share of one-person households and ongoing home-centric consumption patterns that lift purchases of compact and connected appliances.

The Germany Small Home Appliance Market is characterized by a dynamic mix of regional and international players. Leading participants such as BSH Hausgeräte GmbH (Bosch, Siemens), Miele & Cie. KG, De’Longhi Group, Groupe SEB (Rowenta, Tefal, Krups), Philips Domestic Appliances (Versuni), Braun (De’Longhi Group – small kitchen appliances), WMF Group GmbH, AEG (Electrolux Group), Electrolux, Grundig Intermedia GmbH (Arçelik), Severin Elektrogeräte GmbH, Klarstein (Chal-Tec GmbH), Vorwerk (Thermomix), Beurer GmbH, SodaStream (SodaStream International Ltd.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the small home appliance market in Germany appears promising, driven by technological advancements and evolving consumer preferences. As smart home technologies gain traction, the integration of IoT in appliances is expected to enhance user experience and convenience. Additionally, the increasing focus on sustainability will likely push manufacturers to innovate eco-friendly products, aligning with consumer demand for energy-efficient solutions. These trends will shape the market landscape, fostering growth and adaptation in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Small Kitchen Appliances (e.g., coffee machines, blenders, toasters) Home Environment Appliances (e.g., vacuum cleaners, air purifiers, fans) Personal Care Appliances (e.g., hair dryers, shavers, electric toothbrushes) Beverage Appliances (e.g., espresso machines, kettles, soda makers) Food Preparation Appliances (e.g., food processors, mixers, grills) Home Comfort & Seasonal (e.g., dehumidifiers, heaters, humidifiers) Others (niche and emerging small appliances) |

| By End-User | Residential Small Offices and SOHO Student Housing and Vacation Rentals Hospitality and Foodservice (cafés, small restaurants) |

| By Sales Channel | Electronic Stores and Specialist Retailers Online (Brand.com, Marketplaces) Multi-brand Stores and Hypermarkets Direct-to-Consumer and Subscription |

| By Price Range | Budget Mid-Range Premium |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers Quality-Conscious Customers |

| By Product Features | Energy-Efficient Features Smart/Connected Features Multi-Functionality and Compact Design |

| By Distribution Mode | Direct Distribution Indirect Distribution E-commerce Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Kitchen Appliances Market | 120 | Product Managers, Retail Buyers |

| Cleaning Devices Segment | 100 | Sales Representatives, Category Managers |

| Personal Care Appliances | 80 | Consumer Insights Analysts, Brand Managers |

| Market Trends in E-commerce | 100 | E-commerce Managers, Digital Marketing Specialists |

| Consumer Preferences and Feedback | 90 | End-users, Focus Group Participants |

The Germany Small Home Appliance Market is valued at approximately EUR 6.0 billion, reflecting a robust growth trend driven by factors such as increasing single-person households and a focus on health and wellness products.