Global 2 Ethyl Hexanol Market Overview

- The Global 2 Ethyl Hexanol Market is valued at USD 6.5 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for plasticizers in the construction and automotive industries, as well as the rising use of 2-ethylhexanol in the production of solvents, coatings, adhesives, and synthetic lubricants. The market's expansion is further supported by rapid urbanization, infrastructure development in Asia-Pacific and the Middle East, and a shift towards lightweight, durable, and weather-resistant materials in automotive and building sectors. Additionally, innovations in manufacturing processes, such as advances in LP Oxo technology, are enhancing efficiency and sustainability in production .

- Key players in the market include the United States, Germany, and China, which dominate due to their robust industrial bases and significant investments in chemical manufacturing. The Asia-Pacific region, led by China, India, and Japan, is the largest consumer, driven by expanding construction and automotive industries. The presence of established companies and advanced technological capabilities in these regions further enhances their competitive edge, making them leaders in the production and consumption of 2-ethylhexanol .

- In 2023, the European Union continued to enforce stringent regulations regarding the use of hazardous substances in chemical manufacturing, particularly under the REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) framework. This regulation aims to ensure the safe use of chemicals, including 2-ethylhexanol, by requiring manufacturers to provide comprehensive safety data and risk assessments. These regulatory pressures are prompting manufacturers to invest in safer and more sustainable production methods .

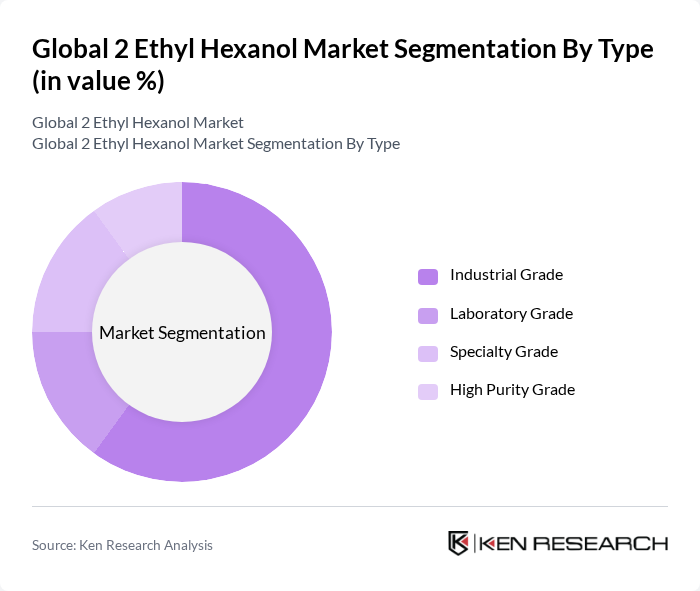

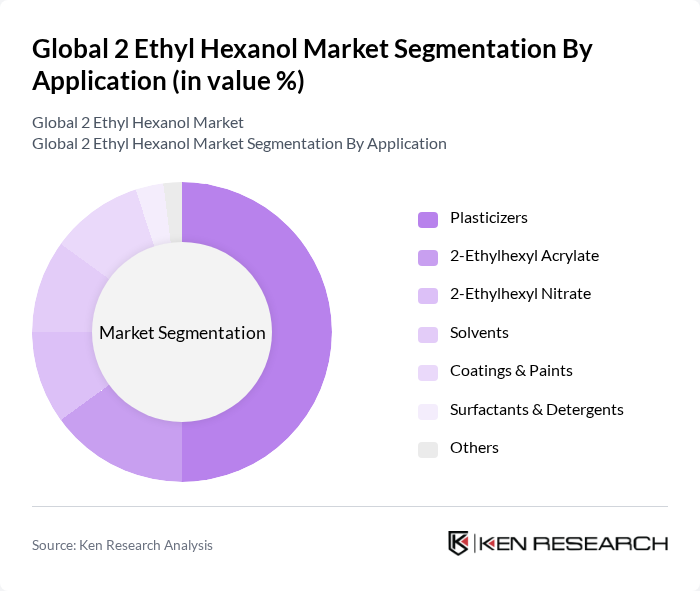

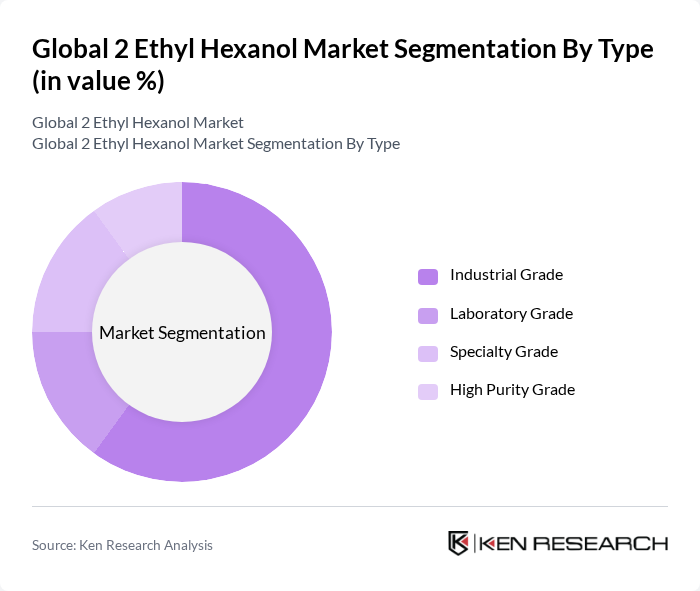

Global 2 Ethyl Hexanol Market Segmentation

By Type:The 2 Ethyl Hexanol market is segmented into four main types: Industrial Grade, Laboratory Grade, Specialty Grade, and High Purity Grade. Among these, the Industrial Grade sub-segment is the most dominant due to its extensive use in the production of plasticizers, solvents, coatings, and adhesives. The demand for Industrial Grade 2 Ethyl Hexanol is driven by its cost-effectiveness, versatility, and suitability for large-scale industrial applications, making it a preferred choice for manufacturers .

By Application:The applications of 2 Ethyl Hexanol include Plasticizers, 2-Ethylhexyl Acrylate, 2-Ethylhexyl Nitrate, Solvents, Coatings & Paints, Surfactants & Detergents, and Others. The Plasticizers application segment holds the largest market share, driven by the increasing demand for flexible and durable materials in the construction and automotive sectors. The trend towards lightweight, high-performance, and weather-resistant materials, especially in automotive interiors and building products, further propels the growth of this segment. Rising production of detergents and surfactants also contributes to market expansion .

Global 2 Ethyl Hexanol Market Competitive Landscape

The Global 2 Ethyl Hexanol Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Eastman Chemical Company, OQ Chemicals GmbH, LG Chem Ltd., Mitsubishi Chemical Corporation, Dow Inc., INEOS Group Holdings S.A., Sasol Limited, Solvay S.A., Grupa Azoty S.A., Huntsman Corporation, Clariant AG, Repsol S.A., Formosa Plastics Corporation, Taminco BVBA contribute to innovation, geographic expansion, and service delivery in this space.

Global 2 Ethyl Hexanol Market Industry Analysis

Growth Drivers

- Increasing Demand from Automotive Industry:The automotive sector is a significant driver for 2 Ethyl Hexanol, with production levels reaching approximately 85 million vehicles globally in future. This demand is projected to increase as manufacturers focus on enhancing fuel efficiency and reducing emissions. The use of 2 Ethyl Hexanol in automotive coatings and lubricants is expected to grow, supported by a projected 5% increase in automotive production in future, according to the International Organization of Motor Vehicle Manufacturers (OICA).

- Growth in Construction Sector:The construction industry is anticipated to expand significantly, with global spending expected to reach $14 trillion in future, according to the Global Construction Perspectives. This growth is driven by urbanization and infrastructure development, particularly in emerging markets. 2 Ethyl Hexanol is increasingly utilized in construction materials, such as adhesives and sealants, which are essential for modern building practices, thereby boosting its demand in this sector.

- Rising Use in Coatings and Paints:The coatings and paints segment is projected to consume over 1.6 million tons of 2 Ethyl Hexanol in future, driven by the increasing demand for high-performance coatings. The global paint and coatings market is expected to grow to $210 billion in future, as reported by the American Coatings Association. This growth is fueled by innovations in formulation technologies that enhance durability and environmental compliance, further propelling the demand for 2 Ethyl Hexanol.

Market Challenges

- Volatility in Raw Material Prices:The prices of raw materials for 2 Ethyl Hexanol production have shown significant fluctuations, with crude oil prices averaging $85 per barrel in future. This volatility can lead to unpredictable production costs, impacting profit margins for manufacturers. The reliance on petroleum-based feedstocks makes the market susceptible to geopolitical tensions and supply chain disruptions, which can further exacerbate price instability.

- Stringent Environmental Regulations:Regulatory frameworks, such as the REACH compliance in Europe, impose strict limits on the use of certain chemicals, including 2 Ethyl Hexanol. In future, compliance costs are expected to rise, with companies investing an estimated $1.2 billion collectively to meet these standards. This regulatory pressure can hinder market growth and increase operational costs for manufacturers, affecting their competitiveness in the global market.

Global 2 Ethyl Hexanol Market Future Outlook

The future of the 2 Ethyl Hexanol market appears promising, driven by increasing applications across various industries. The automotive and construction sectors are expected to continue their upward trajectory, supported by technological advancements and sustainability initiatives. Additionally, the shift towards bio-based products is likely to create new avenues for growth, as consumers and manufacturers alike prioritize environmentally friendly alternatives. Strategic partnerships will also play a crucial role in enhancing market dynamics and fostering innovation.

Market Opportunities

- Expansion in Emerging Markets:Emerging markets, particularly in Asia-Pacific, are projected to witness a surge in demand for 2 Ethyl Hexanol, driven by rapid industrialization and urbanization. With a population exceeding 4.5 billion, these regions present significant growth potential, as infrastructure development accelerates, creating new applications for 2 Ethyl Hexanol in various sectors.

- Innovations in Production Technologies:Advances in production technologies, such as green chemistry and process optimization, are expected to enhance the efficiency of 2 Ethyl Hexanol manufacturing. These innovations can reduce production costs and environmental impact, making it more competitive against alternative chemicals. Companies investing in R&D are likely to gain a significant market advantage in the coming years.