Region:Global

Author(s):Rebecca

Product Code:KRAA1415

Pages:98

Published On:August 2025

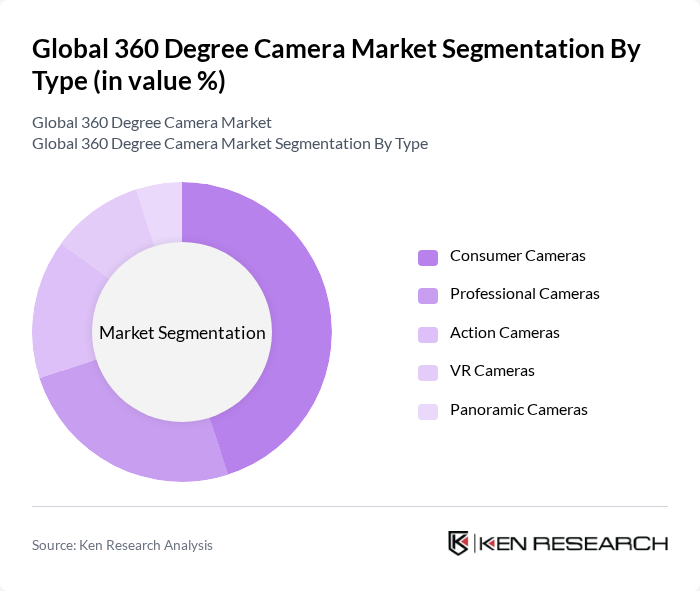

By Type:

The 360-degree camera market is segmented into Consumer Cameras, Professional Cameras, Action Cameras, VR Cameras, and Panoramic Cameras. Among these,Consumer Camerascontinue to dominate the market due to their affordability, ease of use, and appeal to a broad audience. The growing trend of social media sharing, personal content creation, and live streaming has significantly increased demand for these devices.Professional Camerasare also gaining traction, particularly in real estate, media, and security, where high-quality imagery and advanced features are essential .

By End-User:

The end-user segmentation includes Individual Consumers, Businesses & Enterprises, Educational Institutions, Government & Defense Agencies, and Media & Entertainment Companies.Individual Consumerslead this segment, driven by the rapid growth of personal content creation, social media engagement, and the accessibility of consumer-grade 360-degree cameras.Businesses and enterprisesare increasingly adopting these cameras for marketing, virtual tours, training, and surveillance, contributing to overall market expansion .

The Global 360 Degree Camera Market is characterized by a dynamic mix of regional and international players. Leading participants such as GoPro, Inc., Ricoh Company, Ltd., Insta360 (Arashi Vision Inc.), Garmin Ltd., Nikon Corporation, Samsung Electronics Co., Ltd., Canon Inc., Sony Corporation, Humaneyes Technologies (Vuze XR), 360fly, Inc., Lenovo Group Ltd., Kodak Alaris Inc., Xiaomi Corporation, Matterport, Inc., Meta Platforms, Inc. (Facebook Technologies, LLC), YI Technology, LG Electronics Inc., PANONO (Professional 360 GmbH), and Digital Domain Holdings Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the 360-degree camera market appears promising, driven by technological advancements and increasing consumer interest in immersive experiences. As industries continue to explore innovative applications, the integration of artificial intelligence and machine learning will enhance content creation and editing processes. Furthermore, the rise of mobile solutions and user-friendly software will democratize access to 360-degree photography, making it more appealing to a broader audience, thus fostering market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Consumer Cameras Professional Cameras Action Cameras VR Cameras Panoramic Cameras |

| By End-User | Individual Consumers Businesses & Enterprises Educational Institutions Government & Defense Agencies Media & Entertainment Companies |

| By Application | Entertainment and Media Real Estate & Virtual Tours Tourism and Travel Education and Training Security & Surveillance Automotive (Surround View Systems) Healthcare & Medical Imaging Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales (B2B) Specialty Stores Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, UK, France, Rest of Europe) Asia-Pacific (China, Japan, India, South Korea, Rest of APAC) Latin America Middle East & Africa |

| By Price Range | Budget Cameras Mid-Range Cameras Premium Cameras |

| By Brand | Established Brands Emerging Brands Private Labels |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Market for 360-Degree Cameras | 120 | End-users, Hobbyist Photographers |

| Professional Use in Real Estate | 60 | Real Estate Agents, Property Managers |

| Tourism and Travel Industry Applications | 50 | Travel Agencies, Tour Operators |

| Content Creation and Media Production | 40 | Videographers, Content Creators |

| Virtual Reality and Gaming Sector | 45 | Game Developers, VR Content Producers |

The Global 360 Degree Camera Market is valued at approximately USD 1.4 billion, driven by the increasing demand for immersive content across various sectors such as entertainment, real estate, and tourism.