Region:Global

Author(s):Dev

Product Code:KRAA1686

Pages:94

Published On:August 2025

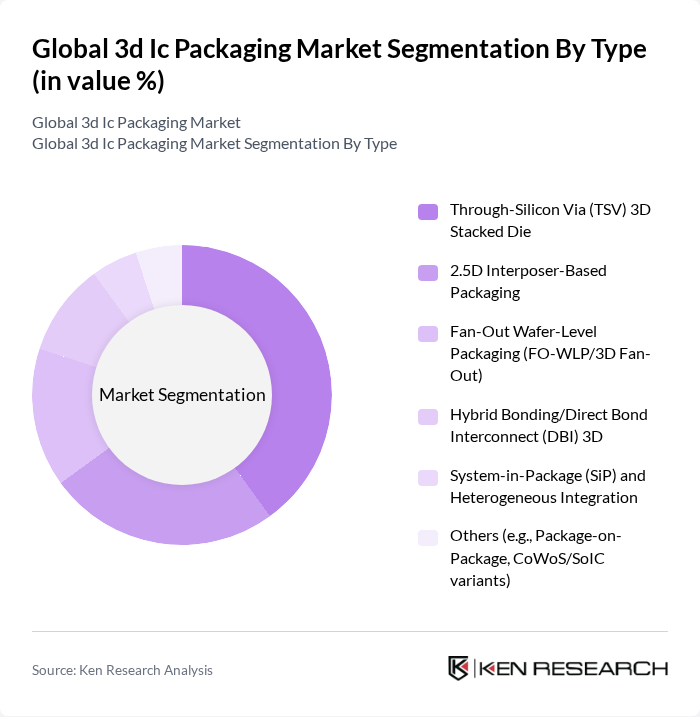

By Type:The 3D IC packaging market can be segmented into various types, including Through-Silicon Via (TSV) 3D Stacked Die, 2.5D Interposer-Based Packaging, Fan-Out Wafer-Level Packaging (FO-WLP/3D Fan-Out), Hybrid Bonding/Direct Bond Interconnect (DBI) 3D, System-in-Package (SiP) and Heterogeneous Integration, and Others (e.g., Package-on-Package, CoWoS/SoIC variants). Among these, the Through-Silicon Via (TSV) 3D Stacked Die is currently the leading subsegment due to its ability to provide high-density interconnections and improved performance for high-performance computing applications. The demand for TSV technology is driven by the increasing need for efficient thermal management, bandwidth scaling for HBM/AI accelerators, and power efficiency in advanced electronic devices .

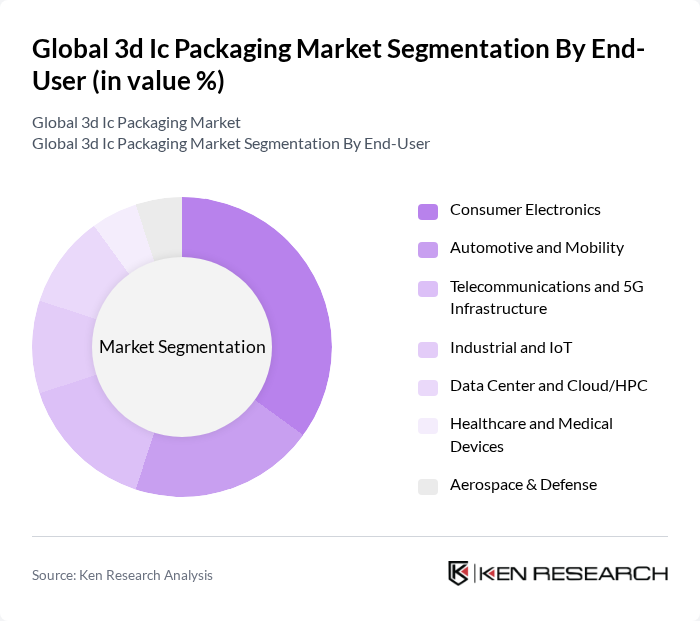

By End-User:The end-user segmentation of the 3D IC packaging market includes Consumer Electronics, Automotive and Mobility, Telecommunications and 5G Infrastructure, Industrial and IoT, Data Center and Cloud/HPC, Healthcare and Medical Devices, and Aerospace & Defense. The Consumer Electronics segment remains significant due to smartphones, tablets, image sensors, and wearables; however, rapid adoption in Data Center and Cloud/HPC is accelerating with AI accelerators and HBM-enabled GPUs driving 2.5D/3D packaging uptake. IoT proliferation and 5G infrastructure also contribute to demand for miniaturization and higher bandwidth packaging .

The Global 3D IC Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Taiwan Semiconductor Manufacturing Company Limited (TSMC), Samsung Electronics Co., Ltd., Intel Corporation, Micron Technology, Inc., SK hynix Inc., ASE Technology Holding Co., Ltd. (ASE Group), Amkor Technology, Inc., Advanced Micro Devices, Inc. (for 3D chiplet/3D V-Cache integration), Taiwan Union Technology Corporation (TUC), and Ibiden Co., Ltd. (advanced substrates), Shinko Electric Industries Co., Ltd., United Microelectronics Corporation (UMC), Powertech Technology Inc. (PTI), Jiangsu Changjiang Electronics Technology Co., Ltd. (JCET Group), STATS ChipPAC Pte. Ltd. (a JCET company), ASE-Siliconware Precision Industries Co., Ltd. (SPIL) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the 3D IC packaging market appears promising, driven by technological advancements and increasing demand for compact electronic solutions. As manufacturers continue to innovate, the integration of AI and machine learning in production processes is expected to enhance efficiency and reduce costs. Additionally, the growing emphasis on sustainability will likely lead to the development of eco-friendly packaging materials, further shaping the market landscape and attracting investment in new technologies.

| Segment | Sub-Segments |

|---|---|

| By Type | Through-Silicon Via (TSV) 3D Stacked Die D Interposer-Based Packaging Fan-Out Wafer-Level Packaging (FO-WLP/3D Fan-Out) Hybrid Bonding/Direct Bond Interconnect (DBI) 3D System-in-Package (SiP) and Heterogeneous Integration Others (e.g., Package-on-Package, CoWoS/SoIC variants) |

| By End-User | Consumer Electronics Automotive and Mobility Telecommunications and 5G Infrastructure Industrial and IoT Data Center and Cloud/HPC Healthcare and Medical Devices Aerospace & Defense |

| By Application | High-Performance Computing (AI/Accelerators) Mobile and Wearables Networking and Edge Computing Memory (HBM/3D NAND) and Storage Imaging Sensors and MEMS Advanced Driver-Assistance Systems (ADAS) and EV Power Electronics Others |

| By Material | Silicon (wafers, interposers) Organic Substrates and Build-Up laminates Glass Interposers Advanced Dielectrics, Underfill, and Mold Compounds Solder Balls, Micro-bumps, and Cu Pillars Thermal Interface Materials Others |

| By Distribution Channel | Direct Manufacturer Engagement (OSAT/Foundry) Authorized Distributors and Design Partners Turnkey/EMS and ODM Channels Online and Platform-Based Procurement Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Entry-Level (Cost-Optimized) Mid-Range (Performance/Cost Balance) Premium (High-Performance/Advanced Node) Custom/Specialized |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Manufacturers | 110 | Product Development Managers, Supply Chain Analysts |

| Automotive Electronics Suppliers | 85 | Engineering Managers, Procurement Specialists |

| Telecommunications Equipment Providers | 75 | Technical Directors, Operations Managers |

| Medical Device Manufacturers | 60 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Research Institutions and Universities | 50 | Academic Researchers, Industry Collaborators |

The Global 3D IC Packaging Market is valued at approximately USD 5861 billion, reflecting strong demand driven by sectors such as AI, high-performance computing (HPC), and advanced logic integration, according to recent industry analyses.