Region:Global

Author(s):Dev

Product Code:KRAB0494

Pages:97

Published On:August 2025

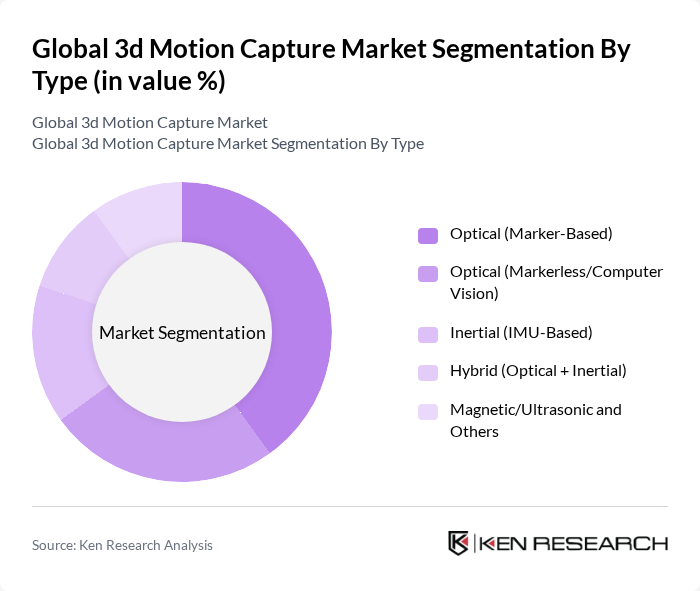

By Type:The 3D motion capture market is segmented into various types, including Optical (Marker-Based), Optical (Markerless/Computer Vision), Inertial (IMU-Based), Hybrid (Optical + Inertial), and Magnetic/Ultrasonic and Others. Optical (Marker-Based) systems remain the preferred choice in high-end film, TV, and AAA game pipelines due to their superior spatial accuracy, low latency, and established workflows, while markerless/computer vision methods and inertial suits are gaining traction for faster setup and portability.

By End-User:The market is also segmented by end-user, which includes Film, TV, and VFX Studios, Gaming and Interactive Media, Sports, Biomechanics, and Performance Labs, Healthcare and Rehabilitation, Industrial, Robotics, and Research Institutes, and Education and Training. Film, TV, and VFX Studios lead due to sustained demand for photoreal animation and real-time performance capture, while gaming and interactive media show strong use tied to real-time engines and VR/AR deployments; sports and healthcare use cases continue to expand for performance analysis and clinical assessment.

The Global 3D Motion Capture Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vicon Motion Systems Ltd., OptiTrack (a division of Movella Inc.), Motion Analysis Corporation, Xsens Technologies B.V. (a Movella company), Qualisys AB, Noitom Ltd. (Perception Neuron), Rokoko, Faceware Technologies, Inc., iPi Soft LLC, Reallusion Inc., Dynamixyz (a Discord company), Perception Neuron Studio by Noitom, Shadow by Manus (Manus BV), StretchSense Limited, Qualibyte (Cascadeur by Nekki) and RADiCAL Solutions contribute to innovation, geographic expansion, and service delivery in this space.

The future of the 3D motion capture market appears promising, driven by continuous technological advancements and increasing applications across various sectors. As industries increasingly recognize the value of immersive experiences, the integration of AI and machine learning will enhance motion capture capabilities, leading to more efficient data processing. Furthermore, the expansion into emerging markets will provide new growth avenues, fostering innovation and collaboration across entertainment, healthcare, and sports sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Optical (Marker-Based) Optical (Markerless/Computer Vision) Inertial (IMU-Based) Hybrid (Optical + Inertial) Magnetic/Ultrasonic and Others |

| By End-User | Film, TV, and VFX Studios Gaming and Interactive Media Sports, Biomechanics, and Performance Labs Healthcare and Rehabilitation Industrial, Robotics, and Research Institutes Education and Training |

| By Application | Character Animation and Previsualization Virtual Production and Digital Humans VR/AR/MR and Metaverse Avatars Sports Analytics and Athlete Performance Clinical Gait Analysis and Ergonomics Robotics Control and Human–Robot Interaction |

| By Component | Hardware (Cameras/Sensors, Suits, Markers, Accessories) Software (Tracking, Solvers, Retargeting, Plugins) Services (Installation, Training, Maintenance, Managed Mocap) |

| By Distribution Channel | Direct (OEM and Enterprise Sales) Online (Official Stores and Marketplaces) Authorized Distributors/Resellers |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Entry-Level (Creator/Indie) Mid-Range (Studio/Pro) High-End (Enterprise/Elite) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Film Production Studios | 120 | Production Managers, Technical Directors |

| Video Game Development Companies | 90 | Game Designers, Animation Leads |

| Sports Analytics Firms | 60 | Data Analysts, Sports Technologists |

| Virtual Reality Content Creators | 70 | VR Developers, Creative Directors |

| Academic Research Institutions | 50 | Research Scientists, Motion Capture Specialists |

The Global 3D Motion Capture Market is valued at approximately USD 230 million, driven by advancements in capture hardware and software, and increasing adoption across various sectors such as media, entertainment, sports, and healthcare.