Region:Global

Author(s):Dev

Product Code:KRAA1553

Pages:95

Published On:August 2025

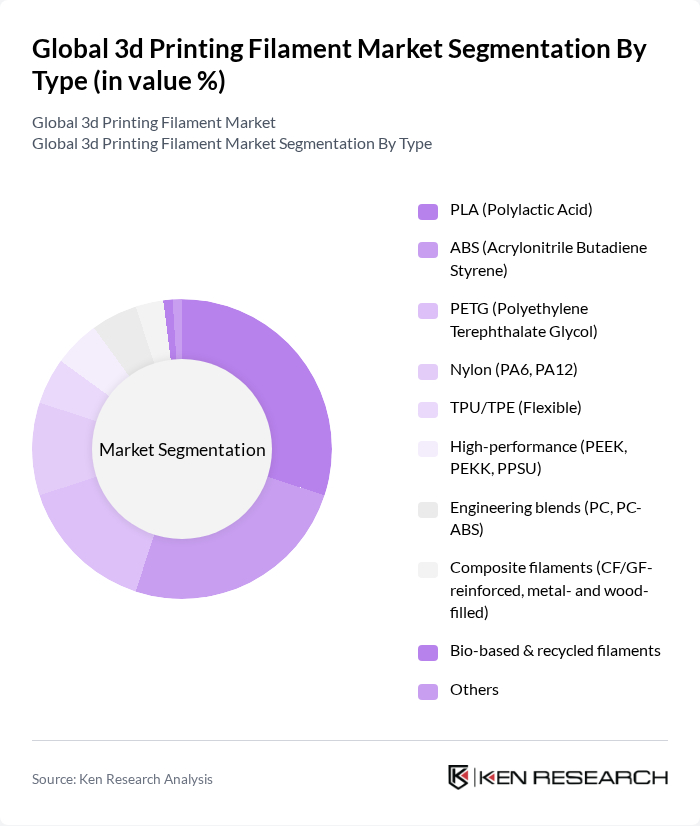

By Type:The 3D printing filament market is segmented into various types, including PLA (Polylactic Acid), ABS (Acrylonitrile Butadiene Styrene), PETG (Polyethylene Terephthalate Glycol), Nylon (PA6, PA12), TPU/TPE (Flexible), High-performance (PEEK, PEKK, PPSU), Engineering blends (PC, PC-ABS), Composite filaments (CF/GF-reinforced, metal- and wood-filled), Bio-based & recycled filaments, and Others. Among these, PLA is the most widely used filament due to its ease of printing, low warp, and bio?based origin, making it popular for education, prototyping, and consumer use; PETG and ABS follow for functional parts needing toughness and temperature resistance.

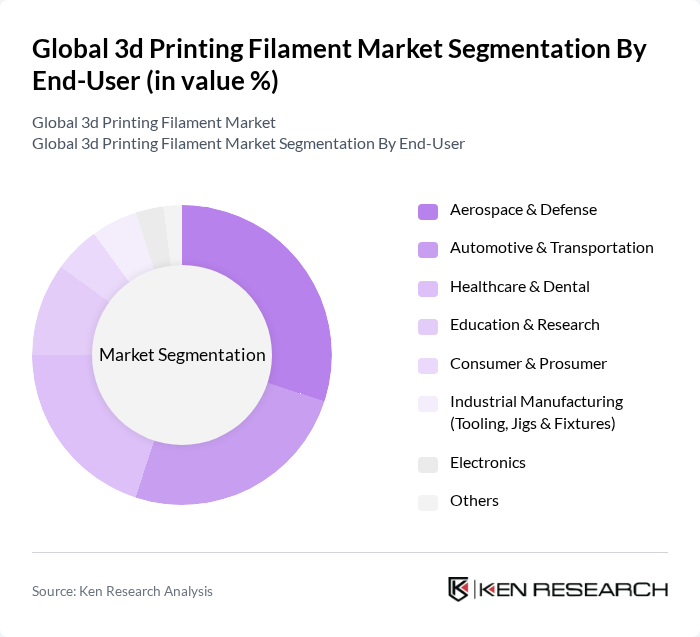

By End-User:The end-user segmentation of the 3D printing filament market includes Aerospace & Defense, Automotive & Transportation, Healthcare & Dental, Education & Research, Consumer & Prosumer, Industrial Manufacturing (Tooling, Jigs & Fixtures), Electronics, and Others. The aerospace and automotive sectors are significant users for rapid prototyping, lightweighting, and tooling; healthcare and dental use biocompatible and sterilizable polymers for models, guides, and certain patient-specific devices; education and prosumer segments accelerate unit volumes due to widespread desktop printer adoption.

The Global 3D Printing Filament Market is characterized by a dynamic mix of regional and international players. Leading participants such as Stratasys Ltd., 3D Systems Corporation, Filamentive, Prusa Research a.s. (Prusament), MatterHackers, Inc., colorFabb B.V., HATCHBOX (KIWI3D, LLC), Ultimaker B.V. (UltiMaker), Raise3D Technologies, Inc., eSUN (Shenzhen eSUN Industrial Co., Ltd.), Formfutura B.V., Polymaker (PolyMaker LLC), 3D-Fuel (3DomFuel, LLC), BASF Forward AM (Ultrafuse), DSM Additive Manufacturing (Novamid/Arnite, legacy), Evonik Industries AG (INFINAM), Arkema S.A. (Kepstan PEEK, Rilsan PA11), Mitsubishi Chemical Group (Verbatim/Kaiteki), Covestro (Addigy, legacy with materials now under Evonik/Sabic), SABIC (LEXAN/ULTEM filaments) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the 3D printing filament market appears promising, driven by ongoing technological advancements and increasing adoption across various sectors. As industries continue to explore innovative applications, the demand for specialized filaments is expected to rise. Furthermore, the integration of sustainable practices and eco-friendly materials will likely shape the market landscape, encouraging manufacturers to develop biodegradable and recyclable filament options, thus enhancing environmental responsibility in production processes.

| Segment | Sub-Segments |

|---|---|

| By Type | PLA (Polylactic Acid) ABS (Acrylonitrile Butadiene Styrene) PETG (Polyethylene Terephthalate Glycol) Nylon (PA6, PA12) TPU/TPE (Flexible) High?performance (PEEK, PEKK, PPSU) Engineering blends (PC, PC?ABS) Composite filaments (CF/GF?reinforced, metal? and wood?filled) Bio?based & recycled filaments Others |

| By End-User | Aerospace & Defense Automotive & Transportation Healthcare & Dental Education & Research Consumer & Prosumer Industrial Manufacturing (Tooling, Jigs & Fixtures) Electronics Others |

| By Application | Prototyping Tooling & Manufacturing Aids End?use/Production Parts Dental & Medical Models/Devices Design, Art & Architecture Packaging & Consumer Goods Others |

| By Sales Channel | Direct/Enterprise Sales E?commerce (Brand Webstores, Marketplaces) Distributors/Resellers Retail Stores Others |

| By Distribution Mode | B2B B2C C2C Others |

| By Price Range | Economy (entry?level) Mid?Range Premium/Industrial?grade Others |

| By Material Properties | Strength & Stiffness Flexibility & Impact Resistance Heat & Chemical Resistance Biodegradability/Recyclability Electrical/ESD?safe Food?contact/Medical?grade Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Filament Users | 120 | Manufacturing Engineers, Production Managers |

| Educational Institutions | 90 | Academic Researchers, Lab Technicians |

| Consumer Market Segment | 80 | Hobbyists, DIY Enthusiasts |

| Healthcare Applications | 70 | Medical Device Developers, Biomedical Engineers |

| Aerospace and Automotive Sectors | 90 | Design Engineers, Product Development Managers |

The Global 3D Printing Filament Market is valued at approximately USD 1.4 billion, driven by the increasing adoption of fused filament fabrication (FFF/FDM) technologies across various industries, including aerospace, automotive, and healthcare.