Region:Global

Author(s):Shubham

Product Code:KRAA1742

Pages:91

Published On:August 2025

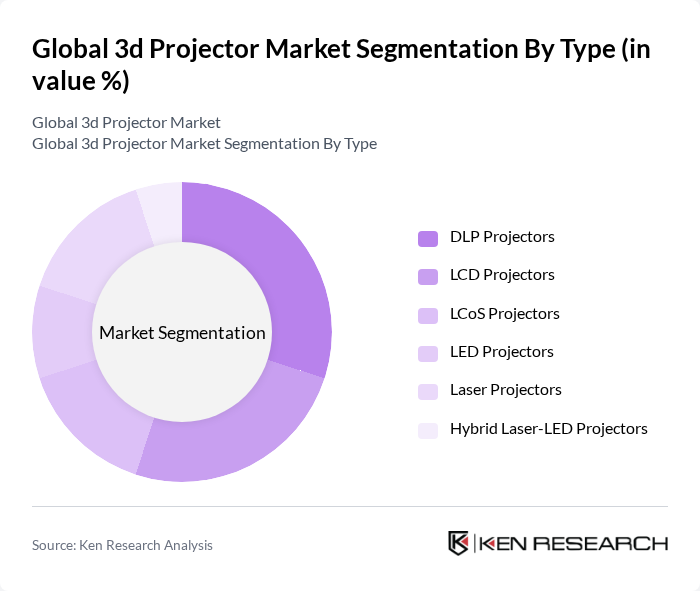

By Type:The market is segmented into various types of projectors, including DLP Projectors, LCD Projectors, LCoS Projectors, LED Projectors, Laser Projectors, and Hybrid Laser-LED Projectors. Each type has unique features and applications, catering to different consumer needs and preferences.

The DLP Projectors segment is currently leading the market due to their strong contrast performance, single-chip designs enabling compact form factors, and broad availability across price tiers used in commercial and residential applications. Wider adoption for home theater and corporate meeting rooms sustains their lead.

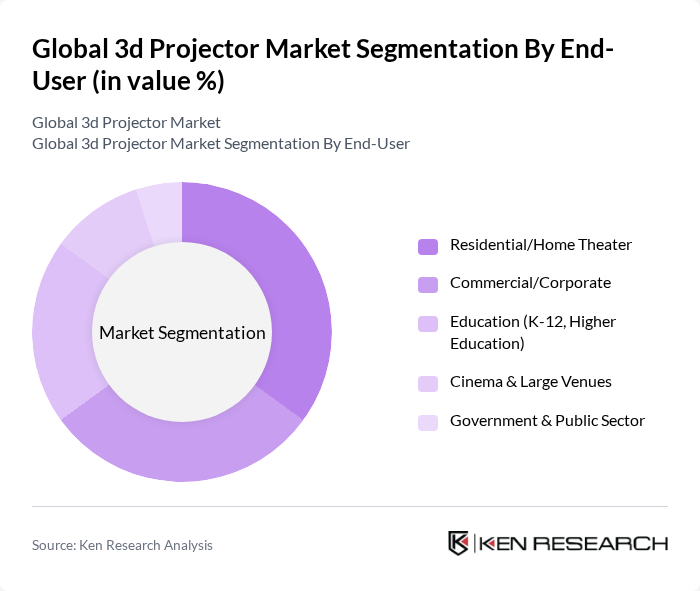

By End-User:The market is segmented based on end-users, including Residential/Home Theater, Commercial/Corporate, Education (K-12, Higher Education), Cinema & Large Venues, and Government & Public Sector. Each segment has distinct requirements and preferences that influence purchasing decisions.

The Residential/Home Theater segment is the largest, supported by the adoption of immersive home entertainment, gaming, and 4K/HDR-capable models at accessible price points, alongside quieter, longer-life laser/LED light sources that reduce maintenance.

The Global 3D Projector Market is characterized by a dynamic mix of regional and international players. Leading participants such as Epson (Seiko Epson Corporation), Sony Corporation, Panasonic Holdings Corporation, BenQ Corporation, ViewSonic Corporation, Optoma Corporation, LG Electronics Inc., Dell Technologies Inc., Christie Digital Systems USA, Inc. (Ushio Inc.), Sharp NEC Display Solutions, Ltd. (NEC Corporation), Acer Inc., Canon Inc., JVCKENWOOD Corporation, Barco NV, Xiaomi Corporation (Mi Projectors), Anker Innovations (Nebula), Hisense Group (Laser Projectors), Vivitek (Delta Electronics, Inc.), InFocus Corporation, AAXA Technologies Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the 3D projector market appears promising, driven by technological innovations and increasing consumer interest in immersive experiences. As more households invest in home entertainment systems, the demand for high-quality projection solutions is expected to rise. Additionally, educational institutions are likely to continue adopting advanced projection technologies, enhancing learning environments. The integration of smart home technologies and the development of portable projectors will further expand market reach, catering to diverse consumer needs and preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | DLP Projectors LCD Projectors LCoS Projectors LED Projectors Laser Projectors Hybrid Laser-LED Projectors |

| By End-User | Residential/Home Theater Commercial/Corporate Education (K-12, Higher Education) Cinema & Large Venues Government & Public Sector |

| By Application | Home Theater & Gaming Business Presentations & Collaboration Education and Training Events, Entertainment & Projection Mapping Simulation & Visualization (Design, Medical, Engineering) |

| By Distribution Channel | Online Retail & E-commerce Offline Retail (Specialty & Big-box) Direct/B2B & System Integrators |

| By Price Range | Budget (Sub-$1,000) Mid-Range ($1,000–$3,999) Premium ($4,000–$9,999) Professional & Large Venue ($10,000+) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology | D Active Shutter Technology D Passive (Polarized) Technology Glasses-Free/Autostereoscopic 3D D-Ready (PC 3D, Full HD 3D) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Education Sector 3D Projectors | 120 | IT Directors, Educational Technology Coordinators |

| Corporate Presentation Solutions | 90 | Corporate Trainers, AV Equipment Managers |

| Home Theater Systems | 80 | Home Theater Enthusiasts, Retail Sales Associates |

| Entertainment and Gaming Applications | 100 | Game Developers, Event Coordinators |

| Healthcare Visualization Tools | 70 | Medical Professionals, Healthcare IT Managers |

The Global 3D Projector Market is valued at approximately USD 4.0 billion, driven by advancements in projection technologies and increasing demand across various sectors, including education, corporate collaboration, and home entertainment.