Region:Global

Author(s):Rebecca

Product Code:KRAB0310

Pages:92

Published On:August 2025

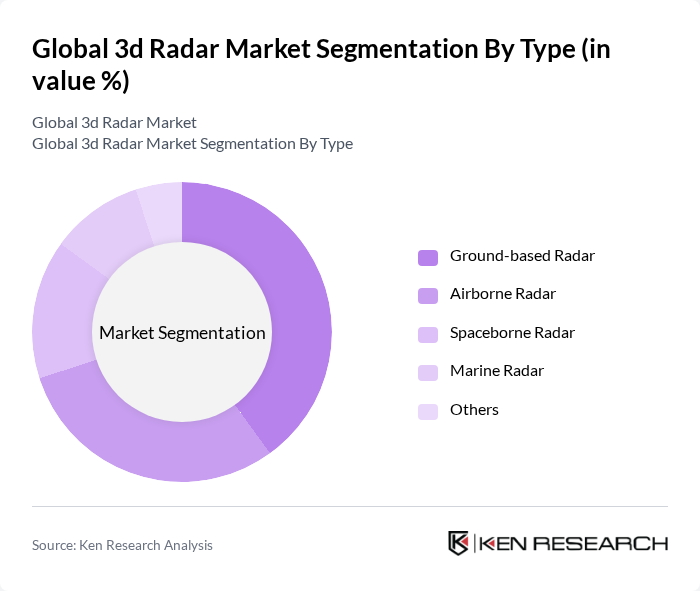

By Type:The 3D radar market is segmented into various types, including Ground-based Radar, Airborne Radar, Spaceborne Radar, Marine Radar, and Others. Among these, Ground-based Radar is currently the leading sub-segment due to its extensive applications in defense and security, providing critical surveillance capabilities. Airborne Radar is also gaining traction, particularly in military and commercial aviation, as it enhances situational awareness and navigation accuracy. The adoption of 3D radar in the automotive industry for autonomous vehicles and in weather monitoring is also increasing .

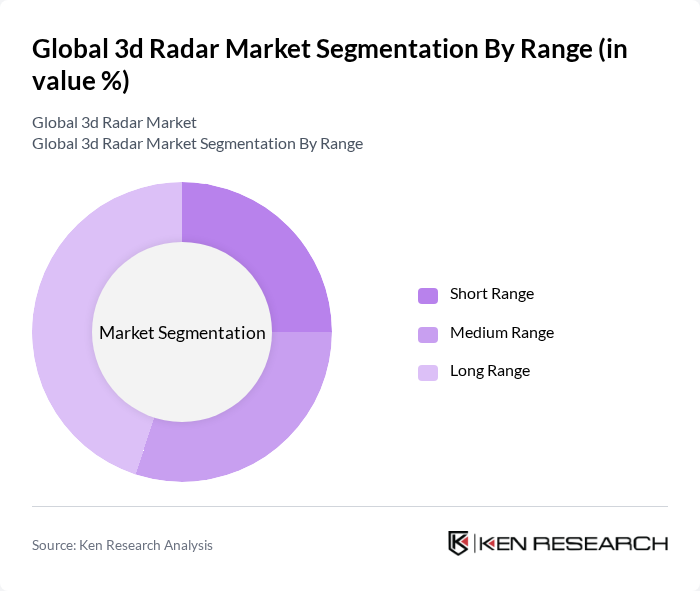

By Range:The market is also segmented by range into Short Range, Medium Range, and Long Range. The Long Range segment dominates the market due to its critical applications in defense and aerospace, where extended detection capabilities are essential. Medium Range radars are widely used in various applications, including traffic management and weather monitoring, while Short Range radars find applications in automotive and industrial sectors. The increasing adoption of 3D radar for autonomous vehicles and smart infrastructure is further driving growth in the short and medium range segments .

The Global 3D Radar Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, Thales Group, BAE Systems plc, Leonardo S.p.A., Saab AB, Elbit Systems Ltd., Harris Corporation, Mitsubishi Electric Corporation, L3Harris Technologies, Inc., General Dynamics Corporation, Rockwell Collins, Inc., Teledyne Technologies Incorporated, Honeywell International Inc., Airbus Defence and Space, Rheinmetall AG, ASELSAN A.?., ELTA Systems Ltd. (Israel Aerospace Industries), Indra Sistemas S.A., 3D-Radar AS, Collins Aerospace contribute to innovation, geographic expansion, and service delivery in this space .

The future of the 3D radar market appears promising, driven by ongoing technological advancements and increasing demand across various sectors. As solid-state radar technology becomes more prevalent, its integration with artificial intelligence and automation will enhance operational efficiency. Furthermore, the collaboration between public and private sectors is expected to foster innovation and accelerate the development of new applications. These trends indicate a robust growth trajectory for the 3D radar market, with significant opportunities for stakeholders to capitalize on emerging technologies and applications.

| Segment | Sub-Segments |

|---|---|

| By Type | Ground-based Radar Airborne Radar Spaceborne Radar Marine Radar Others |

| By Range | Short Range Medium Range Long Range |

| By Platform | Airborne Naval Ground Surface |

| By Frequency Band | C/S/X Band L Band E/F Band Other Frequency Bands |

| By Component | Hardware Software |

| By Industry | Defense Aerospace Automotive & Public Infrastructure Energy & Utilities Government Others |

| By Application | Surveillance Navigation Mapping Traffic Management Weather Monitoring Others |

| By Sales Channel | Direct Sales Distributors Online Sales Others |

| By Distribution Mode | Offline Distribution Online Distribution Hybrid Distribution |

| By Price Range | Low Price Mid Price High Price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Defense Applications | 120 | Defense Contractors, Military Procurement Officers |

| Automotive Industry | 90 | Automotive Engineers, R&D Managers |

| Aerospace Sector | 80 | Aerospace Engineers, Project Managers |

| Industrial Applications | 60 | Manufacturing Managers, Safety Officers |

| Smart City Initiatives | 50 | Urban Planners, Technology Integration Specialists |

The Global 3D Radar Market is valued at approximately USD 2.4 billion, driven by advancements in radar technology and increasing demand for surveillance and detection systems across various sectors, including defense, aerospace, and automotive.