Region:Global

Author(s):Shubham

Product Code:KRAA1816

Pages:94

Published On:August 2025

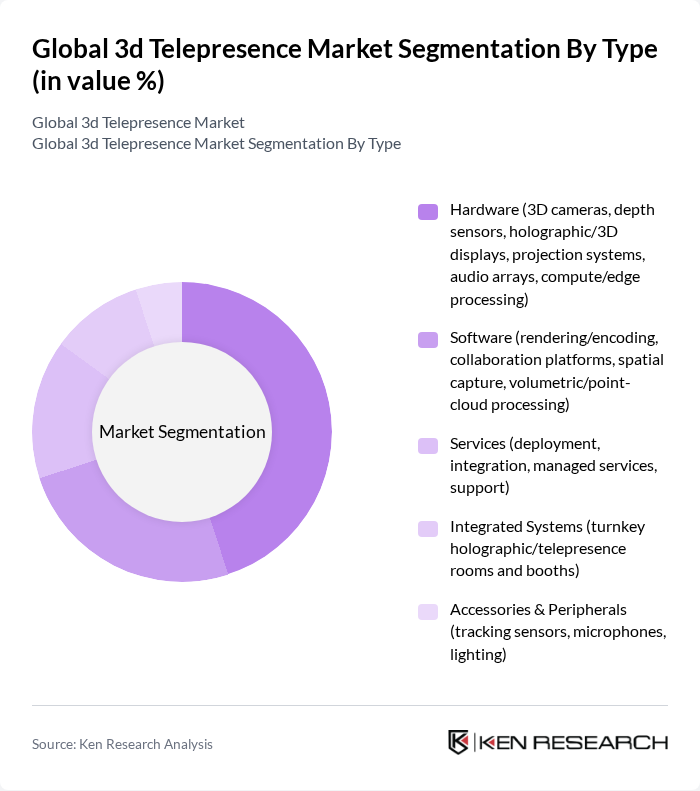

By Type:

The segmentation by type includes Hardware, Software, Services, Integrated Systems, and Accessories & Peripherals. Among these, Hardware is the leading sub-segment, driven by the increasing demand for high-quality 3D cameras, depth sensors, and holographic displays. The rise in remote work and virtual collaboration has led to a surge in the adoption of advanced hardware solutions that enhance user experience. Software solutions are also gaining traction, particularly in rendering and collaboration platforms, but Hardware remains the dominant force in the market .

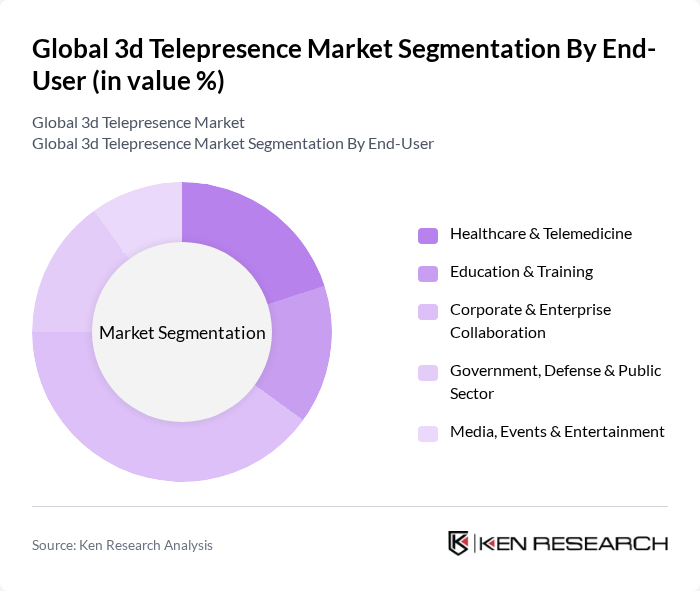

By End-User:

The end-user segmentation includes Healthcare & Telemedicine, Education & Training, Corporate & Enterprise Collaboration, Government, Defense & Public Sector, and Media, Events & Entertainment. The Corporate & Enterprise Collaboration segment is the largest, driven by the increasing need for effective communication tools in remote work settings. Organizations are investing in telepresence solutions to facilitate seamless collaboration among teams, enhancing productivity and engagement. Healthcare & Telemedicine is also a rapidly growing segment, as telepresence technologies enable remote consultations and patient monitoring .

The Global 3D Telepresence Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cisco Systems, Inc., Microsoft Corporation, Poly Inc. (formerly Polycom; a HP company), Avaya LLC, Zoom Video Communications, Inc., Huawei Technologies Co., Ltd., Logitech International S.A., Lifesize, Inc., BlueJeans by Verizon, Pexip Holding ASA, ARHT Media Inc., Proto Hologram, Inc. (formerly PORTL), Musion 3D Ltd., HOLOPRESENCE (HLG Hologram Co., Ltd.), Holo-One AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the 3D telepresence market appears promising, driven by technological advancements and increasing demand across various sectors. As organizations continue to embrace hybrid work models, the integration of AI and machine learning into telepresence solutions is expected to enhance user experiences significantly. Furthermore, the growing emphasis on sustainability will likely lead to the development of energy-efficient telepresence systems, aligning with global environmental goals. These trends indicate a robust trajectory for the market, fostering innovation and broader adoption in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Hardware (3D cameras, depth sensors, holographic/3D displays, projection systems, audio arrays, compute/edge processing) Software (rendering/encoding, collaboration platforms, spatial capture, volumetric/point-cloud processing) Services (deployment, integration, managed services, support) Integrated Systems (turnkey holographic/telepresence rooms and booths) Accessories & Peripherals (tracking sensors, microphones, lighting) |

| By End-User | Healthcare & Telemedicine Education & Training Corporate & Enterprise Collaboration Government, Defense & Public Sector Media, Events & Entertainment |

| By Application | Remote and Hybrid Collaboration Training, Simulation & Skills Transfer Telemedicine & Remote Expert Guidance Virtual/Holographic Events, Advertising & Customer Engagement Customer Service, Retail & Frontline Support |

| By Distribution Channel | Direct (OEM and platform direct sales) Channel Partners/Resellers Systems Integrators Online/Marketplace Telecom/Carrier Bundles |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Model | Subscription (SaaS/PaaS) Per-Device/Seat License Usage-Based (minutes/streams) Capex (one-time system purchase) |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Enterprises Government & Public Institutions Healthcare Providers & Education Institutions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Telepresence Solutions | 100 | Healthcare Administrators, IT Managers |

| Corporate Training Applications | 80 | Training Coordinators, HR Managers |

| Educational Institutions Adoption | 70 | School Administrators, IT Directors |

| Remote Collaboration Tools | 90 | Project Managers, Team Leaders |

| Consumer Market Insights | 60 | End-users, Technology Enthusiasts |

The Global 3D Telepresence Market is valued at approximately USD 2.1 billion, reflecting a significant growth trajectory driven by advancements in technology and increasing demand for immersive remote collaboration solutions across various sectors.